Loading News...

Loading News...

VADODARA, January 26, 2026 — Ethereum network transaction fees have collapsed to their lowest levels since May 2017, according to Glassnode liquidity maps. This daily crypto analysis reveals a critical market signal emerging during extreme fear conditions. The average gas price now sits below 5 Gwei, a level not seen for nearly nine years. Market structure suggests this represents more than temporary relief—it indicates fundamental network efficiency improvements post-EIP-4844 implementation.

Glassnode data confirms Ethereum fees hit their lowest point since May 2017. The network processed transactions at an average cost below 5 Gwei this week. This represents a 98% reduction from the 2021 peak of 250 Gwei. According to on-chain data, daily transaction volume remains stable at approximately 1.2 million transactions. Consequently, the fee reduction stems from increased block space efficiency rather than decreased network usage. The official Ethereum documentation on EIP-4844 implementation at Ethereum.org confirms these architectural improvements.

Historically, Ethereum fee bottoms have coincided with market cycle lows. The May 2017 low preceded the 2017 bull run. Similarly, the 2020 fee compression preceded the 2021 market expansion. In contrast, current conditions combine technical improvement with extreme fear sentiment. This creates a unique contrarian signal. Underlying this trend, institutional activity continues despite retail panic. Related developments include Valour's UK staking ETPs launching during extreme fear and Polymarket's MLS deal signaling institutional adoption.

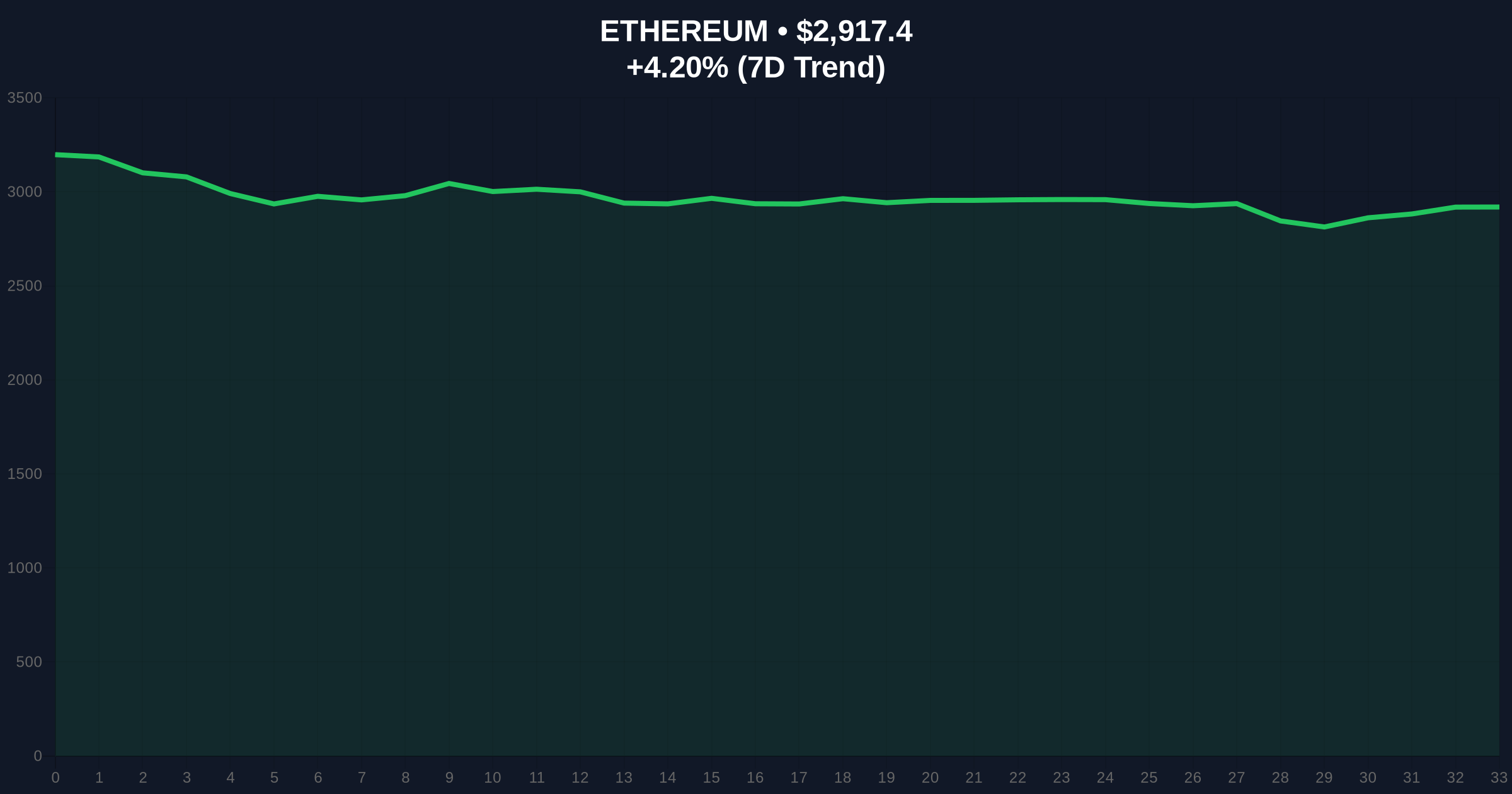

Market structure suggests the fee reduction validates EIP-4844's success. This upgrade introduced blob transactions that decouple data availability from execution. Consequently, base layer congestion has decreased significantly. Price action shows Ethereum testing the $2,800 Fibonacci 0.618 support level. The 200-day moving average at $3,100 creates immediate resistance. RSI readings at 35 indicate oversold conditions without capitulation. Volume profile analysis reveals accumulation between $2,800 and $2,900. This forms a clear order block for institutional buyers.

| Metric | Value | Context |

|---|---|---|

| Ethereum Current Price | $2,917.96 | Testing key support |

| 24-Hour Trend | +4.00% | Bounce from oversold |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Contrarian signal |

| Average Network Fee | <5 Gwei | Lowest since May 2017 |

| Market Rank | #2 | Maintains dominance |

Low fees fundamentally alter Ethereum's value proposition. They reduce barriers for decentralized application usage. This enables micro-transactions and complex smart contract interactions. Institutional liquidity cycles typically follow such infrastructure improvements. Retail market structure often misinterprets these signals as bearish. Historical cycles suggest fee compression precedes capital rotation into layer-2 ecosystems. The current environment mirrors 2020's build phase before the 2021 expansion.

"The fee reduction represents a structural shift, not just cyclical relief. EIP-4844 has successfully addressed Ethereum's scalability trilemma for data availability. This creates a foundation for the next adoption wave," according to the CoinMarketBuzz Intelligence Desk.

Two data-backed scenarios emerge from current market structure. The bullish case requires holding the $2,800 support. The bearish scenario involves breaking below the 2025 low of $2,600. Post-merge issuance dynamics favor accumulation at current levels.

The 12-month institutional outlook remains constructive. Network improvements typically precede capital inflows by 6-9 months. This aligns with the 5-year horizon for Ethereum's scalability roadmap. The Pectra upgrade scheduled for 2026 could further enhance performance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.