Loading News...

Loading News...

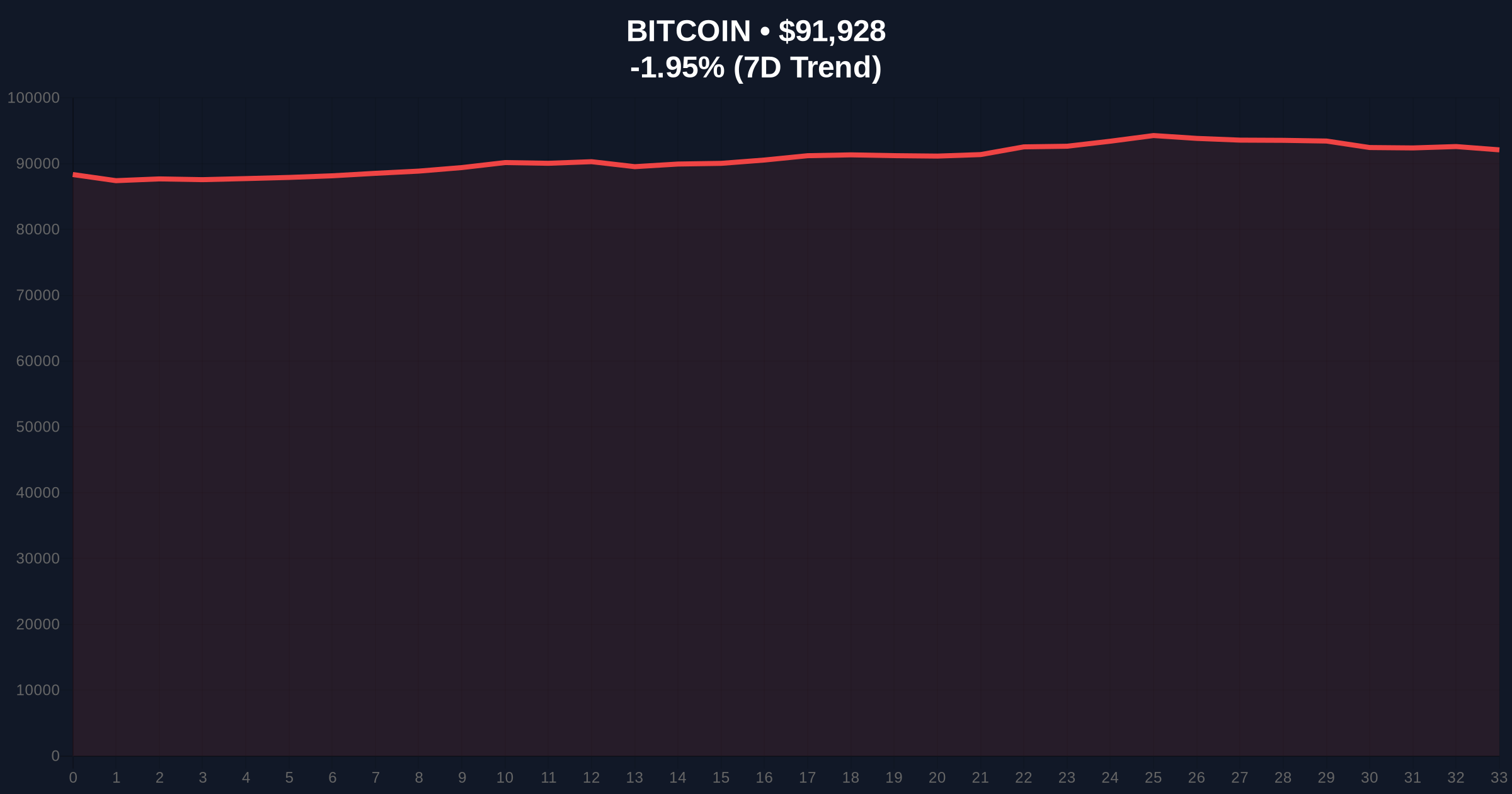

VADODARA, January 7, 2026 — In a stark warning that has reverberated through crypto markets, Bloomberg Intelligence senior macro strategist Mike McGlone has projected Bitcoin could fall to the $50,000 support level in 2026, according to a report by U.Today. This daily crypto analysis examines the macroeconomic drivers behind this forecast, with Bitcoin currently trading at $91,988, down 1.80% in 24 hours amid a broader risk-off environment.

