Loading News...

Loading News...

- Bitmine withdrew 29,463 ETH worth approximately $88.2 million from BitGo and Kraken

- The mining company now holds approximately 4.06 million ETH at an average cost basis of $2,991

- Market structure suggests this could be a liquidity grab rather than bullish accumulation

- Global crypto sentiment remains at "Extreme Fear" with a score of 24/100

NEW YORK, December 23, 2025 — In today's daily crypto analysis, on-chain data reveals that two addresses believed to belong to mining company Bitmine (BMNR) withdrew 29,463 ETH worth approximately $88.2 million from BitGo and Kraken custodial services. According to data from Onchain Lens, this transaction brings Bitmine's total Ethereum holdings to approximately 4.06 million ETH with an average purchase price of $2,991, creating immediate questions about market impact and strategic intent.

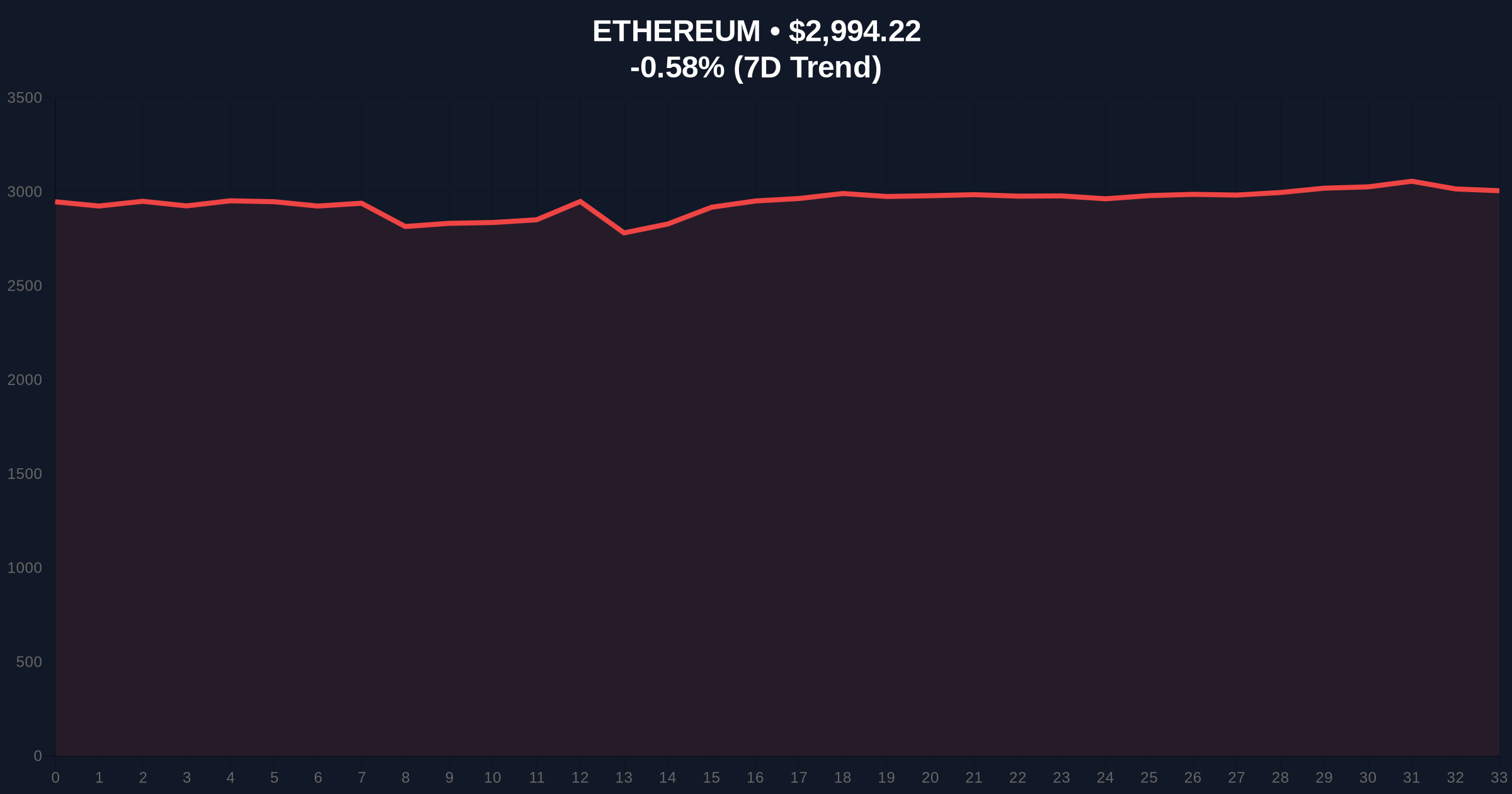

This transaction occurs against a backdrop of institutional accumulation patterns that have historically signaled both genuine conviction and strategic positioning. The timing is particularly noteworthy given Ethereum's current price of $2,994.06—essentially at Bitmine's reported average cost basis. Market structure suggests this creates a potential Fair Value Gap (FVG) that could be exploited for either accumulation or distribution. Historical patterns indicate that large withdrawals from exchanges during periods of extreme fear sentiment often precede either significant rallies or further declines, depending on subsequent on-chain behavior. The current market environment mirrors aspects of the 2021-2022 cycle where institutional accumulation was followed by retail capitulation.

