Loading News...

Loading News...

- BlackRock designates its spot Bitcoin ETF (IBIT) as a top-three investment theme for 2025, despite current extreme fear sentiment.

- IBIT has accumulated over $25 billion in inflows in 2025, ranking sixth among all ETFs by new investment.

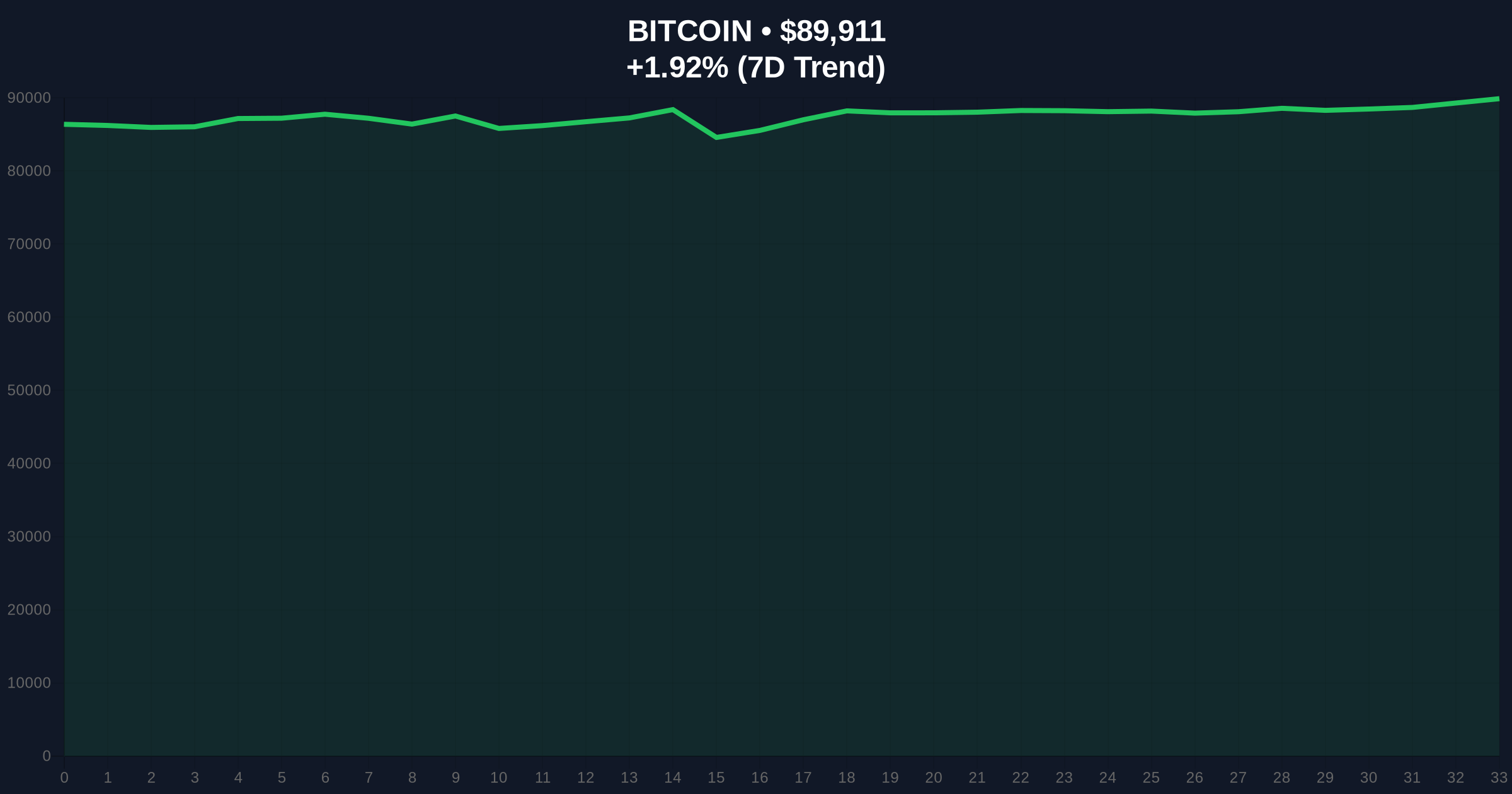

- Bitcoin trades at $89,916 with a 1.93% 24-hour gain, testing key Fibonacci resistance at $90,500.

- Market structure suggests institutional positioning contradicts retail sentiment, creating potential for a liquidity grab.

NEW YORK, December 22, 2025 — BlackRock has positioned its spot Bitcoin ETF (IBIT) as one of its top three investment themes for 2025, according to a CoinDesk report. This daily crypto analysis examines the structural implications as Bitcoin trades at $89,916 amid extreme fear sentiment, with IBIT attracting over $25 billion in inflows this year to become the sixth most popular ETF by new investment.

