Loading News...

Loading News...

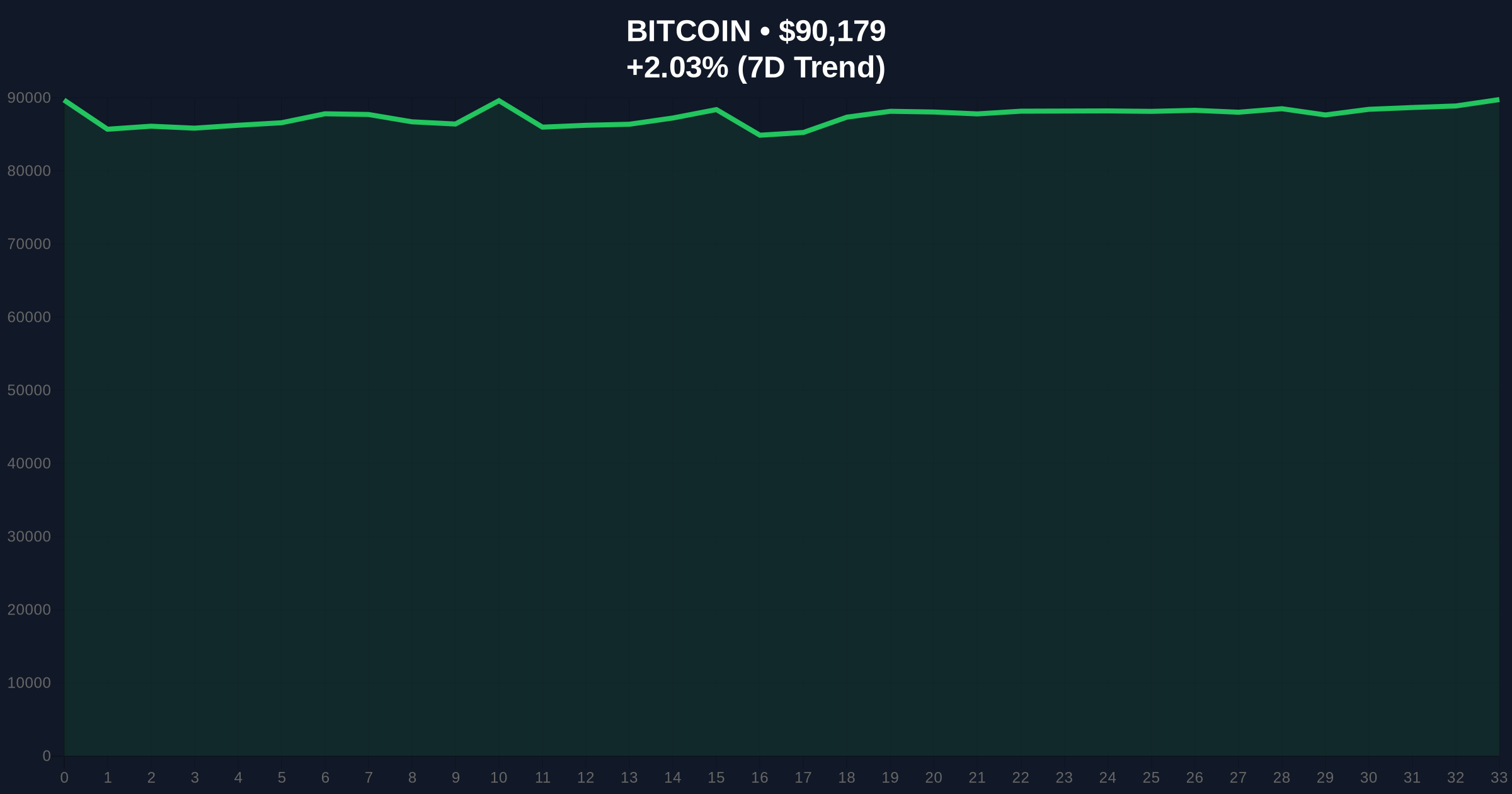

- Strategy paused Bitcoin purchases between December 15-21, 2025, according to Walter Bloomberg data

