Loading News...

Loading News...

VADODARA, January 28, 2026 — Bitmine (BMNR) executed a $340.68 million Ethereum stake this week, according to on-chain data provider Onchain Lens. This daily crypto analysis reveals the company now controls 2,265,984 ETH worth approximately $6.8 billion. Market structure suggests this accumulation occurred precisely as retail sentiment hit extreme fear levels.

Onchain Lens data confirms Bitmine staked an additional 113,280 ETH this week. The transaction value equals $340.68 million at current prices. Consequently, Bitmine's total staked ETH position now stands at 2,265,984 tokens. This represents a 5.3% increase in their staking portfolio. Market analysts note the timing coincides with a broader market pullback.

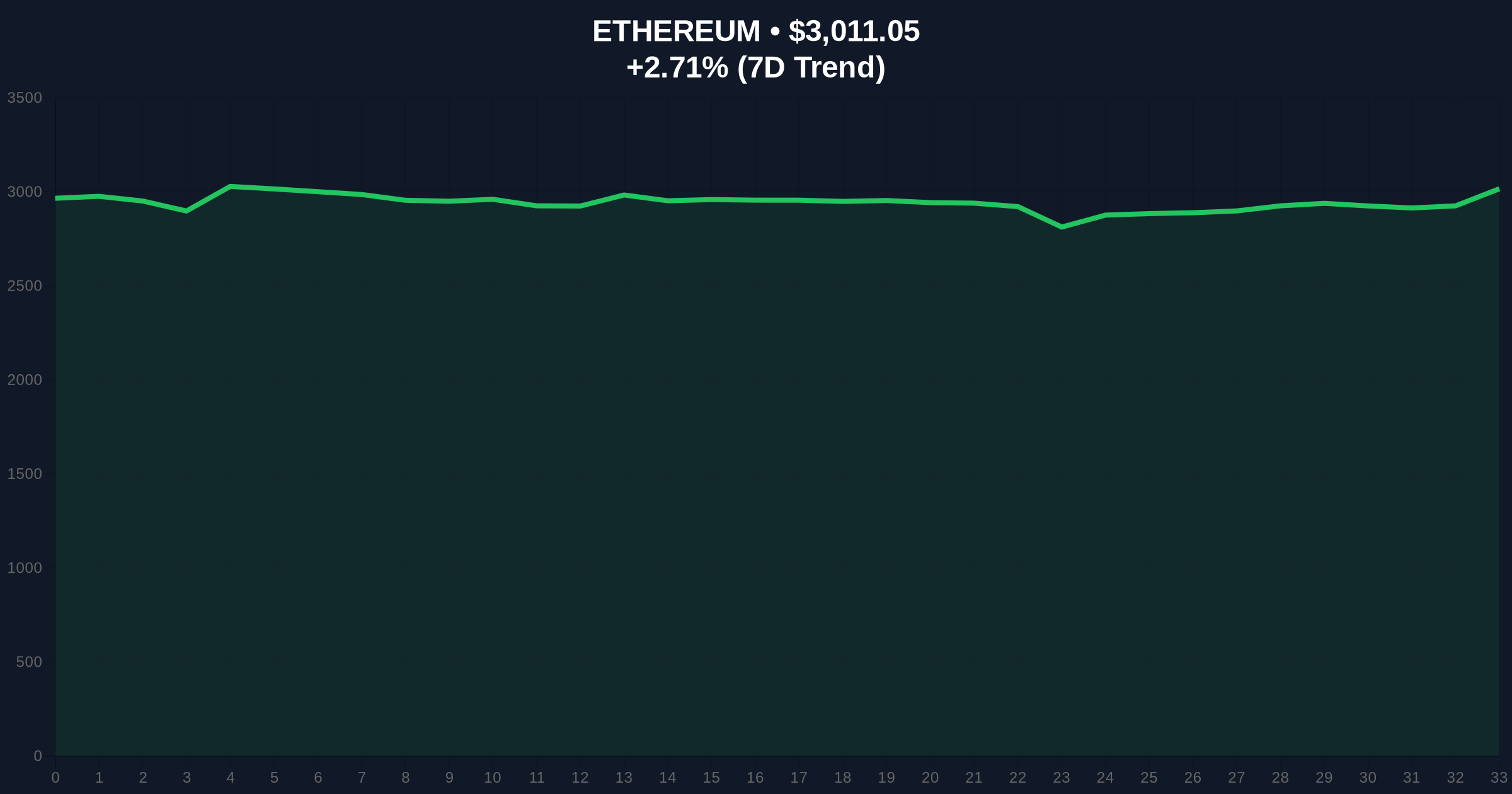

Ethereum's price action shows consolidation around the $3,000 psychological level. The staking occurred during a period of negative funding rates across derivatives markets. , exchange netflows turned positive, indicating potential selling pressure. This creates a classic liquidity grab scenario where institutions accumulate during retail capitulation.

Historically, large staking moves by institutions precede volatility expansions. The 2021-2022 cycle saw similar accumulation patterns before major rallies. In contrast, current market sentiment registers extreme fear at 29/100 on the Crypto Fear & Greed Index. This divergence between institutional action and retail sentiment often marks local bottoms.

Related developments highlight global institutional movements. For instance, Spacecoin's KAIST seminar signals continued institutional interest despite market conditions. Simultaneously, regulatory clarity evolves as seen in South Korean tax rulings on crypto prizes. These factors create a complex backdrop for Bitmine's strategic accumulation.

Ethereum's technical structure shows critical support at the $2,850 level. This aligns with the 0.618 Fibonacci retracement from the recent swing high. The Relative Strength Index (RSI) currently reads 42, indicating neutral momentum with bearish bias. The 50-day moving average sits at $3,150, creating immediate resistance.

