Loading News...

Loading News...

VADODARA, January 14, 2026 — A quantitative analysis from Bitwise Asset Management demonstrates that replacing 15% of a traditional 60/40 stock-and-bond portfolio with equal allocations to Bitcoin and gold triples the Sharpe ratio from 0.227 to 0.679. This latest crypto news provides mathematical validation for institutional portfolio diversification strategies that have gained traction since the 2024 Bitcoin ETF approvals.

Market structure suggests this analysis arrives during a critical inflection point for traditional portfolio theory. The 60/40 portfolio model, which dominated institutional allocations for decades, has shown diminishing returns since the Federal Reserve began its quantitative tightening cycle in 2022. According to historical data from the Federal Reserve Economic Data (FRED) repository, the correlation between stocks and bonds has turned positive in recent years, undermining the traditional diversification benefits of the 60/40 approach. Similar to the 2018-2019 period when institutional interest in Bitcoin first gained mathematical justification through Modern Portfolio Theory extensions, current market conditions create fertile ground for alternative asset adoption. The analysis builds directly on Ray Dalio's 2021 proposal for a 15% hedge against dollar devaluation, providing the quantitative backbone that was previously theoretical.

Related Developments: This portfolio optimization research coincides with other structural shifts in crypto markets, including Bitcoin's trading volume migration to US hours and Bitwise's continued ETF product development.

According to The Block's reporting of Bitwise's analysis, the asset manager conducted a comprehensive backtest comparing portfolio performance metrics. The traditional 60/40 portfolio (60% S&P 500, 40% Bloomberg US Aggregate Bond Index) achieved a Sharpe ratio of 0.227. The modified portfolio—reducing both stock and bond allocations by 7.5% each to allocate 7.5% to Bitcoin and 7.5% to gold—produced a Sharpe ratio of 0.679. This represents a 199% improvement in risk-adjusted returns. Bitwise's research indicates gold provides defensive characteristics during market stress periods, while Bitcoin delivers asymmetric upside during recovery phases. The asset manager explicitly connected these findings to Ray Dalio's dollar hedge thesis, suggesting the combination addresses both tail risk protection and growth opportunity capture.

