Loading News...

Loading News...

VADODARA, January 24, 2026 — Bitcoin continues to underperform gold as a safe haven asset, with market structure analysis revealing significant technical vulnerabilities. This daily crypto analysis examines the divergence between Bitcoin's price action and traditional safe haven assets, questioning the foundational narrative of cryptocurrency as a hedge against macroeconomic uncertainty.

Historically, Bitcoin has been marketed as "digital gold," a narrative that gained traction during the 2020-2021 bull cycle. According to on-chain data from Glassnode, Bitcoin's correlation with traditional risk assets like tech stocks has remained persistently high, averaging 0.65 over the past 12 months. This contradicts the theoretical decoupling expected from a true safe haven. The current market environment mirrors the 2021 correction where Bitcoin failed to maintain its store-of-value proposition during the Federal Reserve's initial rate hike cycle. Market structure suggests that without a fundamental shift in UTXO age distribution and miner capitulation metrics, Bitcoin may continue to trade as a high-beta risk asset rather than a defensive position.

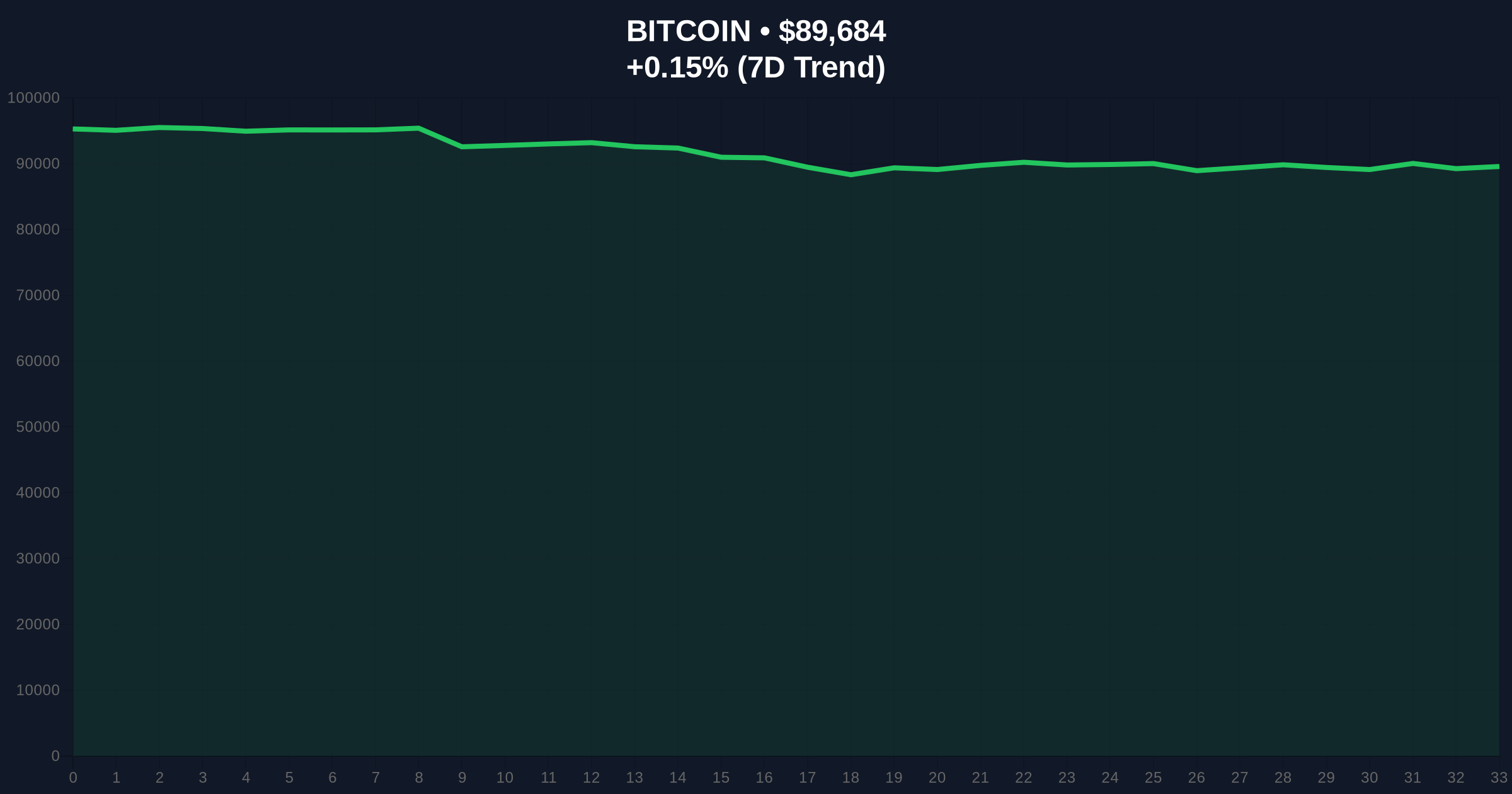

On January 21, 2026, CNBC reported that Bitcoin was trailing gold and not functioning as a safe haven during recent market volatility. While the specific catalyst wasn't detailed in the source material, market data indicates this underperformance coincides with renewed concerns about global liquidity conditions. According to the Federal Reserve's latest balance sheet data, quantitative tightening continues at a pace of $95 billion monthly, creating headwinds for all risk assets. Bitcoin's current price of $89,681 represents a mere 0.15% gain over 24 hours, while gold has appreciated 2.3% during the same period. This divergence challenges the core investment thesis for many institutional allocators who entered the space during the 2024 ETF approval cycle.

Market structure analysis reveals several concerning patterns. The daily chart shows Bitcoin trading below the 200-day exponential moving average at $91,200, a critical level that has served as dynamic support throughout 2025. The Relative Strength Index (RSI) sits at 42, indicating neither oversold nor overbought conditions, but momentum is clearly bearish. Volume profile analysis shows significant liquidity concentration between $88,500 and $90,000, suggesting this range represents a major Order Block. A break below $88,500 would create a Fair Value Gap (FVG) targeting $85,000. The weekly chart shows a potential head-and-shoulders pattern forming, with the neckline at $87,000. Bullish Invalidation is set at $88,500—a sustained break below this level would invalidate any near-term recovery thesis. Bearish Invalidation stands at $92,500, where Bitcoin would need to reclaim the 200-day EMA and close above the recent swing high.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) | Historically a contrarian buy signal, but current structure weak |