Volume profile analysis reveals thin liquidity between $2,900 and $3,100. This Fair Value Gap (FVG) could trigger rapid price movements once filled. The staking activity itself impacts Ethereum's net issuance through the post-merge proof-of-stake mechanism. According to Ethereum.org's official documentation, increased staking reduces sell pressure from validator rewards, creating a structural supply constraint.

| Metric | Value |

|---|---|

| Additional ETH Staked | 113,280 ETH |

| Stake Value | $340.68M |

| Total Staked Position | 2,265,984 ETH ($6.8B) |

| Current ETH Price | $3,011.32 |

| 24-Hour Change | +2.72% |

| Crypto Fear & Greed Index | 29/100 (Fear) |

Bitmine's stake represents a strategic liquidity removal from circulating supply. The 113,280 ETH becomes illiquid for the staking withdrawal period. This creates a potential supply shock if demand accelerates. Institutional accumulation during fear periods often precedes retail FOMO cycles. The $6.8 billion total position gives Bitmine significant governance influence in Ethereum's decentralized ecosystem.

Market structure suggests this move may be hedging against broader macroeconomic uncertainty. With traditional markets showing volatility, crypto-native institutions are doubling down on core assets. The stake also generates yield through validator rewards, currently around 3.5% annually. This creates a cash-flow positive position regardless of short-term price action.

"Large staking moves during fear periods typically signal institutional conviction in long-term value. The timing suggests Bitmine identifies current prices as accumulation zones. However, we must question whether this represents genuine bullishness or simply yield-chasing behavior in a low-rate environment." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. The bullish case requires holding the $2,850 support and breaking above $3,150 resistance. The bearish scenario involves breaking below $2,850 and testing the $2,650 volume node. Historical cycles suggest accumulation at these levels precedes 6-12 month appreciation phases.

The 12-month institutional outlook remains cautiously optimistic. Staking reduces liquid supply while generating yield. The upcoming Pectra upgrade (EIP-7251) will further enhance staking efficiency. For the 5-year horizon, Ethereum's transition to full scalability through danksharding could multiply institutional interest. However, regulatory uncertainty persists as global frameworks evolve.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.