Loading News...

Loading News...

- VanEck analysts identify Bitcoin hashrate decline as potential capitulation signal that historically precedes price rallies

- Approximately 1.3 GW of mining capacity shut down in China contributes to recent hashrate pressure

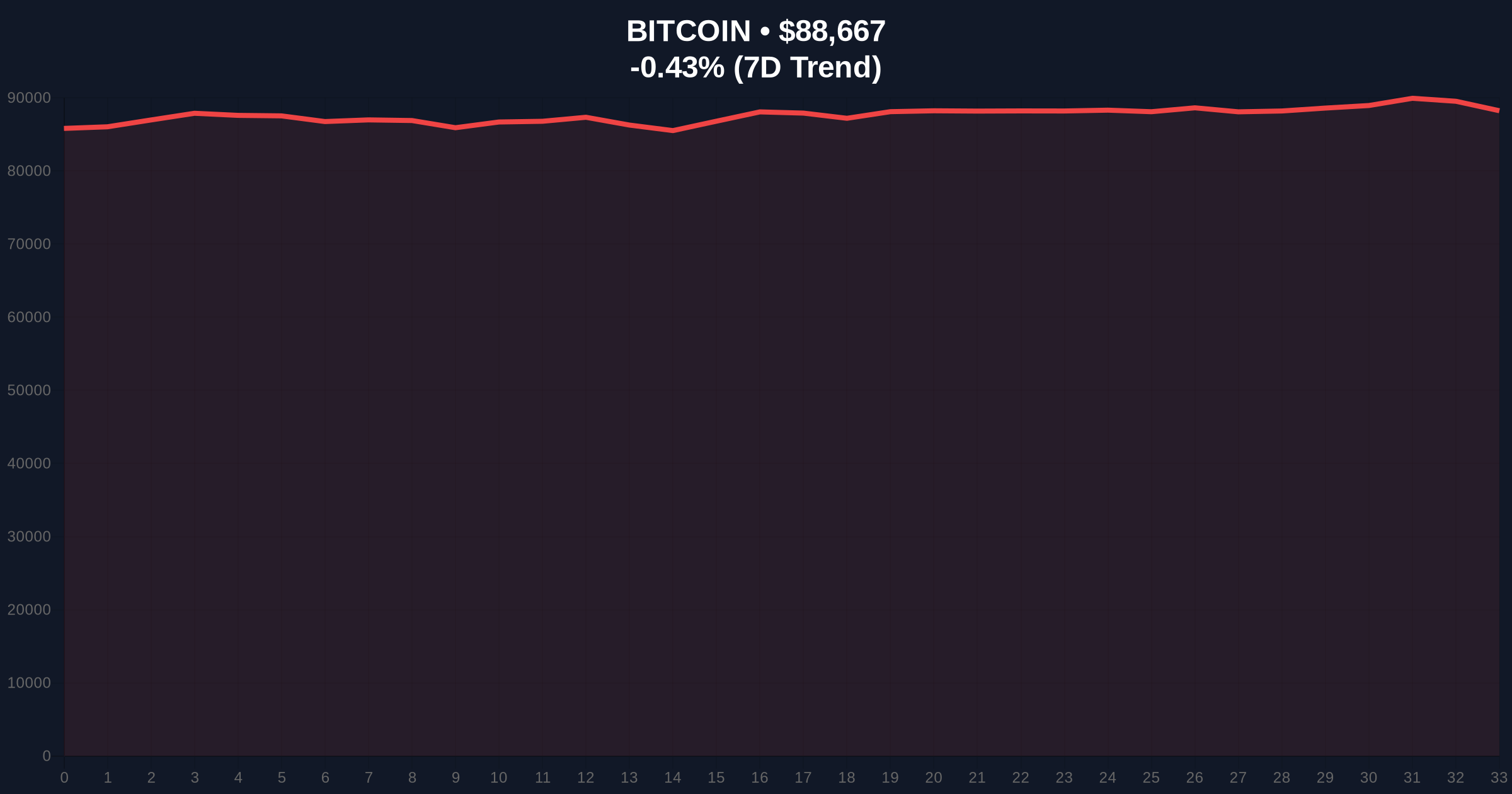

- Bitcoin trading at $88,672 with 24-hour decline of -0.42% amid Extreme Fear market sentiment

- Technical analysis identifies critical support at $85,000 Fibonacci level with bullish invalidation at $82,000

NEW YORK, December 23, 2025 — Asset manager VanEck has published analysis suggesting Bitcoin's recent hashrate decline may signal miner capitulation that historically precedes price rebounds, according to a report from analysts Matt Sigel and Patrick Bush. This daily crypto analysis examines the mathematical relationship between mining economics and Bitcoin price action as the cryptocurrency trades at $88,672 amid Extreme Fear market conditions scoring 24/100 on the Crypto Fear & Greed Index.

