Loading News...

Loading News...

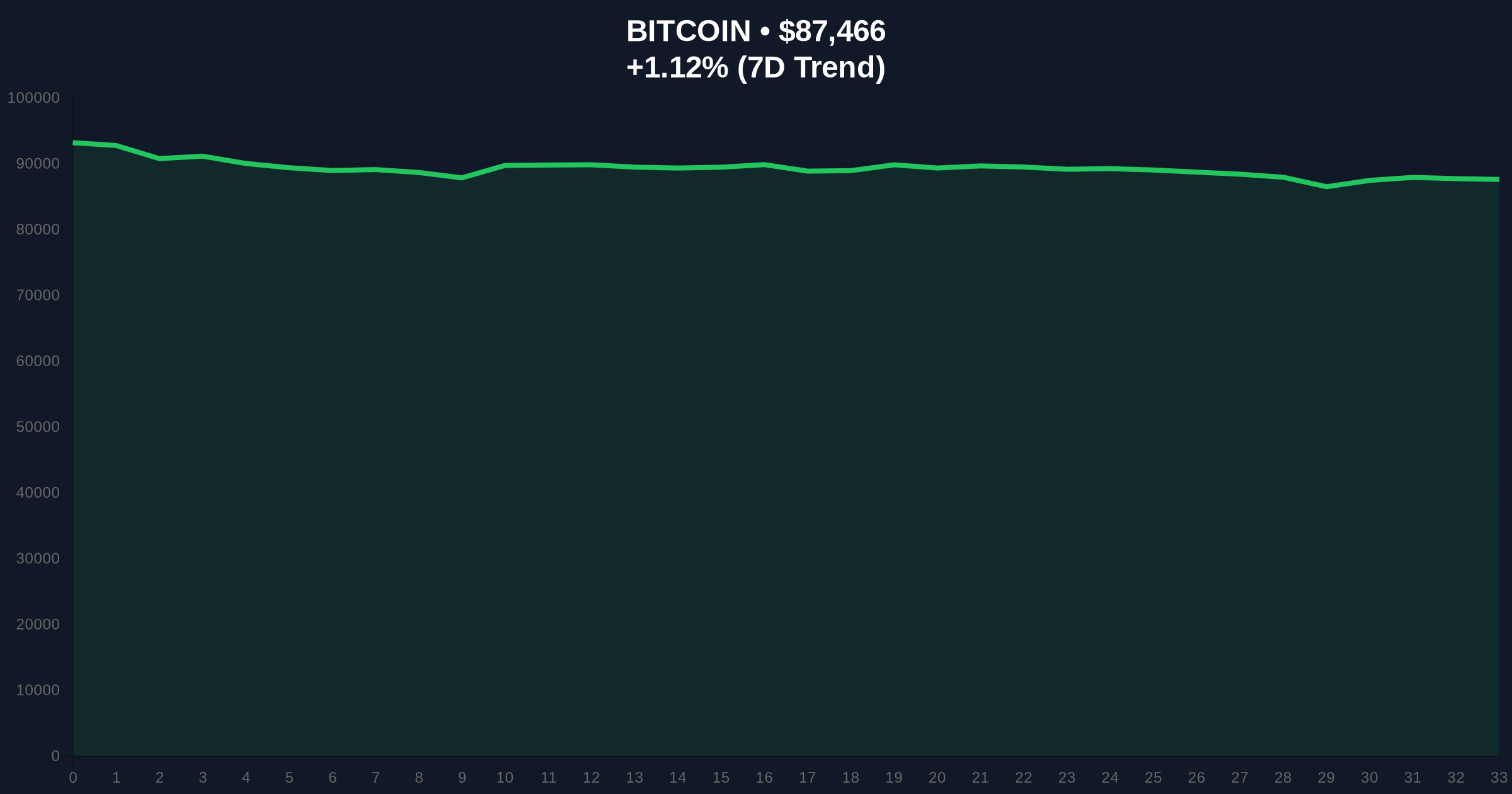

VADODARA, January 26, 2026 — Ju Ki-young, CEO of on-chain analytics firm CryptoQuant, publicly stated on X that Bitcoin functions as a risk-off asset, comparable to traditional safe havens like gold and silver. This latest crypto news arrives as the global cryptocurrency market grapples with extreme fear sentiment, with Bitcoin currently trading at $87,551. Ki-young argued that the market continues to undervalue Bitcoin by treating it primarily as a risk-on asset.

