Loading News...

Loading News...

- Bitcoin perpetual futures open interest increased from 304,000 BTC to 310,000 BTC

- Funding rates rose from 0.04% to 0.09%, indicating growing bullish positioning

- Market sentiment remains at "Extreme Fear" with a score of 24/100 despite futures activity

- Technical structure shows critical support at Fibonacci 0.618 level of $82,000

NEW YORK, December 23, 2025 — Bitcoin perpetual futures traders are accumulating bullish positions despite prevailing market fear, with open interest increasing by 6,000 BTC and funding rates doubling in recent sessions. This daily crypto analysis reveals a divergence between sentiment indicators and derivatives positioning that suggests sophisticated traders are preparing for potential year-end volatility.

Market structure suggests this futures activity mirrors patterns observed during the December 2021 consolidation phase, when institutional traders accumulated positions ahead of the January 2022 rally. The current environment features similar characteristics: elevated open interest, rising funding rates, and a disconnect between retail sentiment and professional positioning. Underlying this trend is the broader macroeconomic context of potential Federal Reserve policy shifts, with traders anticipating possible rate cuts in early 2026 that could catalyze risk asset appreciation.

Related developments in the cryptocurrency space include recent Bitcoin ETF outflows indicating institutional caution and regulatory developments in Asian markets amid similar sentiment conditions.

According to on-chain data from Glassnode analyzed by Cointelegraph, Bitcoin perpetual futures open interest increased from 304,000 BTC to 310,000 BTC in recent trading sessions. During the same period, the funding rate—the periodic payment between long and short positions—rose from 0.04% to 0.09%. This indicates traders are willing to pay a premium to maintain long exposure, suggesting conviction in upward price movement. The analysis attributes this positioning to anticipation of year-end volatility and potential rally catalysts.

