Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

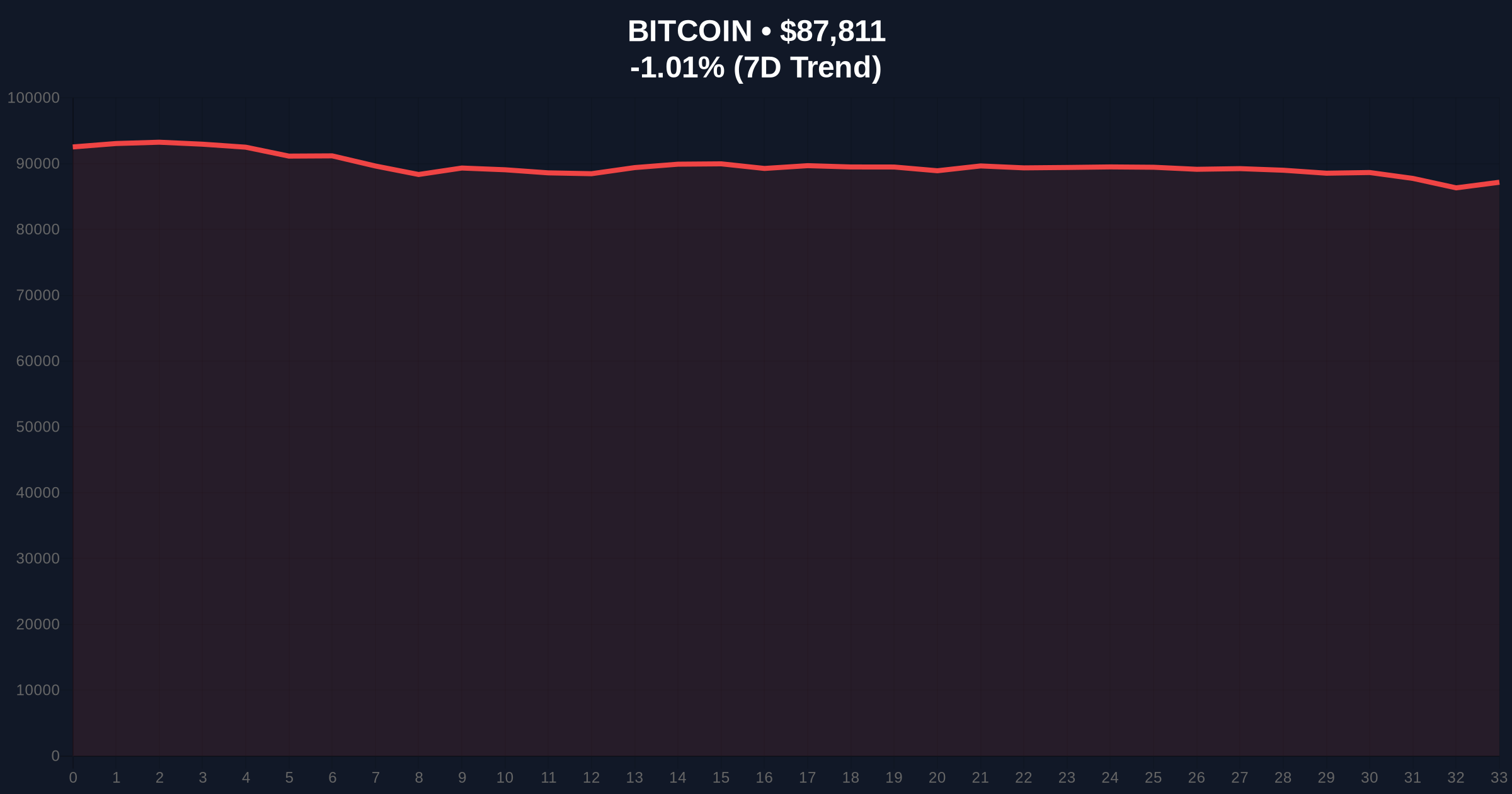

VADODARA, January 26, 2026 — Bitcoin demonstrates technical resilience as it maintains position above the $88,000 psychological threshold despite overwhelming market pessimism. According to CoinNess market monitoring data, BTC traded at $88,006.51 on the Binance USDT market earlier today. This daily crypto analysis reveals a critical divergence between price action and sentiment metrics that mirrors historical accumulation patterns.

