Loading News...

Loading News...

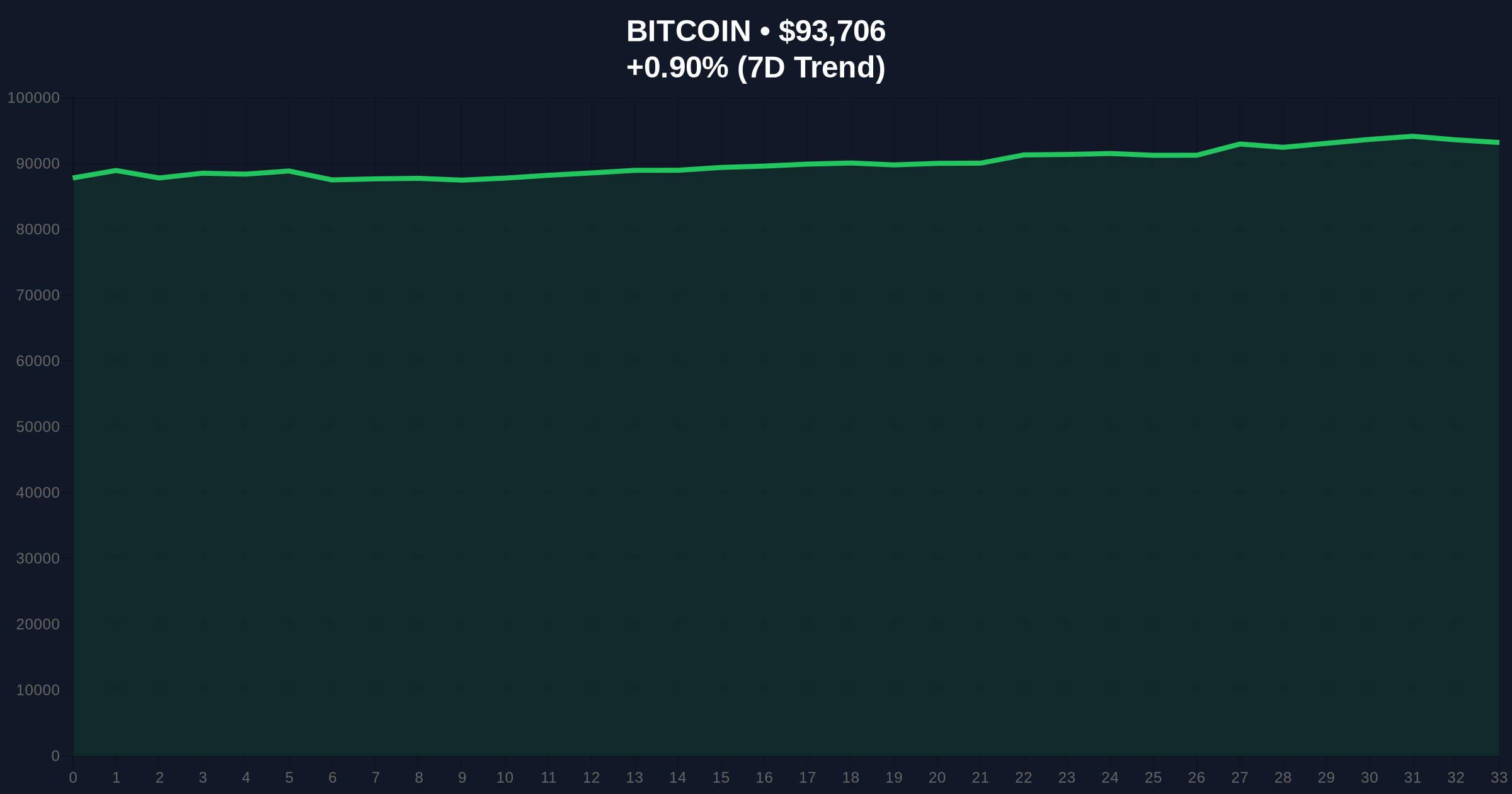

VADODARA, January 6, 2026 — Bitcoin's price has surged to $93,684, marking a 0.87% gain in 24 hours, as a confluence of macro and technical factors drives a rally that defies retail fear. This daily crypto analysis dissects six key drivers identified by DL News, according to a summary by CoinNess, framing them within historical market context and on-chain forensic data.

