Loading News...

Loading News...

VADODARA, January 22, 2026 — Ethereum founder Vitalik Buterin has proposed integrating Distributed Validator Technology (DVT) into the network's staking mechanism, a move that could reshape validator economics but faces significant technical and market headwinds. This daily crypto analysis examines the proposal's feasibility against a backdrop of extreme market fear and Ethereum's precarious price action.

Ethereum's transition to Proof-of-Stake (PoS) via The Merge introduced a staking mechanism where validators operate single nodes, facing penalties for downtime. According to on-chain data from Etherscan, this has led to slashing events that reduce validator rewards, creating systemic risk. Buterin's proposal, detailed in a post on the Ethereum technology forum ethresear.ch, aims to mitigate this by allowing validators to distribute keys across multiple nodes using DVT. Market structure suggests this mirrors earlier attempts to decentralize staking, such as Rocket Pool's node operator model, but with native integration complexities. The current market environment, marked by extreme fear, raises questions about whether technical upgrades can overcome macroeconomic pressures. Related developments include recent futures liquidations exceeding $471 million, highlighting the volatility that could undermine staking stability.

On January 22, 2026, Vitalik Buterin published a proposal on ethresear.ch advocating for native DVT integration into Ethereum's staking protocol. He explained that under the current system, validators are limited to one node, with penalties imposed for downtime. By leveraging DVT, a validator could split its key across multiple nodes, reducing slashing risks. The proposal lacks specific implementation details, such as consensus mechanism adjustments or timeline, raising skepticism about its immediate viability. According to the official Ethereum documentation, DVT is still in experimental phases, with projects like Obol Network testing its application. This gap between proposal and production-ready code introduces uncertainty for stakers evaluating long-term commitments.