Market structure suggests this potential correction mirrors historical patterns observed during previous macro regime shifts. Similar to the 2021 correction that saw Bitcoin decline from $64,000 to $29,000 amid Federal Reserve taper talk, current conditions show a dangerous confluence of surging gold prices and suppressed stock volatility. According to McGlone's analysis, this combination has historically preceded market stress events, with gold acting as a leading indicator for risk asset repricing. The current environment echoes the 2018 bear market, where Bitcoin lost 84% from its peak as traditional markets faced liquidity constraints. On-chain data indicates that long-term holder distribution has accelerated over the past quarter, with UTXO age bands showing increased movement from wallets holding for 2-3 years.

Mike McGlone, in his capacity as senior macro strategist at Bloomberg Intelligence, warned that Bitcoin's price correlation with stock market volatility and gold strength creates vulnerability. He specifically noted that the recent surge in gold prices during 2025 could signal impending market stress, with Bitcoin positioned to correct alongside other risk assets if equity markets become unstable. The analysis, reported by U.Today, points to historical precedents where sustained gold strength combined with low VIX readings has not been sustainable, typically resolving through risk asset corrections. This warning comes as Bitcoin tests key technical levels, with the $91,000 zone representing a critical order block that has absorbed selling pressure throughout December 2025.

Volume profile analysis reveals significant liquidity accumulation between $88,000 and $92,000, creating a potential fair value gap (FVG) that must be filled for healthy price discovery. The 200-day moving average at $85,400 provides intermediate support, while the Fibonacci 0.618 retracement from the 2025 high sits at $82,000. Market structure suggests a break below this level would invalidate the current bullish higher-timeframe structure and open the path to McGlone's $50,000 target. The relative strength index (RSI) on weekly charts shows divergence from price action, indicating weakening momentum despite nominal price stability. Bullish invalidation occurs below $82,000, confirming a structural breakdown. Bearish invalidation requires a sustained move above $98,500, which would fill the current FVG and target the $105,000 resistance zone.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 42 (Fear) | Indicates risk-off sentiment, often precedes volatility spikes |

| Bitcoin Current Price | $91,988 | Testing critical support zone |

| 24-Hour Change | -1.80% | Negative momentum amid macro warnings |

| Market Rank | #1 | Maintains dominance despite correction risk |

| Projected Support Level | $50,000 | Bloomberg analyst target for 2026 |

For institutional portfolios, a correction to $50,000 would represent a 45% drawdown, testing risk management frameworks and potentially triggering systematic deleveraging across crypto-native funds. Retail investors face margin call risks at key technical levels, particularly between $82,000 and $75,000 where significant leveraged positions are concentrated according to exchange heatmaps. The warning highlights Bitcoin's evolving role as a risk asset rather than a pure inflation hedge, with correlation to traditional markets increasing post-2023 ETF approvals. Historical cycles suggest that such macro-driven corrections typically last 12-18 months, with recovery phases requiring fundamental catalyst shifts such as Federal Reserve policy pivots or institutional adoption milestones.

Market analysts on X/Twitter have expressed divided views on McGlone's projection. Bulls point to Bitcoin's resilient network fundamentals, with hash rate continuing to reach all-time highs despite price uncertainty. One quantitative trader noted, "The $50,000 target seems extreme given current on-chain metrics, but we cannot ignore macro headwinds from traditional finance." Bears emphasize the technical breakdown risks, with several chartists highlighting the descending triangle pattern forming on weekly timeframes. The consensus among derivatives traders shows increased put option buying at the $80,000 strike for Q2 2026, indicating hedging against further downside.

Bullish Case: If Bitcoin holds the $82,000 Fibonacci support and traditional markets avoid significant volatility spikes, a recovery toward $105,000 is plausible by Q3 2026. This scenario requires gold prices to stabilize and stock volatility to remain contained, with Bitcoin decoupling from risk assets through increased institutional adoption. The implementation of EIP-4844 proto-danksharding on Ethereum could provide positive spillover effects to the broader crypto ecosystem, supporting Bitcoin's narrative as digital gold.

Bearish Case: A break below $82,000 confirms McGlone's warning, opening a path to $50,000 through a series of liquidity grabs at $75,000, $65,000, and $55,000. This scenario assumes sustained equity market instability and continued gold strength, creating a perfect storm for risk asset repricing. Historical data from the Federal Reserve's monetary policy cycles suggests that such corrections typically bottom 6-9 months after initial breakdowns, potentially placing a trough in late 2026 or early 2027.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.