Loading News...

Loading News...

- Matador Technologies approved $58.2 million share issuance to fund Bitcoin purchases

- Company plans to increase holdings from 175 BTC to 1,000 BTC by end of 2026

- Announcement comes amid "Extreme Fear" market sentiment (24/100)

- Technical analysis shows Bitcoin testing critical Fibonacci support at $86,200

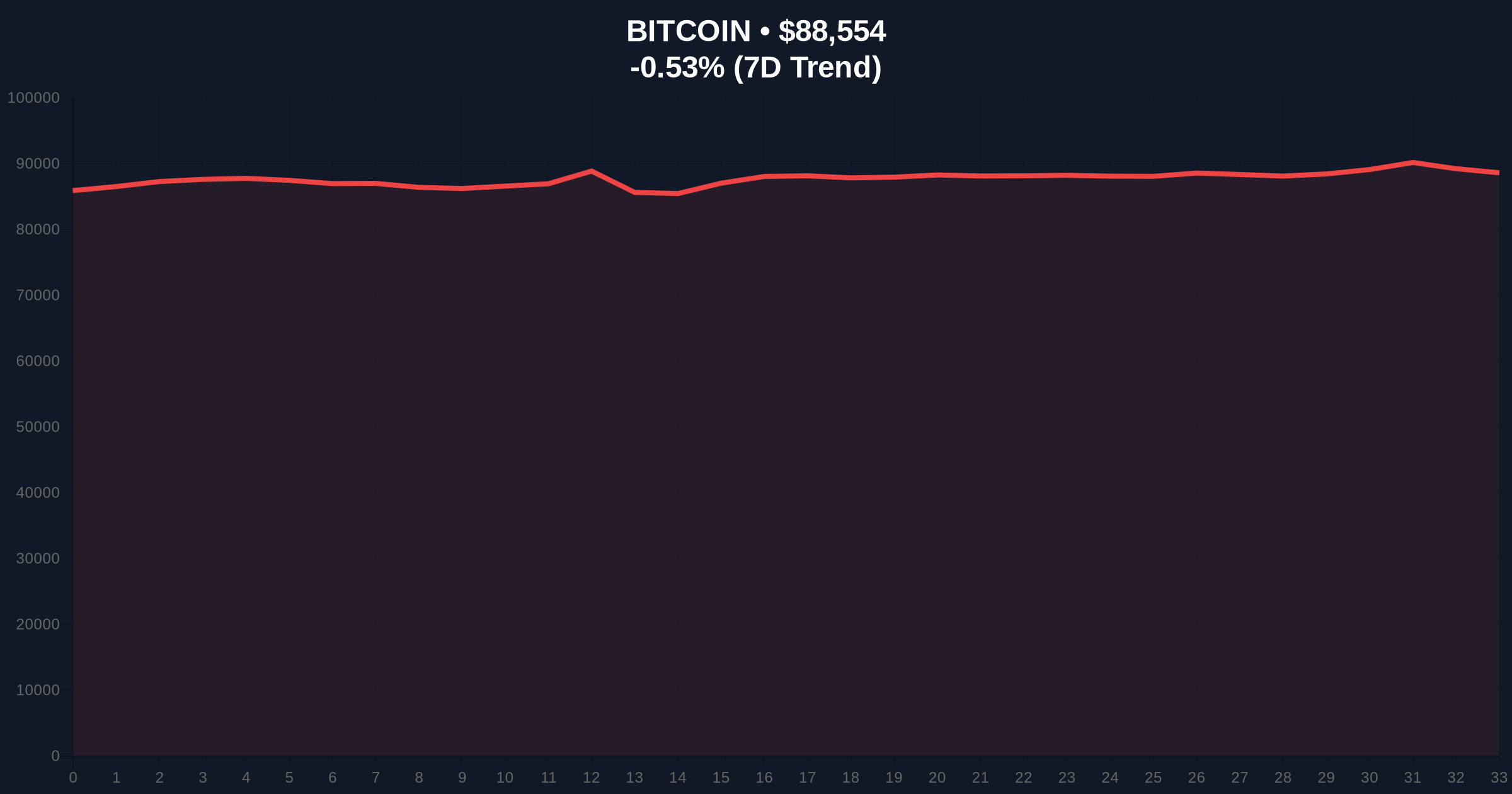

NEW YORK, December 23, 2025 — Matador Technologies, a Toronto Venture Exchange-listed company, has approved an $58.2 million capital raise specifically earmarked for Bitcoin accumulation. This daily crypto analysis examines the institutional implications as the firm targets 1,000 BTC holdings by 2026 while Bitcoin trades at $88,560 amid extreme fear sentiment.

