Loading News...

Loading News...

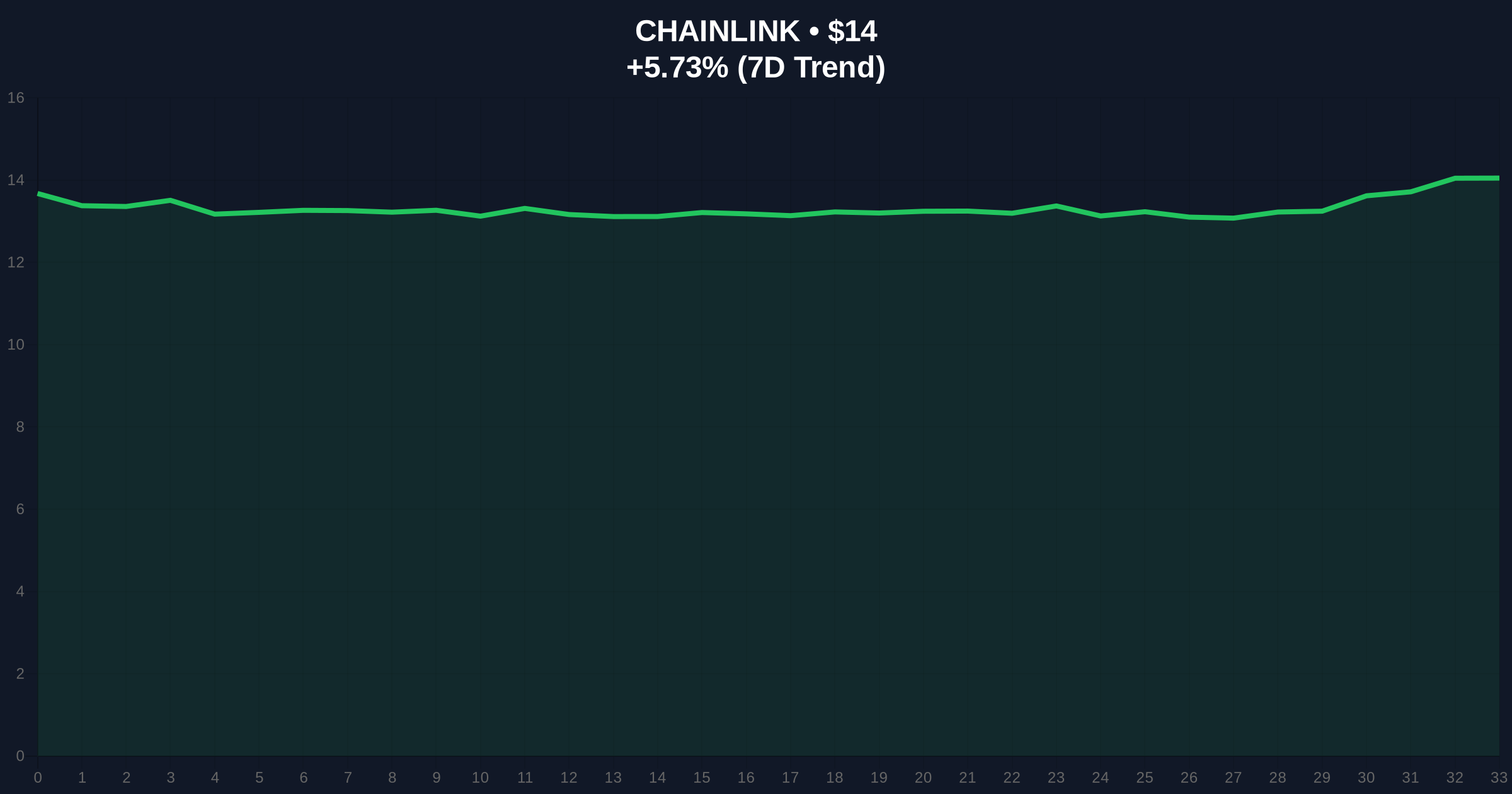

VADODARA, January 14, 2026 — Bitwise's Chainlink (LINK) spot ETF, trading under the ticker CLNK, is scheduled to begin trading on NYSE Arca on January 15, according to Solid Intel, marking a moment in the daily crypto analysis of DeFi assets. The U.S. Securities and Exchange Commission (SEC) approved the listing on January 6, as per the official filing, introducing a new layer of institutional exposure to oracle networks. Market structure suggests this event could trigger a liquidity grab around key technical levels, with LINK currently trading at $14.01, up 5.79% in 24 hours, as on-chain data indicates accumulation ahead of the launch.