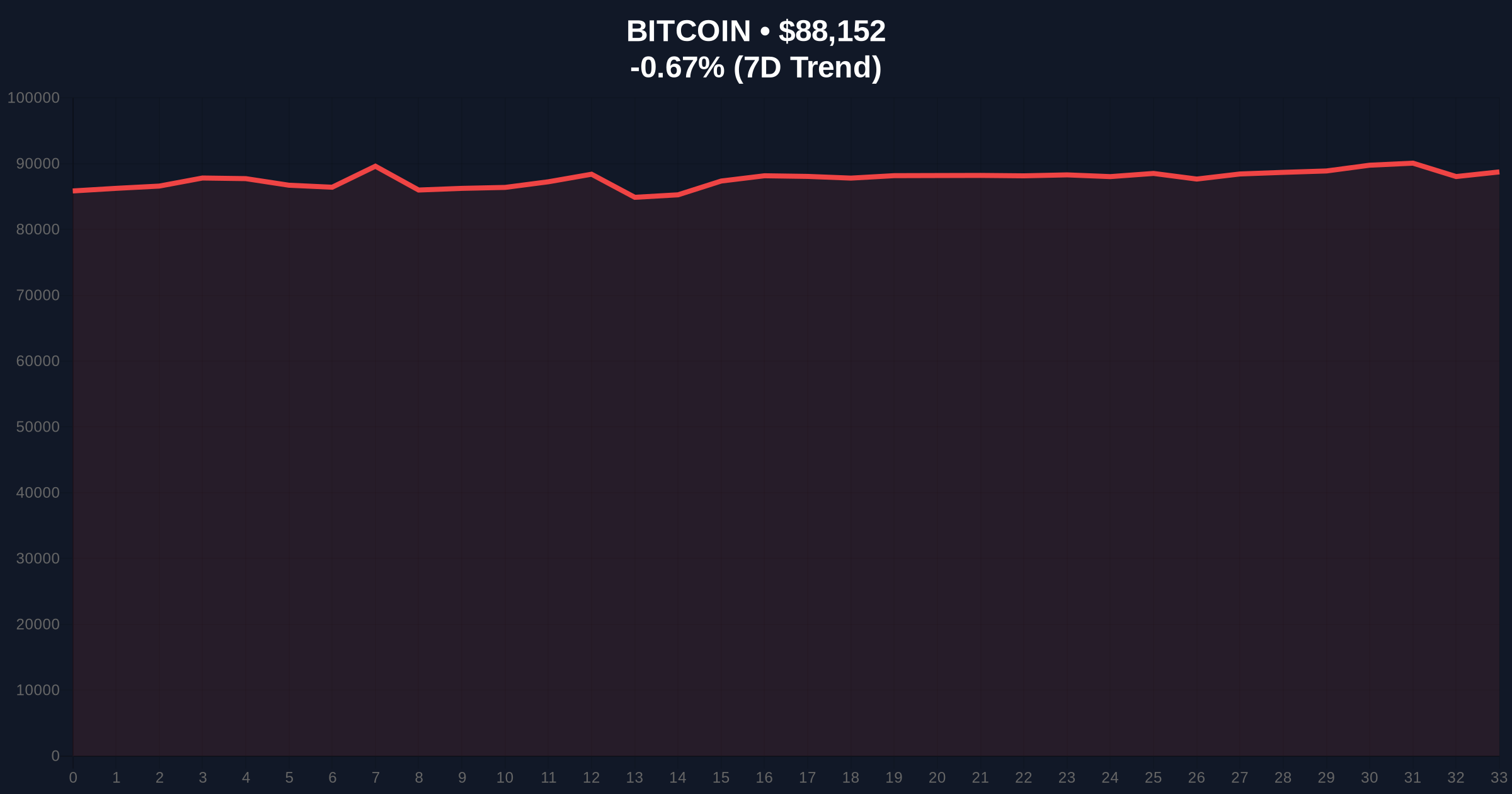

Bitcoin currently trades at $88,128, representing a 24-hour decline of 0.66%. Market structure suggests critical support exists at the Fibonacci 0.618 retracement level of $82,000, which aligns with the 200-day moving average. The Relative Strength Index (RSI) sits at 48, indicating neutral momentum without overbought or oversold conditions. Volume profile analysis shows significant liquidity clusters between $85,000 and $90,000, creating a potential Fair Value Gap (FVG) that price may seek to fill.

Consequently, the Bullish Invalidation Level is established at $82,000. A sustained break below this Fibonacci support would invalidate the current bullish futures positioning thesis. The Bearish Invalidation Level sits at $92,500, representing the recent local high and a key resistance zone. A decisive break above this level would confirm the futures traders' thesis and potentially trigger a short squeeze.

| Metric | Value |

| Bitcoin Current Price | $88,128 |

| 24-Hour Price Change | -0.66% |

| Futures Open Interest Change | +6,000 BTC (304K to 310K) |

| Funding Rate Change | +0.05% (0.04% to 0.09%) |

| Fear & Greed Index Score | 24/100 (Extreme Fear) |

For institutional participants, rising open interest with positive funding rates represents leveraged positioning that could amplify both gains and losses during volatile periods. This creates potential gamma squeeze scenarios where rapid price movements force liquidations in opposing positions. For retail traders, the divergence between "Extreme Fear" sentiment and professional positioning suggests a possible sentiment capitulation event that often precedes trend reversals. The increasing use of perpetual futures for directional bets, as documented by the Commodity Futures Trading Commission in traditional markets, indicates growing sophistication in cryptocurrency derivatives trading.

Market analysts on social platforms express divided perspectives. Bulls point to the futures data as evidence of "smart money" accumulation during fear periods, suggesting the current sentiment reading of 24/100 represents a contrarian opportunity. Bears counter that elevated open interest during uncertainty increases systemic risk, particularly if volatility triggers cascading liquidations. Neither camp disputes the mathematical reality that funding rates have turned positive while spot prices consolidate.

Bullish Case: If Bitcoin maintains above the $82,000 support and breaks through the $92,500 resistance, the current futures positioning could catalyze a move toward the $100,000 psychological level. Positive funding rates would sustain as longs profit, potentially creating a feedback loop of increasing open interest and upward price pressure. This scenario assumes no adverse macroeconomic developments and sustained institutional interest.

Bearish Case: A break below $82,000 would trigger stop-loss orders in the futures market, potentially creating a liquidity grab that drives prices toward the next significant support at $78,000. Negative funding rates would emerge as longs unwind positions, increasing selling pressure. This scenario would validate the current "Extreme Fear" sentiment and likely correlate with broader risk-off movements in traditional markets.

What are Bitcoin perpetual futures?Perpetual futures are derivative contracts without expiration dates that track Bitcoin's price, using funding rates to maintain parity with spot prices.

Why do rising funding rates indicate bullish sentiment?Positive funding rates mean long positions pay short positions, showing traders are willing to pay a premium to maintain bullish exposure.

What is the Fear & Greed Index?A sentiment indicator combining volatility, market momentum, social media activity, surveys, and dominance metrics to gauge market emotion.

How does open interest affect Bitcoin's price?High open interest indicates substantial capital committed to positions, which can amplify price movements during volatility as positions are liquidated.

What happens if Bitcoin breaks below $82,000?The bullish thesis based on current futures positioning would be invalidated, likely triggering stop-loss orders and increasing selling pressure toward lower support levels.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.