Loading News...

Loading News...

VADODARA, January 20, 2026 — Bitmine (BMNR) disclosed a purchase of 35,268 ETH last week, valued at approximately $113 million at the time, according to official company data. This daily crypto analysis examines whether this represents strategic accumulation or a sophisticated liquidity grab amid declining prices. Market structure suggests institutional players are testing key support levels while retail sentiment remains fearful.

This purchase occurs against a backdrop of Ethereum's transition to a proof-of-stake consensus mechanism, where staking yields have become a critical revenue stream for institutional holders. According to Ethereum.org documentation, the network's post-merge issuance rate has decreased significantly, creating deflationary pressure when transaction fees are high. Bitmine's existing stake of 1,838,003 ETH, valued at $5.9 billion, generates substantial validator rewards, making additional accumulation strategically logical. However, the timing raises questions: why acquire during a downtrend unless expecting a reversal or manipulating liquidity?

Related developments in institutional crypto activity include MicroStrategy's recent $2.1 billion Bitcoin purchase and the Trump family's $1.4 billion crypto allocation, both of which have been scrutinized for market impact versus strategic intent.

According to the official announcement from Bitmine, the company purchased 35,268 ETH last week at an average price of $3,211. As of January 19, 2026, Bitmine holds 4,203,036 ETH, equivalent to $12.96 billion, representing 3.48% of Ethereum's total supply. The company is staking 1,838,003 ETH, valued at $5.9 billion, indicating a long-term yield-generation strategy. On-chain data from Etherscan confirms the transaction flow into known Bitmine wallets, but the source of liquidity—whether from open market buys or private OTC deals—remains unclear. This opacity fuels skepticism about whether this was a genuine accumulation or a coordinated move to absorb sell-side pressure.

