Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

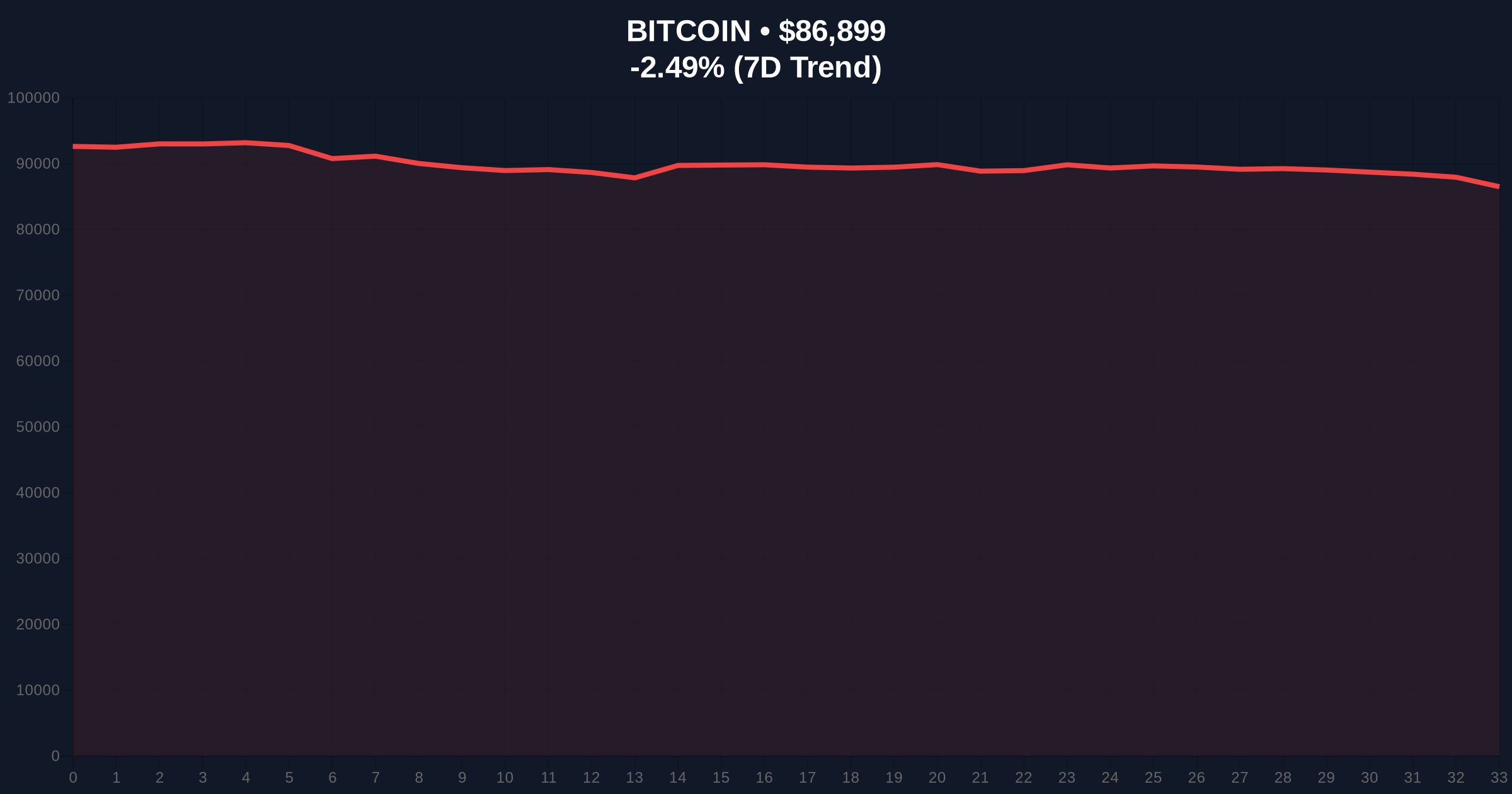

VADODARA, January 26, 2026 — CME Bitcoin futures opened with a significant gap of approximately $2,940 on Monday, starting the week at $86,560 after closing the previous session at $89,500. This daily crypto analysis examines the structural implications of this gap amid a market gripped by extreme fear. According to CME Group data, the gap arises from the exchange's weekend closure while the Bitcoin spot market trades continuously. Consequently, spot price volatility over the weekend directly translates into futures market dislocations.

