Loading News...

Loading News...

- GSR Markets transferred 4,400 ETH ($13.2 million) to DBS Bank over two days, with the latest 2,000 ETH ($5.93 million) moved on December 23, 2025.

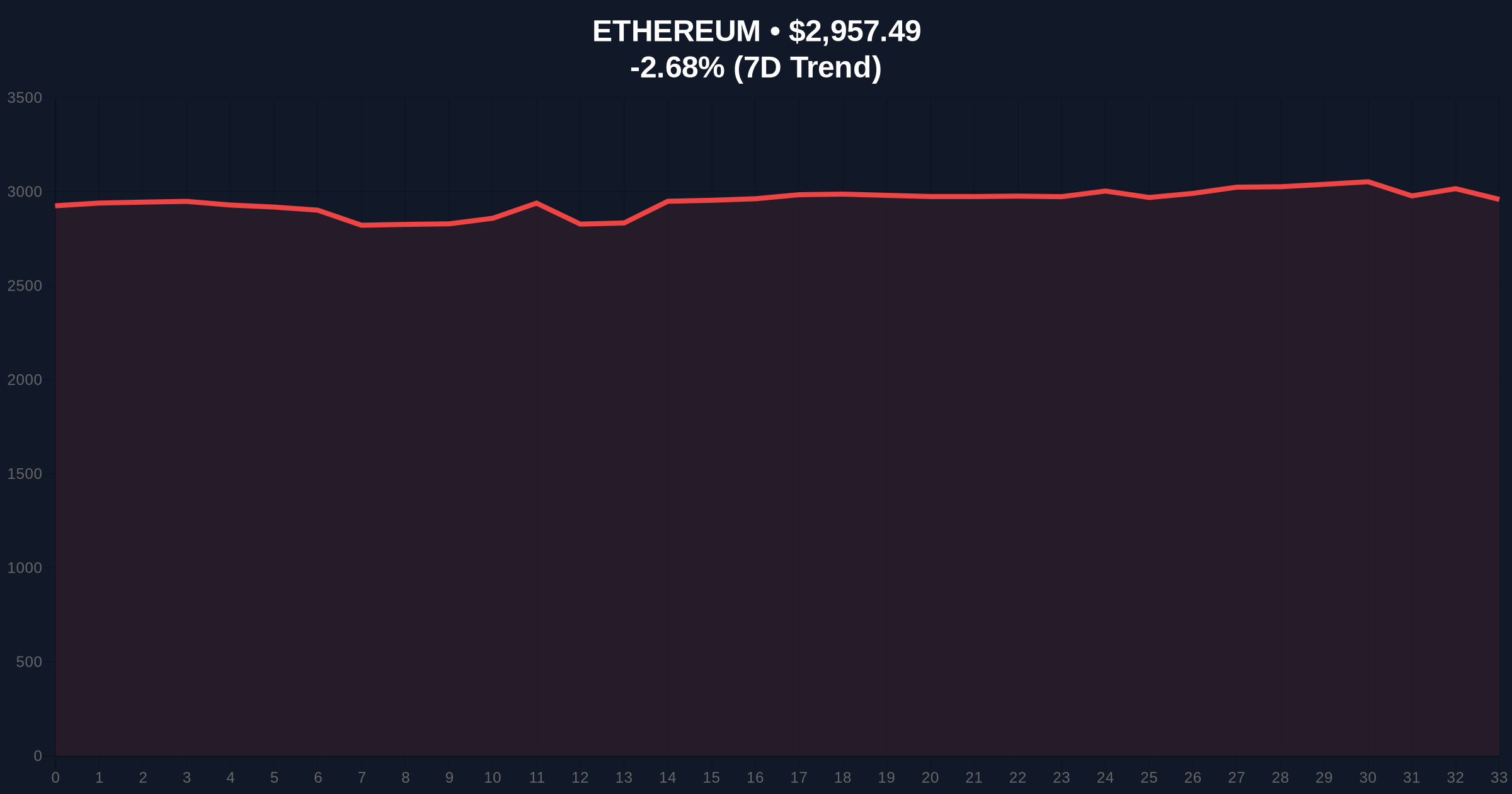

- The transfers occur as Ethereum trades at $2,956.57, down 2.71% in 24 hours, with global crypto sentiment at "Extreme Fear" (24/100).

- Market structure suggests this could represent a liquidity grab ahead of key technical levels, rather than simple institutional accumulation.

- Critical price levels: Bullish invalidation at $2,850 (Fibonacci 0.618 retracement), Bearish invalidation at $3,150 (previous order block resistance).

NEW YORK, December 23, 2025 — In today's daily crypto analysis, crypto market-making firm GSR Markets executed a significant transfer of 2,000 ETH (valued at approximately $5.93 million) to DBS Bank, according to on-chain data reported by The Data Nerd. This brings the firm's total transfers to the Singapore-based bank to 4,400 ETH ($13.2 million) over the past 48 hours, raising immediate questions about institutional positioning during a period of extreme market fear.