Institutional Bitcoin accumulation continues despite market volatility. According to on-chain data, corporate treasury strategies have evolved from speculative positioning to long-term balance sheet allocation. The Matador announcement follows similar moves by MicroStrategy and Tesla, though at a smaller scale. Market structure suggests this represents continued institutional validation of Bitcoin as a treasury reserve asset.

Related developments in institutional Bitcoin adoption include Fold Holdings joining the Russell 2000 index, indicating mainstream financial integration. Meanwhile, hashrate capitulation signals suggest potential miner pressure on prices.

Matador Technologies disclosed regulatory approval for an 80 million Canadian dollar ($58.2 million) share issuance on December 23, 2025. The company explicitly stated proceeds would fund "additional Bitcoin purchases and general operating expenses." Matador currently holds 175 BTC valued at approximately $15.5 million at current prices. The firm's public timeline targets 1,000 BTC accumulation by December 31, 2026—requiring approximately $88.5 million in additional purchases at current valuations.

The capital raise represents a 375% increase in the company's Bitcoin allocation. Market analysts note the timing coincides with Bitcoin's -0.52% 24-hour decline and broader crypto market uncertainty.

Bitcoin currently trades at $88,560, testing the 0.382 Fibonacci retracement level from the November high of $94,200. The 50-day moving average provides dynamic support at $86,200. RSI readings at 42 indicate neutral momentum with bearish bias. Volume profile analysis shows significant liquidity between $85,000 and $87,000, creating a potential order block for institutional accumulation.

Bullish invalidation level: $85,000. A break below this support would invalidate the current accumulation thesis and target $82,000. Bearish invalidation level: $91,500. A sustained move above this resistance would confirm institutional buying pressure and target the all-time high.

| Metric | Value |

| Matador Raise Amount | $58.2 million |

| Current Bitcoin Holdings | 175 BTC |

| Target Holdings by 2026 | 1,000 BTC |

| Current Bitcoin Price | $88,560 |

| Fear & Greed Index | 24/100 (Extreme Fear) |

| 24-hour Price Change | -0.52% |

Institutional impact: The Matador announcement signals continued corporate adoption despite regulatory uncertainty. According to Securities and Exchange Commission filings, public companies now hold approximately 850,000 BTC collectively. Retail impact: Small-cap public companies entering Bitcoin accumulation may create secondary market effects through increased demand and reduced circulating supply.

The strategic allocation matters for Bitcoin's 5-year horizon as institutional adoption reduces volatility and increases network security. As noted in Federal Reserve research on digital assets, corporate treasury allocations represent a structural demand shift distinct from speculative trading.

Market analysts on X/Twitter highlight the accumulation timing. "Buying during extreme fear signals conviction," noted one quantitative trader. Others point to potential gamma squeeze effects if multiple firms announce similar plans simultaneously. The sentiment contrasts with recent concerns about frozen assets affecting major holders.

Bullish case: Successful capital deployment at current levels could establish $86,200 as a long-term support. Institutional accumulation patterns suggest a retest of $94,200 resistance by Q1 2026. Increased corporate adoption following Matador's lead could drive Bitcoin toward $100,000.

Bearish case: Failure to maintain $85,000 support triggers liquidation cascades. Extreme fear sentiment persists, delaying additional institutional entries. Macroeconomic factors including potential Federal Reserve rate hikes pressure risk assets. Bitcoin tests $82,000 Fibonacci support.

What is Matador Technologies?A Canadian company listed on the Toronto Venture Exchange (TSXV) announcing Bitcoin accumulation plans.

How much Bitcoin does Matador currently hold?175 BTC worth approximately $15.5 million at current prices.

What is the timeline for reaching 1,000 BTC?By December 31, 2026, requiring approximately $88.5 million in additional purchases.

How does this affect Bitcoin price?Institutional accumulation reduces circulating supply, potentially creating upward price pressure over time.

What is the Fear & Greed Index reading?24/100 indicating "Extreme Fear" sentiment among market participants.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.