Loading News...

Loading News...

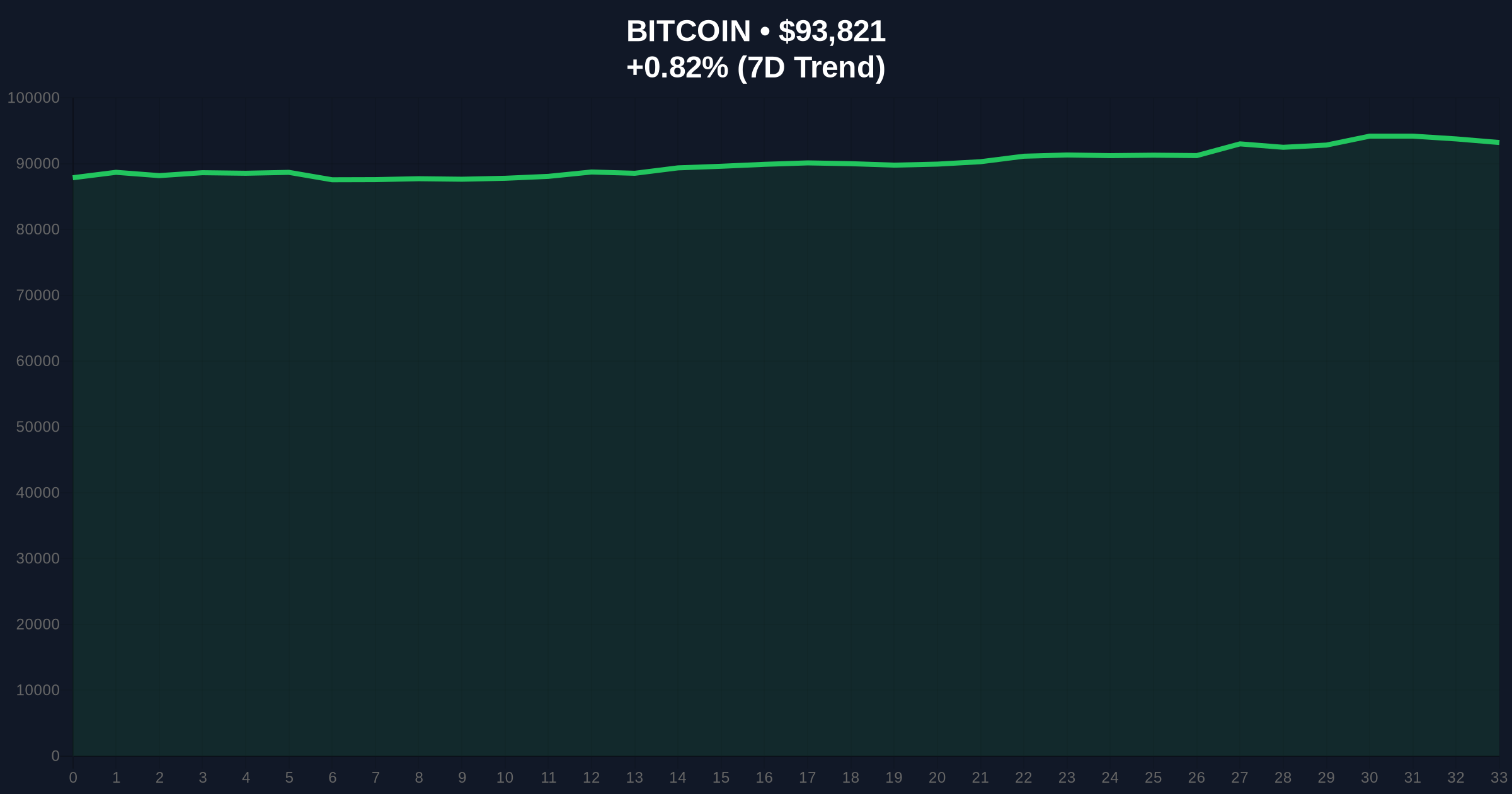

VADODARA, January 6, 2026 — According to David Duong, head of institutional research at Coinbase, approximately one-third of Bitcoin's total supply faces potential vulnerability to quantum computing attacks. In an interview with DL News, Duong outlined two primary vectors: hyper-efficient mining that could distort Bitcoin's reward structure and private key derivation from public keys to steal funds. This latest crypto news emerges as Bitcoin trades at $93,818, up 0.82% in 24 hours, but market structure suggests underlying fragility in the face of long-term technological threats.