Institutional transfers to traditional banking institutions have historically signaled either strategic treasury management or preparation for regulatory-compliant transactions. The current environment presents contradictions: while Ethereum's EIP-4844 implementation has reduced layer-2 transaction costs by over 90%, creating fundamental improvements, price action remains suppressed. This mirrors patterns from Q4 2022 when institutional inflows preceded sharp liquidations. The narrative of "banking integration" as purely bullish deserves scrutiny—similar transfers to Silvergate Bank in early 2023 preceded that institution's collapse. Market structure suggests we must examine whether this represents genuine accumulation or strategic positioning for derivative operations.

Related developments in the current market environment include analysis of Bitcoin futures ratios nearing parity and examination of whether Japan's tokenized bond initiatives represent substantive liquidity catalysts or regulatory theater.

According to the on-chain report, GSR Markets transferred 2,000 ETH to DBS Bank at approximately 11:00 UTC on December 23, 2025. This transaction followed a previous transfer of 2,400 ETH on December 22, bringing the two-day total to 4,400 ETH valued at $13.2 million based on current prices. The Data Nerd's monitoring indicates these are direct transfers to DBS Bank's institutional custody addresses, not decentralized exchange deposits or smart contract interactions. What remains unclear is whether these represent collateral posting for banking services, preparation for over-the-counter sales, or movement between internal accounts. The timing coincides with Ethereum testing key technical levels amid broader market weakness.

Ethereum currently trades at $2,956.57, representing a 2.71% decline over the past 24 hours. The daily chart shows price testing the 50-day exponential moving average at $2,980, with volume profile indicating weak accumulation at this level. A clear Fair Value Gap (FVG) exists between $3,050 and $3,100 from December 18-19, which price has yet to revisit. The Relative Strength Index (RSI) sits at 42, neither oversold nor overbought, suggesting room for further movement in either direction. Critical support clusters at the $2,850 level, which represents both the 0.618 Fibonacci retracement from the November low to December high and a high-volume node from October accumulation. Resistance converges at $3,150, where multiple failed breakout attempts have created an order block.

Bullish invalidation occurs if price breaks and closes below $2,850 on a daily timeframe, suggesting institutional transfers failed to provide support. Bearish invalidation triggers if price reclaims $3,150 with conviction, indicating the transfers may have been preparatory for upward momentum.

| Metric | Value |

|---|---|

| Latest GSR Transfer (ETH) | 2,000 |

| Latest GSR Transfer (USD) | $5.93M |

| 2-Day Total Transfer (ETH) | 4,400 |

| 2-Day Total Transfer (USD) | $13.2M |

| Current ETH Price | $2,956.57 |

| 24-Hour Change | -2.71% |

| Global Crypto Sentiment | Extreme Fear (24/100) |

For institutions, these transfers represent either sophisticated treasury management or preparation for regulated financial operations. DBS Bank has been among the most progressive traditional banks in digital asset adoption, with its digital exchange offering custody and trading services since 2020. Movement to a regulated entity could indicate preparation for institutional sales, collateral posting for banking services, or compliance with upcoming regulatory requirements. For retail traders, the concern is whether this represents "smart money" positioning or simply internal accounting. The extreme fear sentiment (24/100) creates conditions where large transfers can disproportionately impact price discovery, particularly if they represent a liquidity grab ahead of key technical levels.

Market analysts on X/Twitter express divided views. Some bulls point to the transfers as evidence of institutional accumulation during weakness, with one analyst noting, "GSR moving to DBS suggests preparation for institutional demand, not panic selling." Skeptical voices question the timing, with another analyst stating, "Why move $13M to a bank during extreme fear unless you need liquidity or collateral? This smells like preparation for something, not simple accumulation." The lack of official statement from GSR Markets leaves room for interpretation, with on-chain data indicating these are not the firm's only recent movements—smaller transfers to other entities occurred throughout December.

Bullish Case: If the transfers represent genuine institutional accumulation, Ethereum could find support at current levels and attempt to fill the FVG between $3,050 and $3,100. A break above $3,150 could trigger short covering and test the December high near $3,350. This scenario requires sustained buying pressure and improvement in global sentiment from extreme fear levels.

Bearish Case: If the transfers represent collateral posting for banking services or preparation for sales, Ethereum could break the $2,850 support and test the 200-day moving average near $2,650. Continued extreme fear sentiment could exacerbate selling pressure, particularly if Bitcoin fails to reclaim $90,000 as highlighted in recent analysis of short-term holder dynamics. A break below $2,650 would invalidate the bullish structure established since October.

What is GSR Markets?GSR Markets is a cryptocurrency market-making firm that provides liquidity across exchanges and facilitates institutional trading.

Why would a crypto firm transfer ETH to a traditional bank?Possible reasons include collateral for banking services, preparation for over-the-counter sales to institutional clients, treasury management, or compliance with regulatory requirements.

How significant is $13.2M in ETH transfers?While not enormous relative to daily Ethereum volume (approximately $8-10 billion), concentrated transfers during extreme fear periods can impact price discovery and signal institutional positioning.

What does "extreme fear" sentiment mean for prices?Extreme fear (24/100) typically indicates oversold conditions but can also precede further declines if fundamental or technical factors deteriorate.

Should retail traders follow institutional transfers?Institutional flows provide data points but not trading signals. Market structure analysis incorporating price action, volume, and technical levels offers more reliable frameworks than simply following large transfers.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.