Loading News...

Loading News...

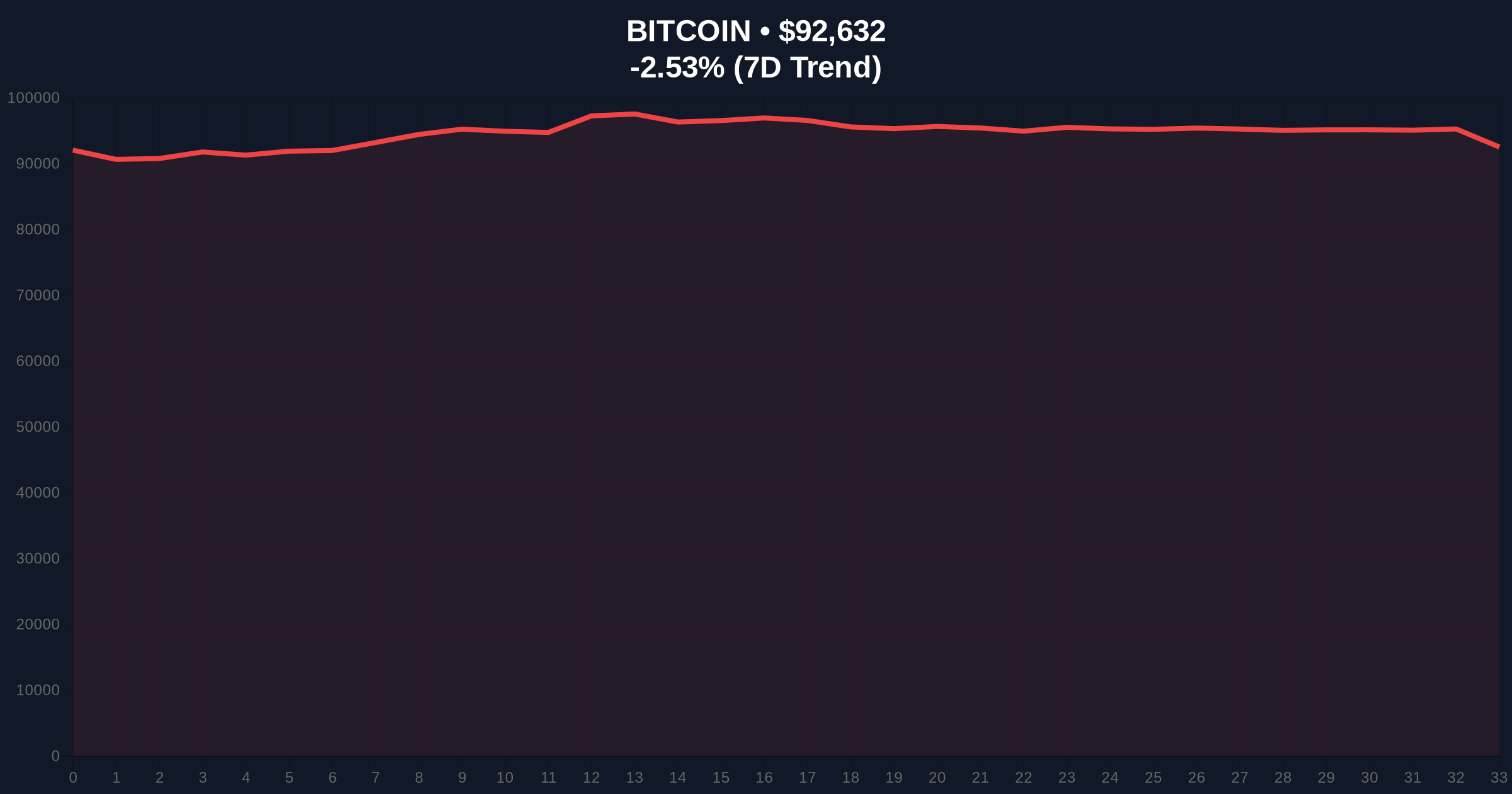

VADODARA, January 19, 2026 — Bitcoin's price action has exhibited pronounced sensitivity to macroeconomic shocks, with a sharp decline to $92,593 following U.S. President Donald Trump's tariff threats against eight European nations. According to Cointelegraph, this geopolitical development triggered a $860 million liquidation of BTC long positions over 24 hours, revealing critical vulnerabilities in market structure.