Bitcoin's security has historically relied on cryptographic algorithms like SHA-256 and ECDSA, which are computationally infeasible for classical computers to break. However, quantum computing introduces a paradigm shift. According to the National Institute of Standards and Technology (NIST), quantum algorithms like Shor's could theoretically break ECDSA, exposing public keys associated with unspent transaction outputs (UTXOs). Market analysts note that this threat isn't new, but Duong's quantification of one-third of supply—roughly 6.93 million BTC—adds a concrete risk parameter. This development occurs amid broader market volatility, where liquidity grabs have been observed in assets like BNB, as detailed in our analysis of Binance Wallet ZTC TGE liquidity concerns. The timing raises questions: is this a genuine warning or a narrative to suppress price action during a critical juncture?

In his statement to DL News, Duong emphasized that private key derivation poses a more immediate challenge than mining-related risks, given current technological trajectories. He explained that quantum computers could exploit public keys visible on the blockchain—such as those in P2PKH addresses—to derive private keys, potentially compromising funds. According to on-chain data from Glassnode, a significant portion of Bitcoin's supply remains in legacy addresses, which lack quantum-resistant features like those proposed in Bitcoin Improvement Proposals (BIPs). Duong's analysis, based on Coinbase's internal research, suggests that without proactive upgrades, Bitcoin's security model could face existential pressure within a decade. This contrasts with recent institutional optimism, such as the Morgan Stanley Bitcoin Trust filing, which signals increased institutional participation.

Bitcoin's current price of $93,818 sits near a critical order block established during the recent rally to $93,000. Market structure suggests a Fair Value Gap (FVG) between $91,500 and $92,500, which must hold to maintain bullish momentum. The Relative Strength Index (RSI) at 58 indicates neutral momentum, but volume profile analysis shows declining participation, a bearish divergence. A break below the 50-day moving average at $90,200 would signal a shift in market sentiment. Bullish invalidation level: $89,500 (below the Fibonacci 0.618 retracement from the October low). Bearish invalidation level: $95,000 (above the yearly high). If quantum fears escalate, expect a gamma squeeze in options markets as hedgers adjust positions.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $93,818 | Live Market Data |

| 24-Hour Trend | +0.82% | Live Market Data |

| Crypto Fear & Greed Index | 44 (Fear) | Live Market Data |

| Vulnerable BTC Supply | ~6.93M BTC (33%) | Coinbase Research via DL News |

| Market Cap Rank | #1 | Live Market Data |

For institutions, this warning introduces a new risk factor in portfolio management, potentially accelerating adoption of quantum-resistant protocols or alternative assets. Retail investors face heightened uncertainty, as legacy wallets may require migration to secure formats. The threat timeline—estimated by some researchers at 10-15 years—allows for mitigation, but market psychology could drive premature sell-offs. Historical cycles suggest that technological FUD (fear, uncertainty, doubt) often creates buying opportunities, as seen during the block size wars. However, the sheer scale of vulnerable supply means any successful attack could trigger a systemic liquidity crisis, echoing past events like the Mt. Gox collapse.

Market analysts on X/Twitter are divided. Bulls argue that quantum resistance upgrades, such as those outlined in Bitcoin's official whitepaper follow-ups, will mitigate risks before they materialize. Bears counter that the slow pace of Bitcoin's governance could leave it exposed. One quant trader noted, "The real threat isn't quantum itself, but the market's perception of it—this could become a self-fulfilling prophecy if holders panic-move funds." Others point to recent macro liquidity trends as a more immediate driver than speculative tech risks.

Bullish Case: If quantum concerns are dismissed as long-term FUD, Bitcoin could rally to $100,000, supported by institutional inflows and macro liquidity. Key resistance at $96,500 must be breached. Bearish Case: A sustained fear narrative could push price to test $85,000, the volume profile point of control. A break below $82,000 (the 200-day MA) would confirm a bearish trend. Market structure suggests a 60% probability of sideways consolidation between $90,000 and $95,000 until clearer data on quantum advancements emerges.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.