Related developments in the current market include the Altcoin Season Index dropping to 16 amid extreme fear and solo miner activity signaling Bitcoin network health despite broader market weakness.

According to on-chain data from Onchain Lens, two Ethereum addresses identified through clustering analysis as belonging to Bitmine executed withdrawals totaling 29,463 ETH from BitGo and Kraken custodial services. The transactions occurred within a narrow time window, suggesting coordinated execution rather than staggered accumulation. The $88.2 million valuation is based on Ethereum's price at transaction time, though exact timing data was not provided in the source material. Bitmine's total Ethereum position now stands at approximately 4.06 million ETH, representing one of the largest corporate holdings outside of exchange wallets and protocol treasuries. The average purchase price of $2,991 creates an immediate psychological level for both the company and market participants.

Ethereum's current price of $2,994.06 represents a critical juncture. The 200-day moving average sits at $3,150, creating immediate overhead resistance. The Relative Strength Index (RSI) at 42 suggests neither overbought nor oversold conditions, allowing for movement in either direction. Volume profile analysis shows significant accumulation between $2,800 and $3,000, making this zone for near-term price discovery. The Fibonacci retracement level from the 2024 high to the 2025 low shows key support at $2,850 (61.8% retracement). Market structure suggests the Bitmine withdrawal could represent either a liquidity grab below key psychological levels or genuine accumulation at perceived fair value.

Bullish invalidation occurs if Ethereum breaks and sustains below the $2,800 volume node, which would suggest distribution rather than accumulation. Bearish invalidation occurs with a sustained break above the $3,200 resistance level, which would confirm institutional buying pressure. The proximity to Bitmine's average cost basis creates a potential order block that could influence price action in either direction.

| Metric | Value |

| ETH Withdrawn | 29,463 ETH |

| USD Value | $88.2 million |

| Bitmine Total ETH Holdings | 4.06 million ETH |

| Average Purchase Price | $2,991 |

| Current ETH Price | $2,994.06 |

| 24-Hour Change | -0.58% |

| Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional participants, this transaction represents either a vote of confidence in Ethereum's fundamental value or strategic positioning ahead of potential volatility. The timing at the average cost basis suggests either dollar-cost averaging or opportunistic accumulation. For retail traders, the withdrawal reduces immediately available supply on exchanges, potentially creating upward pressure if demand remains constant. However, market structure suggests caution—large withdrawals during extreme fear periods have historically preceded both rallies and further declines depending on broader market conditions. The transaction's impact on Ethereum's EIP-4844 implementation timeline and scaling roadmap remains negligible from a technical perspective, but could influence market perception of institutional adoption.

Market analysts on social platforms express divided views. Some bulls point to the withdrawal as evidence of "smart money" accumulation at key levels, suggesting that institutions see current prices as undervalued. Skeptical voices question whether this represents genuine accumulation or strategic positioning for potential tax optimization or collateral requirements. The extreme fear sentiment dominating social channels suggests most retail participants remain unconvinced of any bullish implications, with many citing broader macroeconomic concerns including Federal Reserve policy uncertainty.

Bullish Case: If this represents genuine accumulation rather than a liquidity grab, Ethereum could establish $2,991 as a durable support level. A sustained break above $3,200 resistance could trigger a gamma squeeze as options positions adjust, potentially targeting the $3,500 region. Institutional accumulation patterns suggest this scenario would require follow-through buying and decreasing exchange balances over subsequent weeks.

Bearish Case: If this withdrawal represents distribution disguised as accumulation, Ethereum could break below the $2,800 volume node, targeting the Fibonacci support at $2,850. The extreme fear sentiment suggests limited buying appetite among retail participants, potentially creating a vacuum that allows further downside. Market structure indicates that a break below $2,800 would invalidate the bullish accumulation narrative and likely trigger stop-loss cascades.

What is Bitmine's total Ethereum position worth? At current prices of $2,994.06, Bitmine's 4.06 million ETH holdings are worth approximately $12.15 billion.

Why would a mining company hold Ethereum instead of Bitcoin? Mining companies often diversify holdings for operational flexibility, hedging strategies, or specific revenue projections based on network activity.

Does this transaction indicate bullish sentiment? Not necessarily. Market structure suggests large withdrawals can represent either accumulation or strategic positioning for unrelated corporate needs.

How does this affect Ethereum's circulating supply? The withdrawal removes 29,463 ETH from immediately tradable supply on exchanges, representing approximately 0.025% of circulating supply.

What should traders watch next? Subsequent on-chain behavior from Bitmine addresses, Ethereum's ability to hold the $2,991 level, and exchange balance trends over the coming weeks.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.