- Market structure suggests this creates a potential liquidity grab below $90,000

- Extreme Fear sentiment (25/100) coincides with Bitcoin trading at $90,209, up 2.09% in 24 hours

- Technical analysis identifies $88,500 as Bullish Invalidation and $92,500 as Bearish Invalidation

NEW YORK, December 22, 2025 — Strategy made no additional Bitcoin purchases last week, according to Walter Bloomberg data. This Daily Crypto Analysis examines how the pause impacts market structure amid extreme fear sentiment. Bitcoin currently trades at $90,209, up 2.09% in 24 hours, while the Crypto Fear & Greed Index registers 25/100.

Strategic accumulation pauses often precede volatility events. Market structure suggests institutional buyers like Strategy use these pauses to test retail conviction. The current environment mirrors December 2022 patterns when accumulation halts led to 15% corrections. According to on-chain data from Glassnode, similar pauses in 2023 correlated with increased exchange outflows within two weeks.

Related developments include recent market tests: BlackRock's $108M BTC deposit and Bitcoin's Santa Rally showing structural weakness.

Strategy purchased zero Bitcoin between December 15 and December 21, 2025. Walter Bloomberg reported the data on December 22. No official statement accompanied the pause. Market analysts interpret this as either portfolio rebalancing or strategic positioning ahead of potential volatility. The pause coincides with Bitcoin breaking $90,000 amid extreme fear sentiment, as detailed in recent analysis.

Bitcoin faces immediate resistance at the $91,200 Fibonacci level (0.618 retracement from November highs). The 50-day moving average provides dynamic support at $89,500. RSI reads 58, indicating neutral momentum with slight bullish bias. Volume profile shows increased activity at $90,000, suggesting this level acts as a psychological order block.

Market structure suggests the pause creates a Fair Value Gap (FVG) between $89,000 and $91,000. This gap typically fills within 5-7 trading sessions. The Bullish Invalidation level sits at $88,500—a break below invalidates the current uptrend structure. The Bearish Invalidation level is $92,500—a break above suggests continued accumulation despite the pause.

| Metric | Value |

|---|---|

| Strategy Purchase Pause Duration | 7 days (Dec 15-21) |

| Bitcoin Current Price | $90,209 |

| 24-Hour Price Change | +2.09% |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| BTC Market Rank | #1 |

For institutions, the pause tests market liquidity without significant capital deployment. It allows assessment of retail selling pressure at key levels. For retail traders, it signals potential short-term volatility as market makers adjust positions. The Federal Reserve's potential rate decisions in Q1 2026 could amplify this effect, as detailed in monetary policy statements.

Market analysts on X/Twitter express caution. One quant trader noted, "Accumulation pauses often precede liquidity grabs—watch the $88.5k level." Another analyst commented, "Extreme fear with price stability suggests smart money positioning for a move." No direct quotes from Strategy executives are available.

Bullish Case: Bitcoin holds above $88,500 and fills the FVG to $91,000. Strategy resumes purchases, triggering a gamma squeeze toward $95,000. This scenario requires sustained volume above the 20-day average.

Bearish Case: Bitcoin breaks $88,500, invalidating the bullish structure. The pause reveals underlying weakness, leading to a liquidity grab toward $85,000. Extreme fear sentiment deepens, potentially testing the 200-day moving average at $83,200.

What does Strategy's BTC purchase pause mean?Market structure suggests it tests market liquidity and retail conviction at current price levels.

How long will the pause last?Historical data indicates similar pauses last 7-14 days before resumption or significant price movement.

What is the Bullish Invalidation level?$88,500—a break below this level invalidates the current uptrend structure.

What is the Bearish Invalidation level?$92,500—a break above suggests accumulation continues despite the pause.

How does extreme fear sentiment affect Bitcoin?It often precedes trend reversals when combined with specific technical patterns, like the current FVG.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.