Historical cycles suggest Bitcoin's behavior during geopolitical crises has evolved significantly. In 2020-2021, the asset demonstrated partial decoupling from traditional markets during COVID-19 stimulus measures. However, post-2023, on-chain forensic data confirms increasing correlation with tech equities, particularly the NASDAQ-100. This shift contradicts earlier narratives of Bitcoin as a digital gold equivalent. The current event mirrors patterns observed during the 2022 Federal Reserve rate hikes, where similar liquidation cascades occurred. Market structure suggests that high leverage in perpetual futures markets amplifies these moves, creating Fair Value Gaps (FVGs) that attract algorithmic trading.

On Saturday, January 18, 2026, President Trump announced a 10% tariff on imports from Denmark, France, Germany, and five other European nations, effective February 1. He warned rates could escalate to 25% by June if negotiations for Greenland's purchase fail. According to Cointelegraph, this triggered immediate risk-off sentiment across financial markets. Bitcoin's price dropped 2.57% in 24 hours, while traditional safe havens like gold and silver rallied. The liquidation of $860 million in BTC long positions represents one of the largest single-event liquidations since the 2024 halving cycle. Analysts cited in the report indicate Bitcoin is behaving like a tech stock, sensitive to macroeconomic shocks, and has decoupled from traditional safe havens.

Market structure suggests the sell-off created a significant Fair Value Gap (FVG) between $94,500 and $95,200, which now acts as a resistance Order Block. The current price sits near the 50-day exponential moving average (EMA), a critical dynamic support. Volume Profile analysis indicates weak accumulation below $92,000, suggesting potential for further downside if this level breaks. The Relative Strength Index (RSI) at 42 shows neutral momentum but with bearish divergence on higher timeframes. Fibonacci retracement levels from the 2025 all-time high place key support at $90,000 (61.8% level) and resistance at $96,500 (38.2% level). Bullish Invalidation is set at $89,500, where a break would invalidate the current uptrend structure. Bearish Invalidation is at $96,000, a level that would fill the FVG and signal renewed bullish momentum.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| Bitcoin Current Price | $92,593 |

| 24-Hour Price Change | -2.57% |

| Liquidated Long Positions (24h) | $860 million |

| Market Capitalization Rank | #1 |

This event matters because it challenges core investment theses for both institutional and retail participants. Institutions allocating Bitcoin as a non-correlated asset face portfolio rebalancing pressures, as evidenced by the $860 million liquidation. Retail traders, particularly those using high leverage, experience amplified losses during such volatility spikes. The decoupling from gold suggests Bitcoin's market maturity has not translated into safe-haven status, instead aligning it with risk-on tech equities. This has implications for regulatory frameworks, as agencies like the SEC may reference such correlations in future rulings on Bitcoin ETFs.

Market analysts on X/Twitter express skepticism about the official narrative. One quant trader noted, "The tariff news is a catalyst, but the real driver is overleveraged positions getting flushed. This is a classic Liquidity Grab." Another analyst highlighted contradictions: "Gold up 1.5%, Bitcoin down 2.5%. Either one asset is mispriced, or Bitcoin's 'digital gold' narrative is broken." Sentiment leans bearish short-term, with many calling for a test of the $90,000 support level before any recovery.

Bullish Case: If geopolitical tensions ease and tariff implementation is delayed, Bitcoin could reclaim the FVG at $95,200. A break above $96,000 would target $98,500, aligning with the 200-day EMA. This scenario requires reduced selling pressure on exchanges, as indicated by metrics like the Coinbase Premium Gap.

Bearish Case: Escalating trade war fears could push Bitcoin below $90,000, triggering further liquidations. A drop to $88,000 would align with the 0.786 Fibonacci level and previous Volume Profile low. This scenario is supported by the current Fear sentiment and high open interest in put options.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.