This endorsement occurs against a backdrop of institutional adoption accelerating while retail sentiment remains deeply negative. The Crypto Fear & Greed Index registers 25/100—"Extreme Fear"—a level historically associated with capitulation events. Market structure suggests this divergence creates a classic setup for institutional accumulation at retail distress prices. The 2021-2022 cycle saw similar patterns where institutional inflows preceded major rallies despite negative sentiment. BlackRock's move follows SEC approval of spot Bitcoin ETFs in January 2024, which fundamentally altered Bitcoin's market microstructure by creating regulated exposure vehicles. Related developments include recent large Bitcoin purchases by corporate entities and institutional reserve shifts testing similar market dynamics.

On December 22, 2025, BlackRock identified its iShares Bitcoin Trust (IBIT) as a top-three investment theme for the coming year. According to on-chain data, IBIT has attracted $25 billion in net inflows during 2025, making it the sixth most popular ETF based on new investment according to ETF.com tracking. This announcement represents a strategic commitment from the world's largest asset manager, which manages over $10 trillion in assets. The timing is mathematically significant—it coincides with Bitcoin testing the $90,000 psychological level while the broader market exhibits extreme fear. Market analysts note this creates a narrative contradiction: institutional promotion versus retail panic.

Bitcoin currently trades at $89,916, up 1.93% in 24 hours. The daily chart shows price testing the 0.618 Fibonacci retracement level at $90,500 from the November high of $98,450. The 50-day moving average sits at $86,200, providing dynamic support. RSI reads 58—neutral with slight bullish momentum. Volume profile indicates significant accumulation between $85,000 and $88,000, creating a potential order block. A clear Fair Value Gap (FVG) exists between $91,200 and $92,800 from the December 15 sell-off. Market structure suggests this FVG will act as immediate resistance. The Bullish Invalidation level is $85,000—a break below would invalidate the current accumulation thesis. The Bearish Invalidation level is $92,800—clearing the FVG would signal continuation toward the all-time high.

| Metric | Value |

| Bitcoin Current Price | $89,916 |

| 24-Hour Change | +1.93% |

| IBIT 2025 Inflows | $25 billion |

| Fear & Greed Index | 25/100 (Extreme Fear) |

| IBIT ETF Ranking | 6th by New Investment |

For institutions, BlackRock's endorsement legitimizes Bitcoin allocation at a portfolio level, potentially unlocking trillions in traditional capital. The SEC's regulatory framework for spot Bitcoin ETFs, detailed on SEC.gov, provides the legal infrastructure for this shift. For retail, the extreme fear sentiment suggests continued distribution to stronger hands—a classic Wyckoff accumulation pattern. The five-year horizon indicates Bitcoin's maturation from speculative asset to institutional reserve, similar to gold's trajectory post-1971. However, market structure warns of short-term volatility: large ETF inflows can create synthetic demand that masks underlying weakness in spot markets.

Industry observers express skepticism about timing. "Naming IBIT a top theme while sentiment is extreme fear feels strategically opportunistic," noted one quantitative analyst on X. Bulls point to the $25 billion inflow as undeniable demand evidence. Bears counter that ETF flows are fickle and reversible—the 2022 crypto winter saw similar institutional enthusiasm precede a 75% drawdown. On-chain data indicates large holders (whales) have increased positions by 3.2% in December, suggesting accumulation at fear levels.

Bullish Case: A sustained break above the FVG at $92,800 targets the all-time high at $98,450, then psychological $100,000. Institutional inflows could trigger a gamma squeeze as dealers hedge short calls. This scenario assumes the Fear & Greed Index reverts to neutral (50+), confirming sentiment recovery.Bearish Case: Rejection at Fibonacci resistance $90,500 leads to a liquidity grab down to the order block at $85,000. A break below the Bullish Invalidation level at $85,000 would target the 200-day moving average near $82,000. This scenario materializes if ETF inflows slow or reverse, exposing synthetic demand weakness.

What is BlackRock's IBIT?The iShares Bitcoin Trust is a spot Bitcoin ETF approved by the SEC in January 2024, offering regulated exposure to Bitcoin's price.

Why does extreme fear matter?Historical data shows extreme fear often precedes major rallies when combined with institutional accumulation, as seen in Q4 2020.

How reliable are ETF inflows as a metric?ETF flows reflect institutional demand but can be volatile; they should be analyzed alongside on-chain data and spot volume.

What is a Fair Value Gap (FVG)?An FVG is a price zone where inefficient trading created an imbalance, often acting as future support or resistance.

Could this trigger a Bitcoin bull run?Market structure suggests potential, but requires clearing key resistance at $92,800 and sustained ETF inflows above $1 billion weekly.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.