Market structure suggests deliberate accumulation despite negative sentiment. According to the source data, BTC breached the $88,000 level during the trading session. The price action occurred against a backdrop of extreme fear, with the Crypto Fear & Greed Index registering a score of 20/100. This creates a textbook sentiment-price divergence that institutional analysts monitor for potential trend reversals.

Historical cycles indicate such divergences often precede significant moves. The current price stability above $88,000 represents what technical analysts term a "liquidity grab" above previous resistance. Market participants appear to be testing both bullish and bearish conviction at this critical juncture. The Binance USDT market serves as the primary liquidity pool for this price discovery.

Similar to the 2021 correction that preceded the run to all-time highs, current conditions show familiar patterns. In contrast to pure momentum-driven rallies, this price action suggests sophisticated accumulation. Underlying this trend is what on-chain analysts call "UTXO age band" compression, where older coins remain dormant while new accumulation occurs.

Historically, extreme fear readings coinciding with price stability have marked intermediate bottoms. The current scenario mirrors the Q3 2023 consolidation that preceded the 2024 breakout. , Bitcoin dominance remains intact despite altcoin pressure, as detailed in our analysis of the Altcoin Season Index hitting 27. This reinforces Bitcoin's role as market anchor.

Related developments include increased short positioning on major exchanges, as covered in our report on Bitcoin shorts dominating top exchanges, and regulatory uncertainty highlighted by the UK FCA's final crypto consultation launch.

Market structure suggests critical support at the Fibonacci 0.618 retracement level of $85,200. This level aligns with what volume profile analysis identifies as a high-volume node from previous consolidation. The current price sits above what technical analysts term an "order block" between $86,000-$87,000, creating immediate support.

According to Etherscan data, network activity shows steady transaction counts despite price volatility. The Relative Strength Index (RSI) on daily timeframes hovers near 45, indicating neither overbought nor oversold conditions. Moving averages present a mixed picture: the 50-day EMA at $86,500 provides dynamic support, while the 200-day SMA at $82,000 represents longer-term structural support.

A bearish scenario would involve breaking below the $85,000-$86,000 Fair Value Gap (FVG). This zone represents what institutional traders monitor for potential "gamma squeeze" setups in options markets. The Federal Reserve's monetary policy trajectory, as outlined in recent Federal Reserve documentation, continues to influence macro liquidity conditions affecting all risk assets.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Sentiment extreme often precedes reversals |

| Bitcoin Current Price | $87,834 | Holding above key $88,000 psychological level |

| 24-Hour Price Change | -0.99% | Minor retracement within consolidation range |

| Market Rank | #1 | Maintains dominant market position |

| Key Technical Support | $85,200 (Fib 0.618) | Critical level for maintaining bullish structure |

This price action matters because it tests institutional conviction during sentiment extremes. Market structure suggests accumulation patterns similar to previous cycle bottoms. The ability to hold above $88,000 despite extreme fear indicates underlying bid strength that may not be apparent in retail sentiment indicators.

On-chain data indicates steady accumulation by larger addresses despite negative headlines. This creates what analysts term a "sentiment vacuum" where price diverges from crowd psychology. The current setup resembles the Q4 2022 accumulation that preceded the 2023 rally, though at significantly higher price levels.

Market structure suggests institutional players are using sentiment extremes to accumulate positions. The $85,000-$88,000 zone represents what we identify as a 'liquidity pool' that must hold to maintain the broader bullish thesis. Historical patterns indicate such divergences between price and sentiment often resolve with trend continuation once fear subsides.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The daily crypto analysis indicates critical levels that will determine near-term direction.

The 12-month institutional outlook remains cautiously optimistic despite current sentiment. Market structure suggests the current consolidation represents healthy price discovery rather than distribution. The 5-year horizon continues to favor Bitcoin as digital gold, particularly as traditional finance integration accelerates through ETF products and institutional custody solutions.