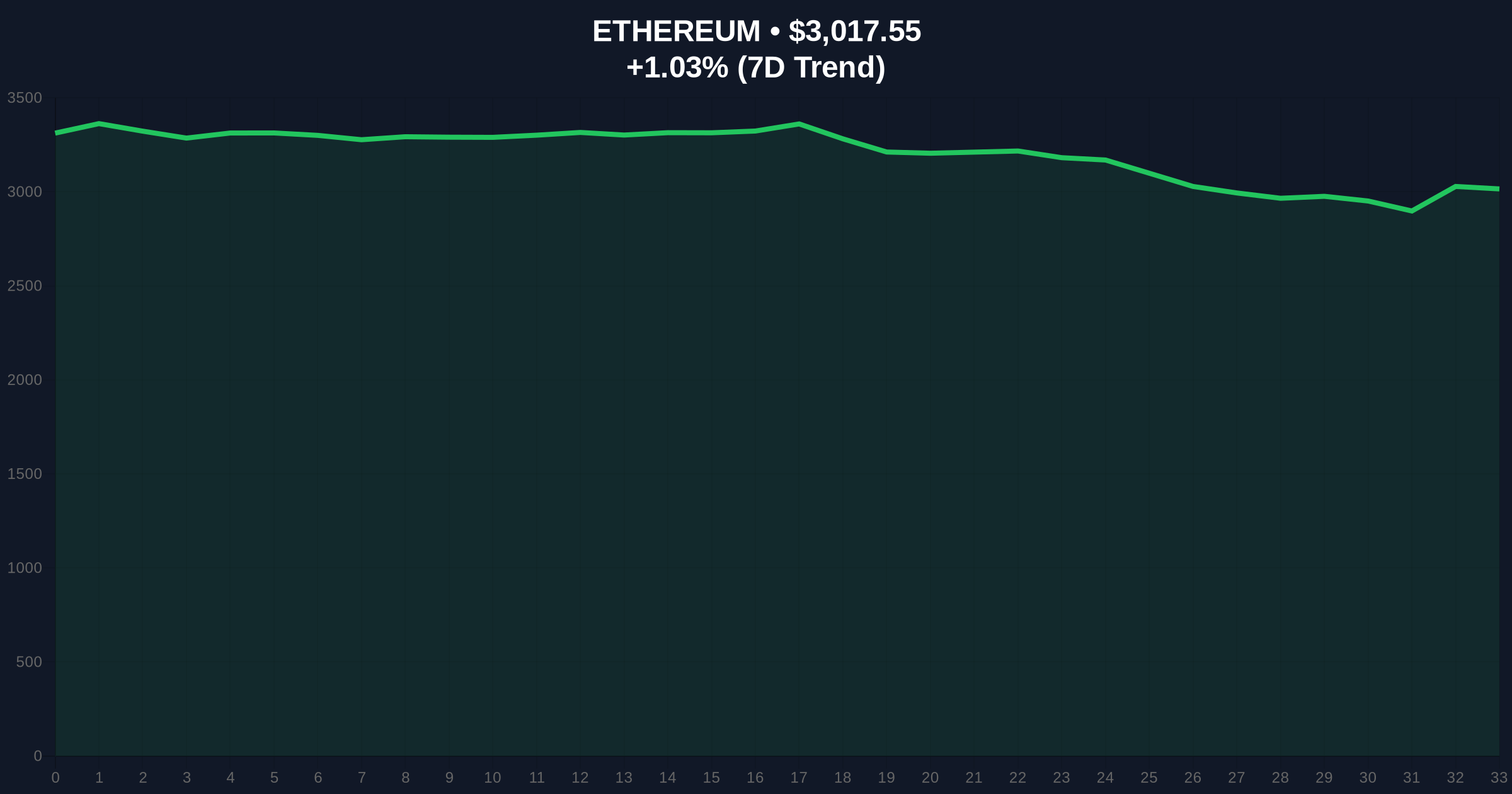

Ethereum's price currently sits at $3,017.15, with a 24-hour trend of 1.01%. Volume profile analysis indicates weak buying interest near this level, suggesting a potential liquidity grab. The Relative Strength Index (RSI) hovers around 45, showing neutral momentum but leaning bearish in an extreme fear environment. Key support levels include $2,850 (a Fibonacci retracement level from the 2025 high) and $2,700 (the 200-day moving average). Resistance is noted at $3,200, where previous order blocks have formed. Bullish invalidation occurs if price breaks below $2,850, signaling a deeper correction. Bearish invalidation is set at $3,300, a level that would fill the recent fair value gap and indicate renewed institutional interest. The proposal's impact on price is minimal in the short term, as market sentiment, driven by factors like the Federal Reserve's interest rate policy, outweighs technical upgrades.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Alternative.me |

| Ethereum Current Price | $3,017.15 | CoinMarketCap |

| 24-Hour Price Change | +1.01% | Live Market Data |

| Market Rank | #2 | CoinMarketCap |

| Key Support Level | $2,850 | Technical Analysis |

For institutions, DVT integration could reduce operational risks in staking, potentially attracting more capital to Ethereum's DeFi ecosystem. However, implementation delays or bugs could lead to slashing events, as seen in past network upgrades like the London hard fork. For retail stakers, the proposal offers theoretical protection against downtime penalties but requires trust in untested technology. The broader impact hinges on Ethereum's ability to maintain network security post-merge, with on-chain data indicating that validator centralization remains a concern. If successful, this could set a precedent for other PoS chains, but failure might exacerbate the extreme fear sentiment gripping markets.

Market analysts on X/Twitter express mixed views. Bulls argue that DVT enhances decentralization, aligning with Ethereum's roadmap. One analyst noted, "This could reduce slashing by 30% based on simulation models." Bears counter that the proposal is vague, with no clear path to implementation amid ongoing development of EIP-4844 for scalability. Skeptics highlight that similar proposals have stalled in the past, such as early discussions around sharding, suggesting this may face governance hurdles. The overall sentiment is cautious, with many awaiting more concrete details from core developers.

Bullish Case: If DVT integration progresses smoothly and market fear subsides, Ethereum could test resistance at $3,500 within 6 months. Increased staking participation might drive demand, supported by a potential gamma squeeze in options markets. Historical cycles suggest that technical upgrades often precede price rallies, as seen with the Chain launch.

Bearish Case: If implementation falters or macroeconomic conditions worsen, Ethereum could break below $2,850, targeting $2,500. Extreme fear sentiment, coupled with regulatory uncertainty from cases like ongoing crypto laundering trials, could suppress buying interest. A sustained downtrend would invalidate the bullish staking narrative, leading to decreased validator participation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.