Loading News...

Loading News...

- Bitmain purchased 98,852 ETH last week, bringing total holdings to 4.066 million ETH

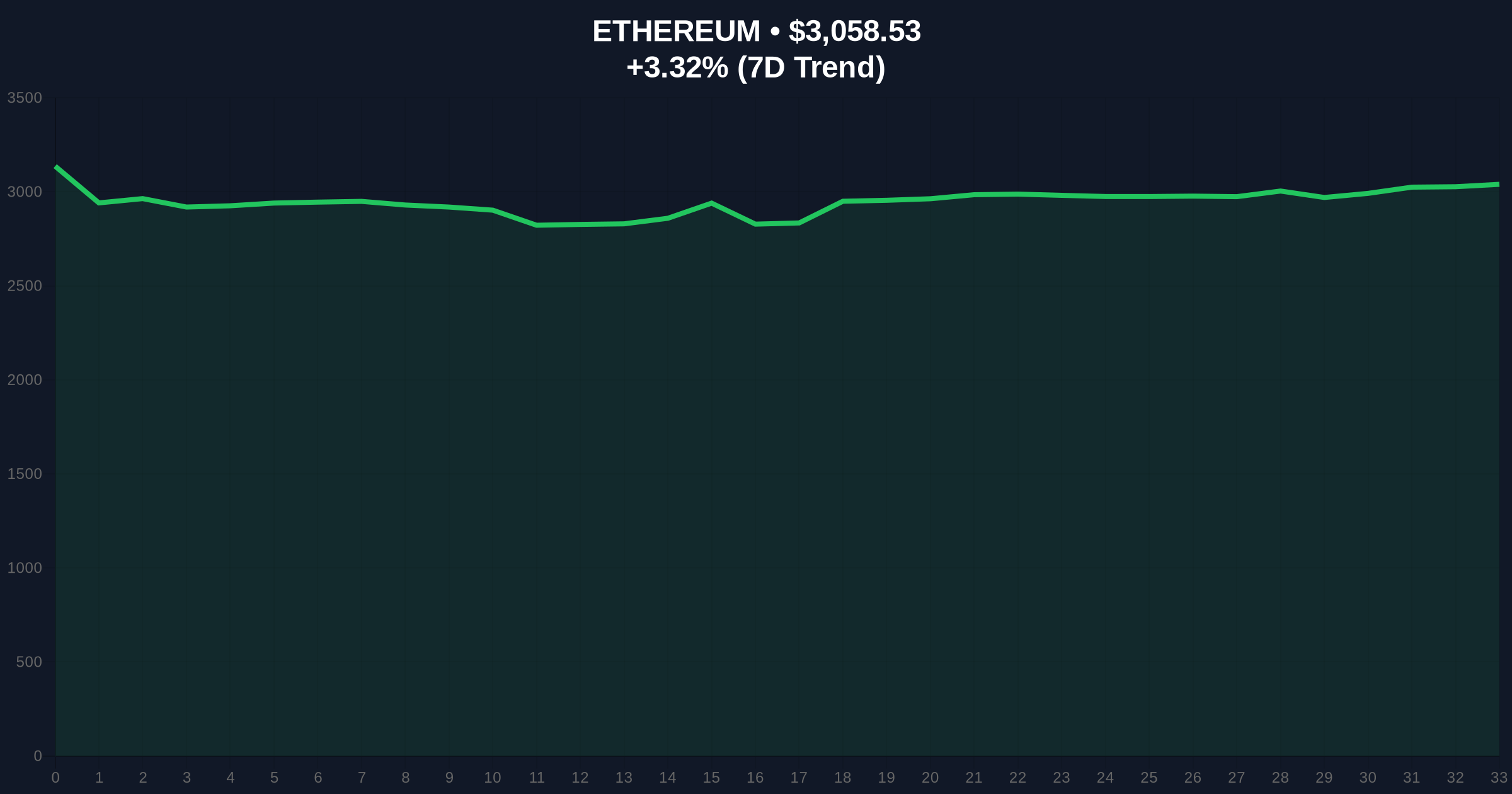

- Current ETH price at $3,058.67 with 3.33% 24-hour gain amid Extreme Fear sentiment

- Market structure suggests potential liquidity grab above $3,200 resistance level

- Bullish invalidation at $2,850, bearish invalidation at $3,250

NEW YORK, December 22, 2025 — In a move that challenges prevailing market narratives, mining giant Bitmain accumulated 98,852 ETH last week, bringing its total Ethereum holdings to 4.066 million ETH according to on-chain data from Unfolded. This daily crypto analysis examines whether this institutional accumulation represents strategic positioning or a potential liquidity trap as ETH trades at $3,058.67 amid Extreme Fear market sentiment.