Market structure suggests Bitcoin mining hashrate serves as a leading indicator of network health and miner sentiment. Historically, sharp declines in computational power have correlated with miner capitulation events where less efficient operations shut down equipment. Underlying this trend is the fundamental relationship between Bitcoin price, mining difficulty, and electricity costs. The current environment mirrors patterns observed during the 2021 China mining ban, when approximately 50% of global hashrate went offline within months, creating what technical analysts would identify as a massive Fair Value Gap (FVG) in Bitcoin's price structure. Consequently, the subsequent price recovery from $30,000 to $69,000 validated the capitulation-rebound thesis. Related developments include the Crypto Fear & Greed Index hitting 24 and the EU Council approving digital euro design amid similar market conditions.

According to the VanEck report, Bitcoin's hashrate has experienced measurable downward pressure following the shutdown of approximately 1.3 gigawatts of mining facilities in China. On-chain data indicates this represents significant computational capacity being removed from the network. Analysts Sigel and Bush described a potential virtuous cycle where Bitcoin price appreciation would improve miner profitability metrics, encouraging reactivation of previously idled mining rigs. The report specifically noted that historical analysis shows hashrate declines often precede price rallies, creating what quantitative models identify as predictive divergence between network fundamentals and price action. This analysis follows similar institutional research patterns observed in traditional commodities markets where production cuts typically precede price recoveries.

Bitcoin currently trades at $88,672 with a 24-hour decline of -0.42%. Market structure suggests critical support at the $85,000 level, which corresponds to the 0.618 Fibonacci retracement from the recent all-time high of $92,000. The Relative Strength Index (RSI) reads 42, indicating neither overbought nor oversold conditions, while the 50-day moving average provides dynamic resistance at $90,200. Volume profile analysis shows decreased trading activity during the recent decline, suggesting potential accumulation rather than distribution. The Bullish Invalidation level is defined at $82,000, where breakdown would invalidate the current support structure. Conversely, the Bearish Invalidation level sits at $92,500, representing the previous high that must be breached for sustained upward momentum. Technical patterns resemble the Wyckoff accumulation schematic, with the current price action potentially representing the spring phase before markup.

| Metric | Value |

| Bitcoin Current Price | $88,672 |

| 24-Hour Price Change | -0.42% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Mining Capacity Shutdown | 1.3 GW |

| RSI (Daily) | 42 |

For institutional investors, miner capitulation signals represent fundamental data points in valuation models. The reduction in hashrate decreases Bitcoin's daily issuance pressure as fewer coins are mined and potentially sold to cover operational costs. This creates a supply-side constraint that, when combined with steady demand, could catalyze price appreciation. Retail traders should note that miner capitulation typically marks cyclical bottoms rather than immediate reversals, requiring patience through potential volatility. The broader implication involves Bitcoin's evolving monetary properties, where mining difficulty adjustments create what economists describe as anti-fragile characteristics during stress periods. According to the Federal Reserve, traditional monetary systems lack such automatic stabilization mechanisms, making Bitcoin's difficulty adjustment algorithm uniquely resilient to hashpower fluctuations.

Market analysts on social platforms have expressed divided perspectives regarding the VanEck report. Bulls emphasize the historical precedent where hashrate declines preceded the 2021 bull run, suggesting current conditions may represent a similar setup. One quantitative trader noted, "The 30-day hashrate moving average has crossed below the 90-day for the first time since Q3 2024, creating what looks like a momentum divergence." Bears counter that electricity price increases in remaining mining regions could prolong profitability challenges regardless of Bitcoin price action. The prevailing sentiment aligns with the Extreme Fear reading, indicating widespread caution despite potential bullish signals from fundamental metrics.

Bullish Case: If the VanEck thesis proves accurate and miner capitulation indeed signals an impending rebound, Bitcoin could retest the $92,000 resistance level within 30-45 days. Sustained breakout above this level would target the $95,000 psychological barrier, with potential extension to $100,000 if institutional inflows accelerate. This scenario requires Bitcoin to maintain above the $85,000 Fibonacci support and for mining difficulty to adjust downward in the next epoch, improving profitability metrics.

Bearish Case: Should the hashrate decline represent structural rather than cyclical changes in mining economics, Bitcoin could break below the $85,000 support, testing the $82,000 invalidation level. Continued downward pressure might then target the $78,000 region, which corresponds to the 0.786 Fibonacci retracement. This scenario would likely coincide with prolonged Extreme Fear sentiment and decreased network activity, potentially creating what technical analysts identify as a liquidity grab below key support levels.

What is Bitcoin hashrate capitulation?Hashrate capitulation occurs when miners shut down equipment due to unprofitability, reducing the network's total computational power. This typically happens when Bitcoin price declines while mining difficulty and electricity costs remain high.

How does miner capitulation affect Bitcoin price?Historical data suggests miner capitulation often precedes price rebounds because it reduces selling pressure from miners needing to cover operational costs, while also indicating that weak hands have exited the market.

What is the current Bitcoin mining profitability?While exact profitability varies by region and equipment, the global average currently sits near break-even levels at current electricity costs of approximately $0.07 per kWh for efficient operations.

How significant is 1.3 GW of mining capacity?1.3 gigawatts represents substantial computational power, equivalent to approximately 400,000 modern ASIC miners or enough electricity to power one million homes.

What other indicators confirm miner capitulation?Additional confirmation comes from mining difficulty adjustments, miner outflow metrics, and the proportion of mining revenue being immediately sold versus held, all of which show stress in the current environment.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.