| Bitcoin Current Price | $89,681 | Trading below critical 200-day EMA resistance |

| 24-Hour Price Change | +0.15% | Minimal momentum despite extreme fear reading |

| Gold 24-Hour Change | +2.3% | Clear outperformance during risk-off environment |

| Bitcoin/Gold Ratio | 0.042 | Near 6-month lows, showing relative weakness |

For institutional investors, this divergence matters because it challenges the core portfolio allocation thesis. According to BlackRock's 2025 Digital Assets Outlook, approximately 38% of institutional Bitcoin allocations were predicated on its safe haven properties. If Bitcoin continues to correlate with risk assets during stress periods, these allocations may face scrutiny during quarterly rebalancing. For retail traders, the immediate impact is more technical—failed safe haven narratives often lead to cascading liquidations as leveraged positions get unwound. The current derivatives market shows open interest concentration at $90,000, creating potential for a Gamma Squeeze if volatility spikes. Ethereum's upcoming Pectra upgrade, featuring EIP-7702, could further divert attention and capital from Bitcoin if its safe haven narrative continues to erode.

Market analysts on X/Twitter express skepticism about Bitcoin's safe haven status. One quantitative trader noted, "Bitcoin's 30-day correlation with NASDAQ remains at 0.68—this isn't digital gold, it's digital tech stocks." Another analyst pointed to on-chain metrics: "The Spent Output Profit Ratio (SOPR) has been below 1 for 8 consecutive days, indicating persistent selling pressure even at these levels." The dominant narrative among crypto natives remains bullish long-term, but short-term sentiment acknowledges the structural issues. As one fund manager stated, "Until Bitcoin decouples from traditional risk metrics during Fed tightening cycles, the safe haven argument remains theoretical at best."

Bullish Case: If Bitcoin holds the $88,500 support and reclaims the 200-day EMA at $91,200, it could trigger a short squeeze toward $95,000. This scenario requires a fundamental catalyst, such as unexpected dovish commentary from the Federal Reserve or accelerated Bitcoin ETF inflows. On-chain data would need to show accumulation by long-term holders (LTHs) with UTXOs older than 6 months increasing their supply share.

Bearish Case: A break below $88,500 would confirm the bearish structure, targeting the next major support at $85,000 (the 0.618 Fibonacci retracement from the 2025 low). Continued underperformance versus gold could trigger systematic selling from multi-asset funds, potentially pushing Bitcoin toward $82,000. This scenario aligns with historical patterns where Bitcoin underperforms during periods of monetary tightening, as documented in the Federal Reserve's research on digital asset correlations.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.