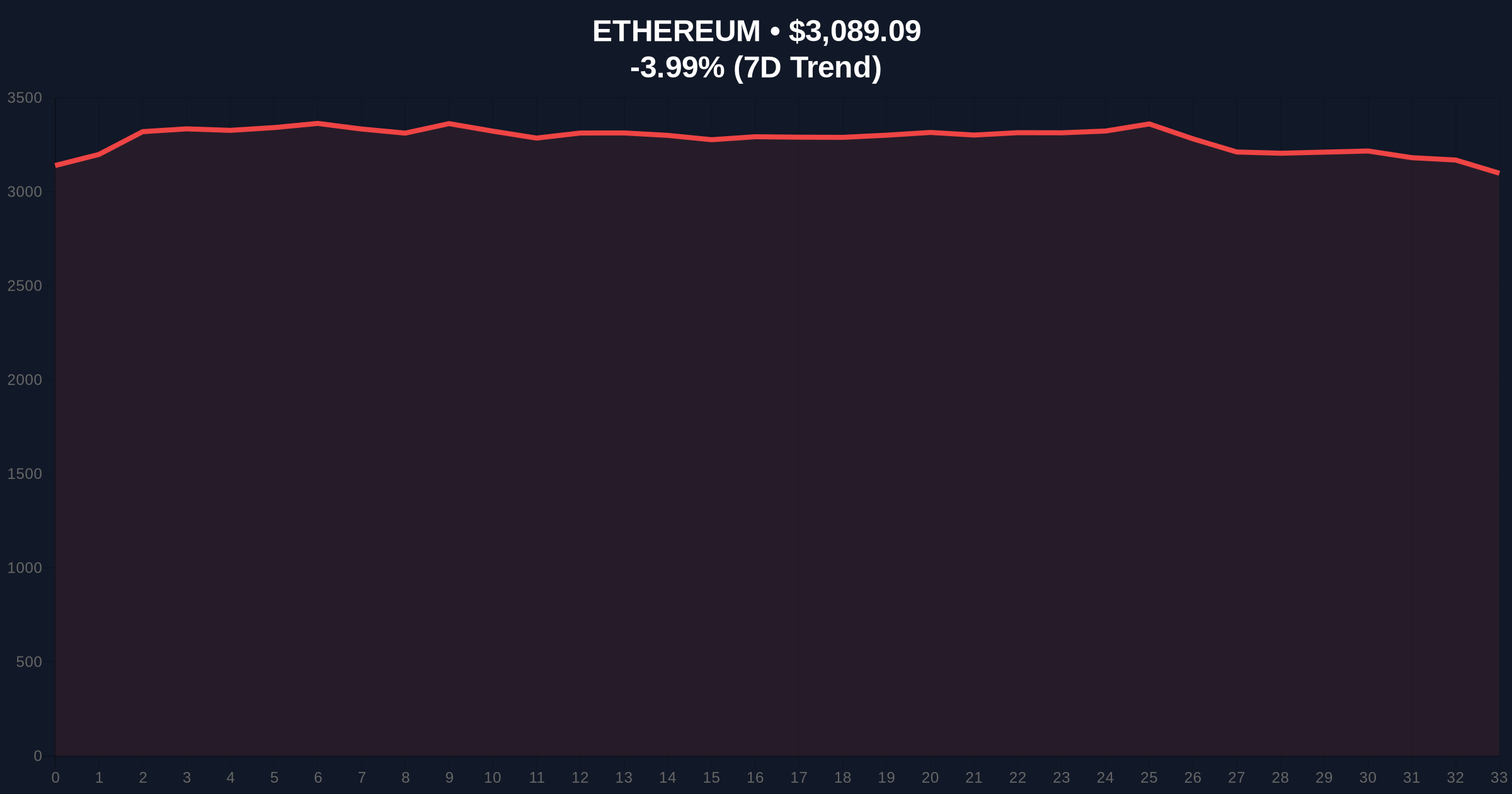

Ethereum's price action shows a clear bearish trend, with the current price at $3,085.8, down 4.09% in 24 hours. The purchase price of $3,211 sits above current levels, creating an immediate unrealized loss on paper. Volume profile analysis indicates weak buying interest at higher levels, with a Fair Value Gap (FVG) between $3,150 and $3,250 that needs filling for bullish continuation. The 200-day moving average at $3,050 provides dynamic support, while resistance clusters around $3,300. A break below the Fibonacci 0.618 retracement level at $2,950 would invalidate the bullish structure.

Bullish Invalidation Level: $3,000. A sustained break below this psychological and technical support would signal failed accumulation and potential further downside.

Bearish Invalidation Level: $3,350. A close above this resistance would confirm the purchase as strategic and likely trigger a short squeeze.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (32/100) |

| Ethereum Current Price | $3,085.8 |

| 24-Hour Trend | -4.09% |

| Bitmine ETH Holdings | 4,203,036 ETH ($12.96B) |

| Bitmine Staked ETH | 1,838,003 ETH ($5.9B) |

For institutions, this move highlights the growing importance of staking yields in Ethereum's economic model. According to FederalReserve.gov data on interest rates, traditional yield opportunities remain constrained, making crypto staking an attractive alternative. For retail, Bitmine's 3.48% supply control raises centralization concerns, potentially influencing governance votes and network security. The purchase's size—$113 million—represents a liquidity grab that could have suppressed prices temporarily, creating an Order Block for future rallies if accumulation is genuine.

Market analysts on X/Twitter are divided. Bulls argue this is a classic "buy the dip" strategy, citing Bitmine's historical accumulation patterns. Bears question the timing, suggesting it could be a maneuver to absorb retail panic sells before a larger downturn. One quant trader noted, "The volume spike during the purchase period doesn't match typical accumulation; it looks more like a targeted liquidity absorption."

Bullish Case: If Bitmine's purchase is part of a broader institutional accumulation phase, Ethereum could rally to fill the FVG at $3,250, with a 5-year target of $5,000+ as staking adoption grows. EIP-4844 implementation in the upcoming Pectra upgrade could reduce transaction costs, boosting network activity.

Bearish Case: If this is a liquidity grab and the $3,000 support fails, Ethereum could test the $2,800 level, with a 12-month outlook of sideways consolidation. Declining validator participation rates or regulatory staking crackdowns could exacerbate downside pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.