Loading News...

Loading News...

- Fasanara Capital acquired 6,569 ETH over two days, valued at approximately $19.2 million at current prices

- The assets were deposited into Morpho's lending protocol with 13 million USDC borrowed against collateral

- Transaction occurs as Crypto Fear & Greed Index hits "Extreme Fear" at 24/100

- Market structure suggests potential liquidity grab below $2,850 support level

NEW YORK, December 23, 2025 — Fasanara Capital executed a significant Ethereum accumulation strategy over the past 48 hours, acquiring 6,569 ETH while global crypto sentiment plunged to extreme fear levels. This latest crypto news reveals institutional positioning during market weakness, with the London-based investment firm depositing assets into Morpho's lending protocol and borrowing substantial stablecoin liquidity.

Institutional accumulation during fear periods mirrors patterns from Q4 2022. Market structure suggests sophisticated players target oversold conditions when retail capitulation creates liquidity vacuums. The current environment echoes the March 2020 COVID crash, where institutions accumulated Bitcoin below $4,000 while sentiment readings bottomed.

Related developments include Bitcoin's recent breakdown below key support and Citadel's profit-taking signaling institutional risk-off positioning.

According to on-chain data from Lookonchain, Fasanara Capital purchased 6,569 ETH between December 21-22, 2025. The transactions occurred at average prices between $2,900-$2,950. Immediately following acquisition, the firm deposited the entire position into Morpho, a decentralized lending protocol. Against this collateral, Fasanara borrowed 13 million USDC.

The borrowing represents approximately 68% loan-to-value ratio against the ETH collateral. Market analysts interpret this as potential dry powder for additional accumulation or yield generation strategies. The timing coincides with Ethereum testing critical technical levels.