Bitmain's accumulation occurs against a backdrop of institutional divergence in crypto strategy. While some traditional financial institutions face skepticism about their crypto ambitions, other players continue aggressive accumulation. This mirrors the 2021-2022 accumulation patterns where large holders built positions during periods of market uncertainty. The current Extreme Fear sentiment reading of 25/100 suggests retail capitulation, creating optimal conditions for institutional accumulation at perceived discount levels. Market structure indicates this could represent either a strategic long-term position or a sophisticated liquidity grab targeting retail stop-losses.

Related Developments:

According to on-chain analytics firm Unfolded, Bitmain executed purchases totaling 98,852 ETH over the past seven days through multiple transactions. This brings their publicly identifiable Ethereum holdings to 4.066 million ETH, representing approximately 3.4% of Ethereum's circulating supply. The accumulation occurred during a period when ETH traded between $2,950 and $3,150, with the asset showing relative strength against Bitcoin. No official statement from Bitmain has accompanied these on-chain movements, leaving market participants to interpret the strategic intent through price action and order flow analysis.

ETH currently trades at $3,058.67 with a 3.33% 24-hour gain, testing the upper boundary of a consolidation range that has persisted since early December. The 50-day moving average at $3,120 provides immediate resistance, while the 200-day moving average at $2,890 offers support. RSI readings at 58 suggest neutral momentum with room for extension in either direction. Volume profile analysis shows significant accumulation between $2,950 and $3,050, creating a potential order block that must hold for bullish continuation.

A critical technical development is the upcoming Ethereum Cancun-Deneb upgrade (EIP-4844), which aims to reduce layer-2 transaction costs significantly. While not directly related to Bitmain's accumulation, this fundamental catalyst could explain institutional positioning ahead of network improvements. The current price action suggests market makers are testing liquidity above $3,200, where significant sell-side interest resides according to exchange order book data from major platforms.

| Metric | Value |

| Bitmain Weekly ETH Purchase | 98,852 ETH |

| Total Bitmain ETH Holdings | 4.066 million ETH |

| Current ETH Price | $3,058.67 |

| 24-Hour Price Change | +3.33% |

| Global Crypto Sentiment | Extreme Fear (25/100) |

For institutional participants, Bitmain's accumulation represents either a vote of confidence in Ethereum's long-term value proposition or a sophisticated market-making operation. The 4.066 million ETH position represents approximately $12.4 billion at current prices, creating significant market influence. For retail traders, this accumulation creates both opportunity and risk—large holder movements often precede volatility events as market structure adjusts to new equilibrium levels.

The divergence between Extreme Fear sentiment and institutional accumulation suggests a potential sentiment reversal catalyst. However, historical patterns indicate that not all institutional accumulation leads to immediate price appreciation—sometimes serving as distribution into retail demand. According to data from the Ethereum Foundation, network fundamentals continue to improve with rising transaction counts and decreasing gas fees post-Merge, providing fundamental support for the accumulation thesis.

Market analysts on social platforms express divided opinions. "Large accumulation during fear periods typically precedes rallies," noted one quantitative analyst, while skeptics question whether this represents genuine accumulation or position hedging. The lack of official commentary from Bitmain fuels speculation about their strategic intent, with some suggesting this could be collateral positioning for mining operations rather than pure investment.

Bullish Case: If ETH holds above the $2,950 order block and breaks through $3,200 resistance, next targets include $3,450 (Fibonacci 0.618 extension) and $3,650 (previous high). Bullish invalidation occurs below $2,850, which would break the current higher low structure.

Bearish Case: Failure to sustain above $3,050 could trigger a retest of $2,800 support, with extended targets at $2,650 (volume point of control). Bearish invalidation requires a sustained break above $3,250 with accompanying volume expansion.

How much ETH does Bitmain now own?Bitmain holds 4.066 million ETH according to on-chain data, representing approximately 3.4% of circulating supply.

What is the current Ethereum price?ETH trades at $3,058.67 with a 3.33% 24-hour gain as of December 22, 2025.

What is market sentiment for cryptocurrency?The Global Crypto Fear & Greed Index shows Extreme Fear at 25/100, indicating high levels of market pessimism.

What are the key technical levels for ETH?Immediate resistance at $3,200, support at $2,950. Bullish invalidation at $2,850, bearish invalidation at $3,250.

How does this compare to other institutional moves?This accumulation contrasts with MicroStrategy's recent pause in Bitcoin accumulation, suggesting divergent institutional strategies across crypto assets.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.