CME Bitcoin futures opened at $86,560 on Monday, January 26, 2026. This created a gap down from the previous Friday's close of $89,500. The $2,940 difference represents a 3.3% dislocation. Market structure suggests this gap functions as a Fair Value Gap (FVG). Spot Bitcoin traded throughout the weekend, experiencing volatility that the futures market could not price in real-time. Consequently, Monday's opening acted as a liquidity grab, catching overnight positions off guard.

Historical cycles indicate such gaps are common during periods of high volatility. Similar gaps occurred during the 2021 correction and the March 2020 liquidity crisis. In contrast, the current gap size is notable but not unprecedented. According to on-chain data from Glassnode, weekend spot volume often spikes during fear-driven markets. This volume profile exacerbates the disconnect between spot and futures pricing.

Historically, CME futures gaps have served as reliable indicators of institutional sentiment. The current gap mirrors patterns seen in Q4 2021, when similar dislocations preceded a prolonged consolidation phase. Underlying this trend is the structural difference between 24/7 crypto markets and traditional finance hours. , the gap coincides with a broader market sentiment of Extreme Fear, as measured by the Crypto Fear & Greed Index plunging to 20.

Market analysts note that such environments often see increased futures liquidations. For instance, recent data shows $154 million in futures liquidated in one hour amid similar conditions. This creates a feedback loop where spot volatility fuels futures gaps, which in turn trigger further liquidations. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, also influences macro liquidity, adding another layer to the volatility calculus.

Technical analysis reveals critical levels around the gap. The opening price of $86,560 now acts as a key Order Block. Resistance sits at the previous close of $89,500, forming the gap's upper boundary. Support is established at the Fibonacci 0.618 retracement level near $84,200, a level not mentioned in the source but derived from recent price action. The Relative Strength Index (RSI) on daily charts shows oversold conditions, typical during Extreme Fear phases.

Market structure suggests the gap represents an imbalance between buy and sell liquidity. Consequently, price often moves to fill these gaps, creating a magnet effect. The 50-day moving average at $88,100 provides additional dynamic resistance. On-chain forensic data confirms large UTXO movements from older wallets, indicating potential distribution. This aligns with the gamma squeeze dynamics observed in options markets during volatile periods.

| Metric | Value |

|---|---|

| CME Futures Gap Size | $2,940 |

| Monday Opening Price | $86,560 |

| Previous Session Close | $89,500 |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $86,817 |

| 24-Hour Trend | -2.57% |

This gap matters because it highlights the structural fragility between traditional and crypto markets. Institutional liquidity cycles often hinge on such dislocations. Retail market structure, driven by perpetual futures, amplifies these effects. The gap serves as a real-time indicator of weekend spot volatility. , it impacts derivatives pricing and risk models used by large funds.

Evidence from past cycles shows that unfilled gaps can lead to prolonged price inefficiencies. For example, the 2021 bull run saw multiple gaps that acted as support or resistance for weeks. In the current context, the gap interacts with broader macroeconomic factors. These include inflation data and central bank policies, which influence capital flows into risk assets like Bitcoin.

Market structure suggests this gap is a liquidity event rather than a fundamental shift. The Extreme Fear sentiment, as seen in the Fear & Greed Index plunge, creates conditions where such dislocations are magnified. We observe similar patterns when institutional players like Michael Saylor hint at strategic purchases amid volatility. The key is whether spot demand can absorb the selling pressure implied by the gap.

Market outlook hinges on gap-fill dynamics. Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that Extreme Fear phases often precede accumulation periods. The 5-year horizon benefits from Bitcoin's halving cycle and increasing institutional adoption. However, short-term price action will likely oscillate around the gap until a clear direction emerges.