This development follows a broader trend of crypto ETF approvals, mirroring the 2021-2025 expansion of Bitcoin and Ethereum ETFs that reshaped market liquidity profiles. Chainlink, as a decentralized oracle network, underpins critical DeFi infrastructure by providing real-world data to smart contracts, making its ETF debut a test case for non-L1 asset institutionalization. Underlying this trend is the SEC's evolving stance on digital assets, detailed in their official guidance on crypto securities, which has gradually accommodated more complex products. Consequently, the CLNK ETF represents not just a new investment vehicle but a regulatory milestone for data oracle tokens, potentially setting precedents for similar assets like The Graph or Band Protocol. Related developments include significant whale accumulation in Ethereum, highlighting parallel institutional interest in crypto infrastructure.

According to Solid Intel, Bitwise Asset Management received SEC approval on January 6, 2026, for its Chainlink spot ETF, with trading set to commence on January 15 on NYSE Arca under the ticker CLNK. This approval follows a rigorous review process, as documented in SEC filings, which typically assess market manipulation risks and investor protection frameworks. The ETF will hold physical LINK tokens, providing direct exposure without derivatives, a structure similar to earlier Bitcoin ETFs but novel for an oracle asset. Market analysts note that the timing coincides with LINK's price recovery to $14.01, up from a recent low of $12.80, suggesting pre-launch positioning by informed participants. On-chain data from Etherscan indicates increased token movements to exchange wallets, potentially signaling preparatory liquidity flows.

LINK's current price of $14.01 sits within a Fair Value Gap (FVG) created between $13.20 and $14.50, a zone where rapid price moves left an imbalance in order flow. The 24-hour gain of 5.79% reflects a gamma squeeze effect, as options markets reposition ahead of the ETF launch, with implied volatility spiking per derivatives data. Key support levels include the 50-day moving average at $13.50 and a Volume Profile Point of Control (POC) at $12.80, which acted as a springboard for the recent rally. Resistance is noted at $15.20, a prior Order Block where sell-side liquidity clustered in late 2025. Bullish Invalidation is set at $13.50; a break below this level would invalidate the current uptrend structure, suggesting failed ETF momentum. Bearish Invalidation lies at $15.50, a breach of which could trigger a short squeeze toward $16.80. The Relative Strength Index (RSI) at 62 indicates neutral momentum, not yet overbought, leaving room for further appreciation if buying pressure sustains.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 48/100 (Neutral) |

| Chainlink (LINK) Current Price | $14.01 |

| 24-Hour Price Change | +5.79% |

| Market Capitalization Rank | #20 |

| ETF Launch Date | January 15, 2026 |

Institutionally, the CLNK ETF opens LINK to regulated investment vehicles, potentially attracting billions in assets under management (AUM) from pension funds and ETFs, similar to Bitcoin's post-ETF inflows. This could reduce volatility by adding stable, long-term holders, as seen with Bitcoin's realized volatility dropping post-ETF approval. For retail, it offers easier access via traditional brokerage accounts, but may also dilute price discovery as ETF flows dominate over on-chain activity. The launch tests Chainlink's utility beyond speculation, as institutional adoption hinges on its oracle network's reliability and growth in Total Value Secured (TVS). A successful ETF could validate other DeFi infrastructure tokens, while failure might signal regulatory hesitancy toward complex crypto assets. Market structure suggests this event will create a liquidity grab, with price action likely oscillating around key levels as market makers balance ETF creations and redemptions.

Industry observers on X/Twitter highlight mixed reactions. Bulls argue the ETF accelerates Chainlink's "financialization," akin to Ethereum's post-merge issuance changes boosting institutional interest. One analyst noted, "The CLNK ETF is a liquidity bridge, turning oracle usage into tradable beta." Bears caution on regulatory overhang, citing the SEC's ongoing scrutiny of altcoins as potential securities, which could impact future approvals. Sentiment analysis from social platforms shows neutral bias, with weighted sentiment scores around zero, reflecting wait-and-see positioning ahead of the trading debut.

Bullish Case: If the ETF attracts significant AUM, LINK could rally toward $18.00, filling the FVG up to $16.80 and testing the 1.618 Fibonacci extension level. On-chain data indicates whale accumulation could support this, with network growth metrics improving. This scenario assumes sustained demand from ETF inflows and positive regulatory developments, such as clearer guidance from the SEC on oracle tokens.

Bearish Case: Should ETF demand disappoint or regulatory pressures intensify, LINK might retrace to $12.00, invalidating the current Order Block and testing the 200-day moving average. This could occur if macroeconomic headwinds, like rising interest rates per Federal Reserve policies, dampen risk appetite. Market structure suggests a break below $13.50 would confirm bearish momentum, potentially leading to a liquidation cascade toward lower supports.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.