According to the statement posted on X, Ju Ki-young explicitly positioned Bitcoin within the risk-off asset category. He drew a direct parallel to gold and silver, assets historically sought during economic uncertainty. The CEO's assertion implies a fundamental shift in how institutional frameworks should evaluate Bitcoin's correlation with broader market cycles. Market structure suggests this reclassification challenges the dominant post-2020 narrative that tightly coupled Bitcoin with tech equities.

Ki-young's analysis, sourced directly from his social media post, indicates that persistent treatment of Bitcoin as risk-on represents a market inefficiency. This undervaluation thesis hinges on Bitcoin's evolving monetary properties and decoupling from traditional risk metrics. On-chain data from platforms like Glassnode will be critical in validating this decoupling hypothesis over the coming quarters.

Historically, Bitcoin's price action has shown periods of both risk-on and risk-off behavior. During the 2021 bull market, Bitcoin exhibited high correlation with the Nasdaq, reinforcing its risk-on label. In contrast, the 2022-2023 bear market saw moments where Bitcoin acted as a liquidity sink during banking crises, hinting at nascent safe-haven traits.

Similar to the 2021 correction, the current environment of extreme fear often precedes major trend inflection points. Underlying this trend is a battle between macroeconomic headwinds and Bitcoin's hardening network fundamentals. The reclassification debate mirrors early arguments about gold's role before its formal acceptance as a reserve asset.

Related developments in this climate of extreme fear include institutional moves to build infrastructure, such as the formation of Coinbase's Quantum Advisory Council and Bitwise launching its first on-chain vault on Morpho.

Market structure suggests Bitcoin is testing a critical juncture. The current price of $87,551 sits near a high-volume node identified in the Volume Profile. A key Fibonacci support level derived from the 2024-2025 rally converges around $85,000, aligning with the 0.618 retracement. This zone represents a major Order Block.

The daily RSI reading near 35 indicates oversold conditions, yet not extreme capitulation. The 200-day moving average, a benchmark for long-term trend health, provides dynamic support near $84,200. A breach below this level would invalidate the current bullish market structure and likely trigger a Liquidity Grab toward $80,000.

Conversely, reclaiming the $90,000 level would fill a significant Fair Value Gap (FVG) and signal strength. This technical setup is for assessing the validity of the risk-off thesis, as true safe-haven assets demonstrate resilience at key technical supports during broad market stress.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Indicates high market stress and potential buying opportunity zones. |

| Bitcoin (BTC) Price | $87,551 | Current trading price, down 1.45% in 24h. |

| 24-Hour Trend | -1.45% | Minor decline amid consolidation. |

| Market Rank | #1 | Maintains dominant market capitalization position. |

| Key Fibonacci Support | $85,000 (0.618) | Critical level for maintaining bullish structure. |

This reclassification carries profound implications for institutional capital allocation. If validated, Bitcoin could attract flows from pension funds and sovereign wealth funds traditionally reserved for gold and treasuries. On-chain data indicates a steady accumulation by long-term holders (LTHs), a behavior consistent with risk-off asset accumulation during downturns.

, regulatory treatment may evolve if major institutions like the Federal Reserve begin to acknowledge Bitcoin's divergent correlation profile. The shift impacts derivative markets, potentially reducing Bitcoin's beta to tech stocks and altering hedging strategies. Retail market structure often lags these institutional realignments by 6-12 months.

"The risk-off asset thesis isn't new, but coming from a data-centric entity like CryptoQuant, it carries significant weight. We are observing a decoupling in UTXO age bands, where older coins are moving less frequently despite price volatility. This is a hallmark of safe-haven behavior, not speculative trading." – CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from the current market structure. The bullish case requires Bitcoin to hold above the $85,000 Fibonacci support and reclaim $90,000 to confirm a reversal. The bearish scenario involves a breakdown below $85,000, targeting the $80,000 liquidity zone.

The 12-month institutional outlook hinges on macroeconomic data and Bitcoin's continued network growth. Historical cycles suggest that periods of extreme fear often precede major rallies if fundamental metrics remain strong. The 5-year horizon will likely see Bitcoin's correlation profile tested across multiple economic regimes.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.