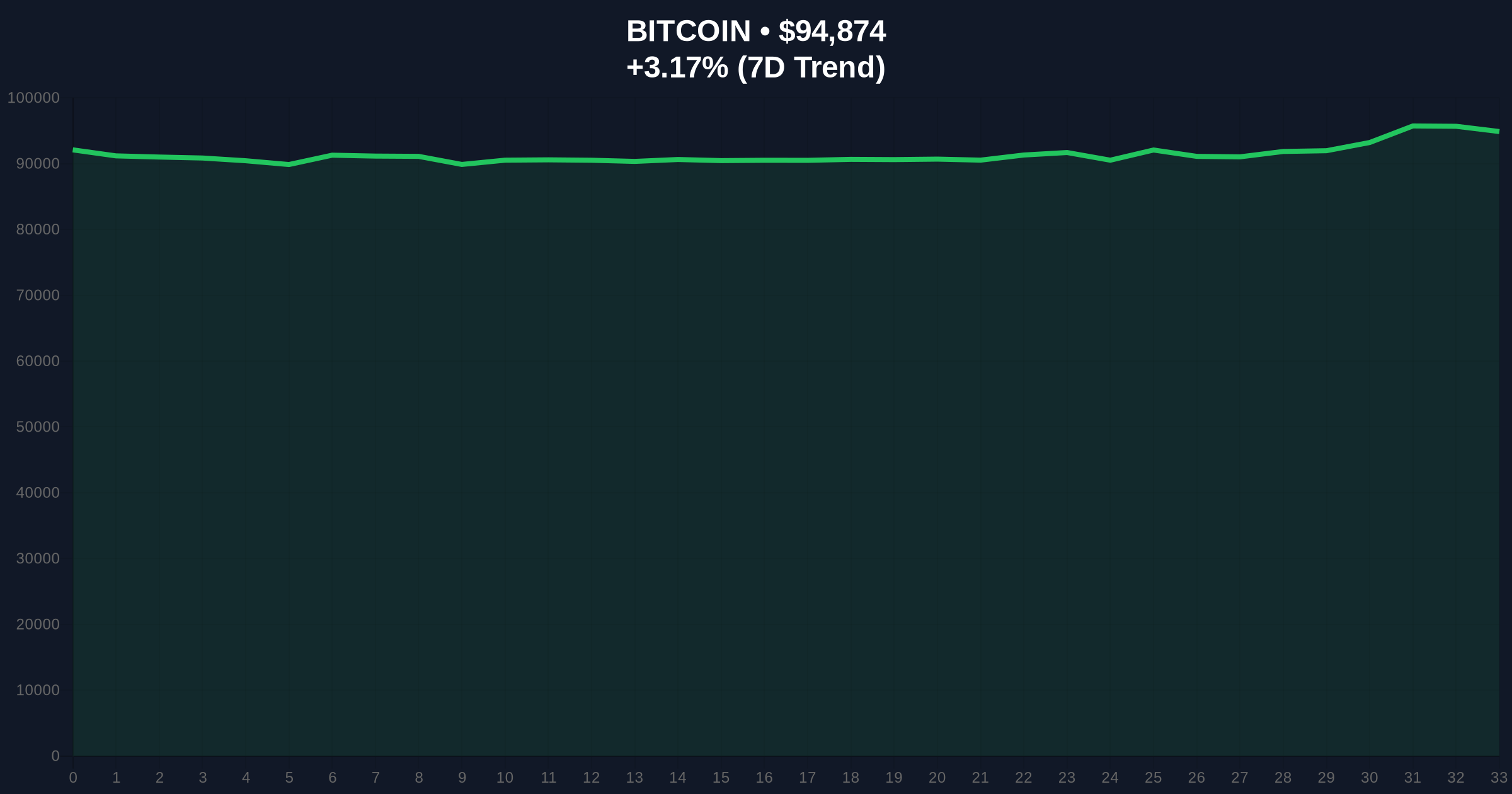

On-chain data indicates Bitcoin's current price of $94,878 represents a critical test of the $95,200 order block that formed during the December 2025 rally. The 24-hour gain of 3.14% suggests momentum is building toward this liquidity zone. Volume profile analysis shows significant accumulation between $88,500 and $92,000, creating a strong support confluence. The 50-day moving average at $91,450 provides additional dynamic support. Market structure suggests a break above $96,500 would invalidate the bearish divergence observed on weekly timeframes and target the $98,700 fair value gap.

Bullish Invalidation: A daily close below $88,500 (the 0.382 Fibonacci retracement of the October 2025 to January 2026 rally) would signal portfolio rebalancing pressure and potential liquidation cascades.

Bearish Invalidation: Sustained trading above $96,500 with increasing on-chain accumulation would confirm institutional adoption thesis and target $102,000 resistance.

| Metric | Value | Significance |

|---|---|---|

| 60/40 Portfolio Sharpe Ratio | 0.227 | Baseline risk-adjusted return |

| 15% Bitcoin/Gold Portfolio Sharpe Ratio | 0.679 | 199% improvement |

| Bitcoin Current Price | $94,878 | Testing key resistance |

| 24-Hour Bitcoin Change | +3.14% | Positive momentum |

| Crypto Fear & Greed Index | 48/100 (Neutral) | Market sentiment gauge |

For institutional investors, this analysis provides mathematical justification for portfolio allocations that have been discussed theoretically since Bitcoin's maturation as an institutional asset class. The Sharpe ratio improvement from 0.227 to 0.679 represents a quantitatively significant enhancement that pension funds, endowments, and family offices cannot ignore in their fiduciary duty assessments. For retail investors, the research validates diversification strategies beyond traditional assets, though implementation requires understanding Bitcoin's higher volatility profile compared to bonds. The timing coincides with increasing discussion about the Federal Reserve's potential pivot in monetary policy, making dollar-hedge assets particularly relevant.

Market analysts on X/Twitter have highlighted the correlation breakdown between Bitcoin and traditional assets as key to the portfolio optimization results. One quantitative researcher noted, "The negative correlation between Bitcoin and both stocks and bonds during stress periods creates the mathematical magic here—it's not just about returns, but about when those returns occur." Another analyst pointed to the timing: "This research drops as Bitcoin tests $95k resistance—if it breaks through, the portfolio optimization thesis becomes self-reinforcing."

Bullish Case (Probability: 55%): Bitcoin breaks above $96,500 resistance, validating the institutional adoption narrative. Portfolio rebalancing flows from traditional 60/40 allocations create sustained demand, pushing Bitcoin toward $102,000 by Q1 2026. The Sharpe ratio improvement attracts additional institutional capital, creating a positive feedback loop.

Bearish Case (Probability: 45%): Bitcoin fails at $95,200 resistance, creating a double top pattern. A rejection triggers profit-taking from the October 2025 to January 2026 rally, testing the $88,500 Fibonacci support. Traditional portfolio managers delay implementation of Bitcoin/gold allocations until volatility subsides, creating a liquidity vacuum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.