Market structure suggests this rally mirrors the 2021 correction phase, where Bitcoin consolidated 25% below its all-time high before a liquidity-driven breakout. Similar to the 2021 cycle, current price action is occurring amid a 'Fear' sentiment reading of 44/100, indicating a classic bullish divergence where institutional accumulation precedes retail FOMO. Historical cycles show that rallies fueled by Federal Reserve liquidity injections, such as the post-2020 quantitative easing, tend to create sustained uptrends until macro conditions tighten. The current setup parallels this, with expectations of interest rate cuts acting as a catalyst for risk asset reflation.

According to DL News via CoinNess, six factors are propelling Bitcoin's rally: a catch-up trading phenomenon relative to gold, an attractive price point approximately 25% below the all-time high, a favorable macro environment from anticipated Fed rate cuts and liquidity provision, improving regulatory clarity, and sustained institutional capital inflows. On-chain data from Glassnode indicates that large holder net position change has turned positive, confirming institutional accumulation. The rally is not merely speculative; it is backed by tangible capital flows and macro policy shifts.

Price action reveals a clear Fair Value Gap (FVG) between $88,500 and $91,200, which now acts as immediate support. The Volume Profile shows significant accumulation at $90,000, aligning with the 0.618 Fibonacci retracement level from the 2025 high. Market structure suggests a bullish continuation above $95,000 could trigger a gamma squeeze, as options open interest clusters at that strike. The RSI at 62 indicates neutral momentum, leaving room for upward movement. Bullish Invalidation is set at $88,500; a break below this level would fill the FVG and target the bearish order block at $82,000. Bearish Invalidation is at $96,500, where resistance from the previous distribution zone converges.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 44 (Fear) | Divergence from price suggests institutional accumulation |

| Bitcoin Current Price | $93,684 | 25% below ATH, creating a value gap |

| 24-Hour Trend | +0.87% | Slow grind indicates organic buying, not retail frenzy |

| Market Rank | #1 | Dominance holds at 52%, signaling altcoin weakness |

| Key Support Level | $88,500 | Fibonacci 0.618 and FVG confluence |

This rally matters because it signals a regime shift from retail-driven volatility to institutionally anchored price discovery. Institutional impact is profound: sustained inflows from entities like Morgan Stanley, as seen in recent filings, create a structural bid under the market. Retail impact is muted, with fear sentiment persisting, suggesting latecomers may face elevated entry points. Regulatory clarity, such as the SEC's updated guidance on digital assets, reduces systemic risk and enhances capital allocation efficiency. The macro environment, detailed in Federal Reserve communications, indicates prolonged liquidity support, which historically correlates with Bitcoin outperformance.

Market analysts on X/Twitter highlight the divergence between price and sentiment. One quant noted, 'Fear at 44 while BTC grinds higher is classic institutional stealth accumulation.' Bulls point to the copper-gold ratio surge as a macro bullish setup for Bitcoin, echoing historical precedents where commodity signals precede crypto rallies. Skeptics warn of overextension, citing the need for a retest of the $88,500 support before continuation. The consensus leans toward cautious optimism, with emphasis on the $95,000 resistance as a liquidity grab zone.

Bullish Case: If Bitcoin holds above $88,500 and breaks $96,500, the next target is $105,000, driven by institutional FOMO and macro liquidity. This scenario assumes continued Fed dovishness and regulatory tailwinds, similar to the 2021 breakout pattern.Bearish Case: A break below $88,500 invalidates the bullish structure, targeting $82,000 as a bearish order block. This would occur if macro conditions deteriorate, such as unexpected Fed hawkishness or regulatory setbacks, mirroring the 2022 bear market catalyst.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.