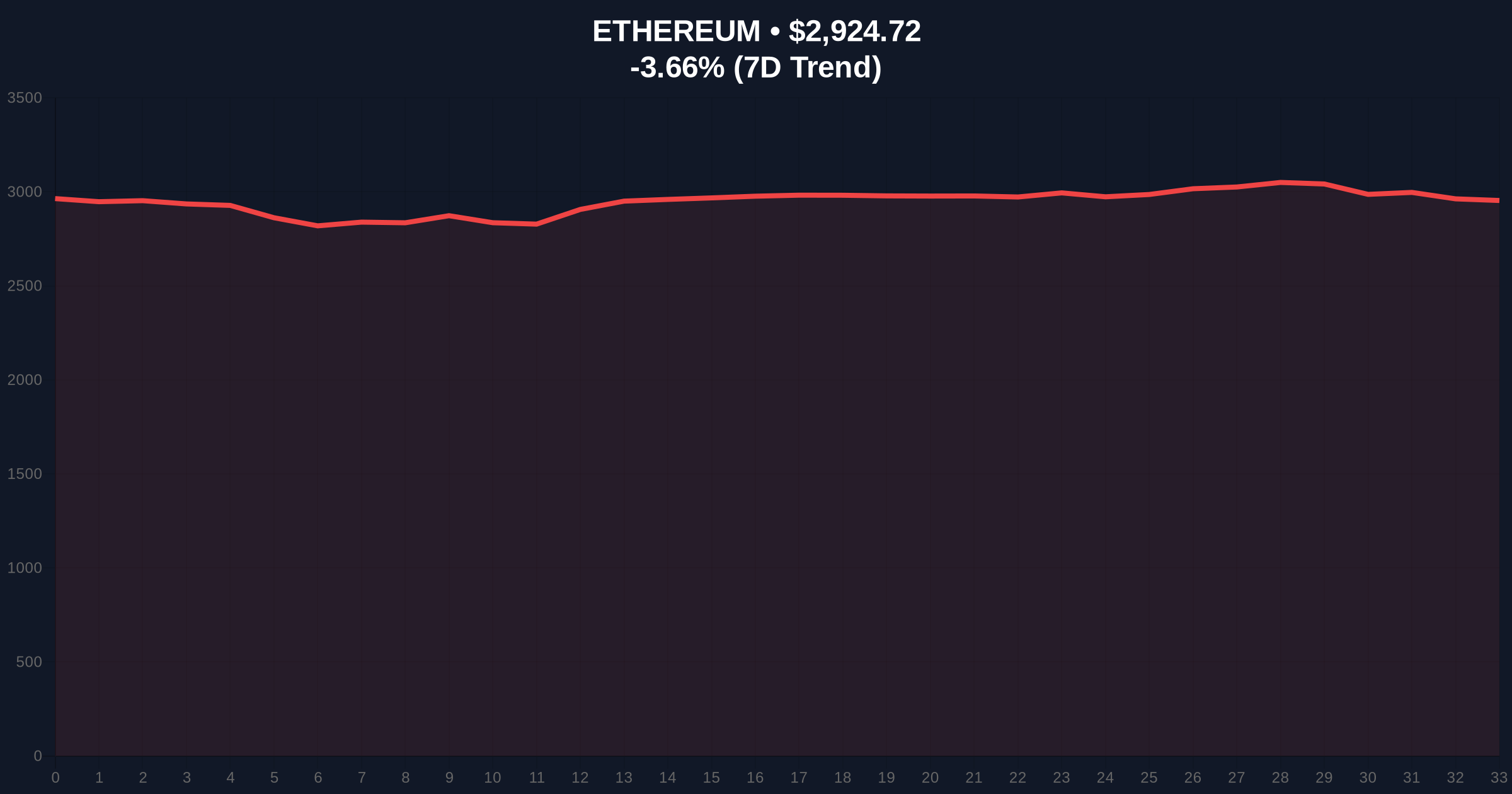

Ethereum currently trades at $2,924.72, down 3.66% over 24 hours. The 200-day moving average provides dynamic support at $2,880. RSI readings at 34 indicate oversold conditions without extreme capitulation.

A clear Fair Value Gap (FVG) exists between $2,850-$2,900. This zone represents unfilled liquidity from the December 18th flash decline. Volume profile shows significant accumulation between $2,820-$2,880 throughout Q4 2025.

Bullish invalidation: Break below $2,750 would invalidate the higher timeframe uptrend structure. Bearish invalidation: Sustained move above $3,150 would confirm institutional accumulation thesis and target $3,400 resistance.

| Metric | Value |

| ETH Purchased | 6,569 ETH |

| Current Value | $19.2 million |

| USDC Borrowed | 13 million |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Ethereum 24h Change | -3.66% |

| Loan-to-Value Ratio | ~68% |

Institutional impact: Fasanara's move signals professional capital deploying during retail fear. The Morpho deposit indicates DeFi integration for institutional treasury management. Borrowing against collateral suggests leverage optimization rather than outright speculation.

Retail impact: Follow-through buying could trigger short covering. Failure to hold $2,850 support may accelerate liquidations. The transaction demonstrates sophisticated capital allocation during EIP-4844 implementation uncertainty.

Market analysts on X/Twitter highlight the strategic timing. "Institutions accumulate when blood is in the streets," noted one quantitative researcher. Another observed: "The Morpho deposit suggests yield generation as secondary objective to price appreciation."

Sentiment remains divided between accumulation opportunity and broader market risk. The extreme fear reading at 24/100 represents potential contrarian signal according to historical patterns documented by the Federal Reserve's financial stability reports.

Bullish case: Institutional accumulation triggers reversal above $3,000. Short covering accelerates move toward $3,400 resistance. EIP-4844 implementation reduces gas fees, boosting Ethereum network utility. Target: $3,600-$3,800 by Q1 2026.

Bearish case: Failure at $2,850 support triggers liquidation cascade. Broader crypto correlation with traditional risk assets persists. Target: $2,500-$2,600 retest of 2024 accumulation zone.

What is Fasanara Capital?London-based investment firm managing approximately $4 billion across credit, venture capital, and digital assets.

Why deposit ETH into Morpho?Morpho provides decentralized lending with competitive rates. Deposit enables borrowing while earning yield on collateral.

What does borrowing USDC indicate?Potential dry powder for additional purchases or working capital for other investments.

How significant is 6,569 ETH?Represents approximately 0.005% of circulating supply. Meaningful but not market-moving in isolation.

What's the risk in this strategy?ETH price decline could trigger margin calls on borrowed position. Current LTV of 68% provides buffer to approximately $2,150 before liquidation.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.