Loading News...

Loading News...

VADODARA, January 26, 2026 — CoinMarketCap's Altcoin Season Index registers at 27, signaling Bitcoin dominance persists. This daily crypto analysis reveals a market structure favoring BTC over altcoins. Extreme fear grips traders. Capital rotation remains muted.

According to CoinMarketCap's official methodology, the Altcoin Season Index currently stands at 27. The index compares price performance of the top 100 cryptocurrencies against Bitcoin over 90 days. It excludes stablecoins and wrapped tokens. An altcoin season requires 75% of these assets to outperform BTC. The current score is far below that threshold. Market structure suggests Bitcoin dominance is intact. This data point confirms a lack of broad altcoin momentum.

Historical cycles indicate such low readings often precede consolidation phases. For instance, during Q4 2023, the index hovered near 30 before a brief altcoin rally. However, the current macro environment differs. Underlying this trend, on-chain liquidity maps show capital parked in Bitcoin UTXOs. This reduces available fuel for altcoin pumps.

Historically, altcoin seasons follow Bitcoin bull runs. The 2021 cycle saw the index hit 100 in May. In contrast, today's reading of 27 mirrors late 2022 conditions. That period preceded a prolonged crypto winter. Market analysts attribute this to institutional preference for Bitcoin. ETFs and macro uncertainty drive this bias.

, the global crypto sentiment score sits at 20/100—extreme fear. This aligns with the Altcoin Season Index data. Fear typically suppresses risk-on altcoin bets. Consequently, traders flock to Bitcoin as a relative safe haven. Related developments include the Crypto Fear & Greed Index plunging to 20, amplifying market anxiety. Additionally, Michael Saylor hinted at Bitcoin purchases, reinforcing BTC's appeal.

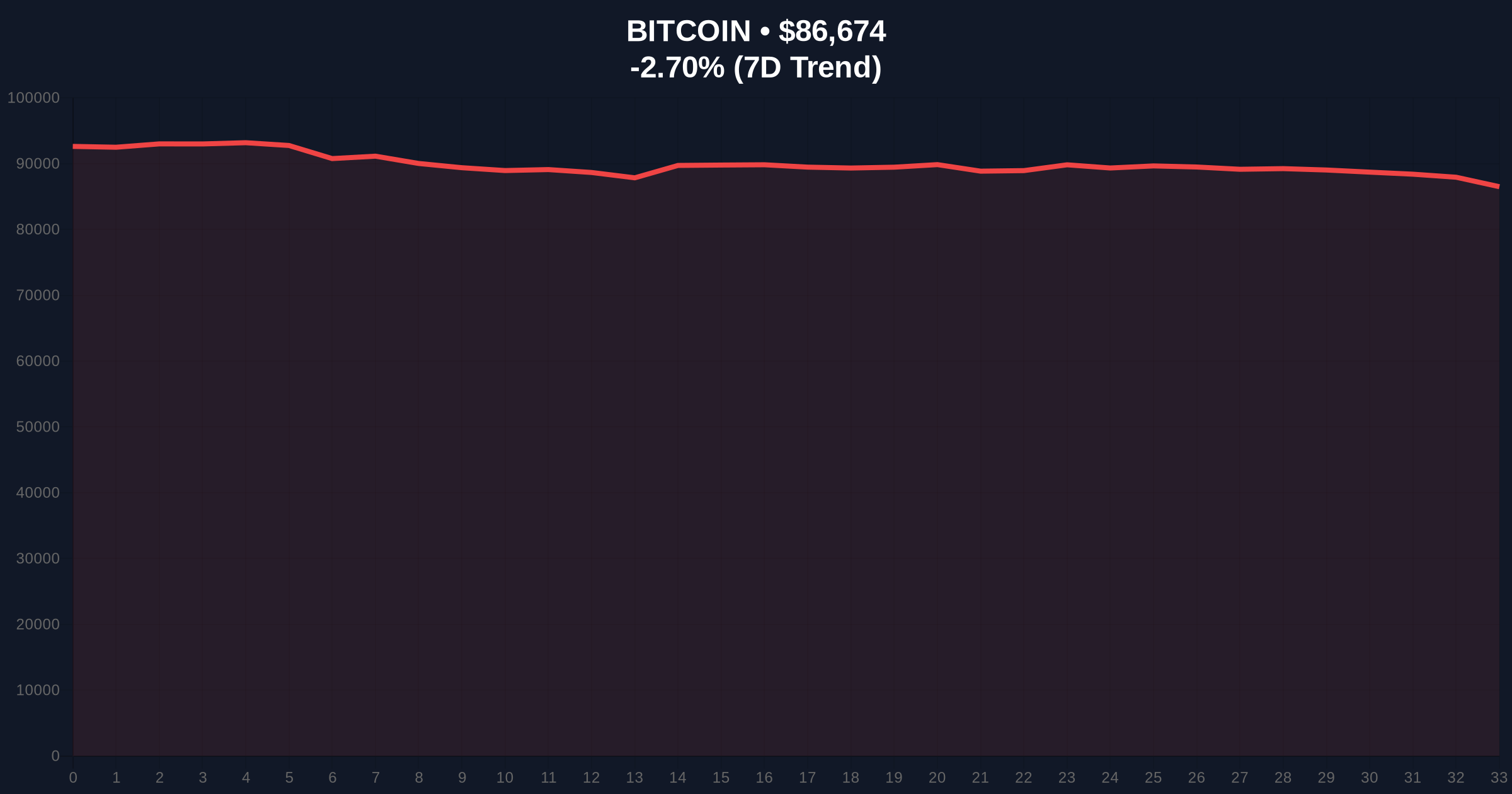

Bitcoin trades at $86,765, down 2.56% in 24 hours. Technical analysis reveals a critical support cluster near $85,000. This level aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below could invalidate the current structure. RSI sits at 42, indicating neutral momentum with bearish bias.

Market structure suggests altcoins face headwinds. Ethereum, for example, shows weak relative strength against BTC. Its ETH/BTC pair tests yearly lows. This confirms the Altcoin Season Index reading. Order block analysis identifies a fair value gap between $88,000 and $90,000 for Bitcoin. Filling this gap requires sustained buying pressure. Currently, volume profile indicates low participation.

| Metric | Value | Implication |

|---|---|---|

| Altcoin Season Index | 27 | No altcoin season; Bitcoin dominance |

| Bitcoin Price | $86,765 | -2.56% 24h; testing key support |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | High risk aversion; favors BTC |

| 90-Day Threshold for Altcoin Season | 75% of top 100 coins outperform BTC | Current performance far below |

| Bitcoin Dominance (Approx.) | 54% | Elevated; capital concentration in BTC |

This data impacts institutional and retail strategies. For institutions, low altcoin season scores justify Bitcoin-heavy portfolios. They often reference Ethereum's official documentation on network upgrades to assess altcoin viability. Currently, EIP-4844 adoption hasn't spurred altcoin rallies. Retail traders face amplified volatility. Extreme fear leads to panic selling in altcoins.

Market structure suggests a liquidity grab is underway. Weak hands exit altcoin positions. Strong hands accumulate Bitcoin at support. This dynamic reinforces Bitcoin's store-of-value narrative. Historically, such phases precede explosive moves. But timing remains uncertain.

"The Altcoin Season Index at 27 is a clear signal. Capital isn't rotating. Bitcoin's institutional inflows, via ETFs and corporate treasuries, create a gravitational pull. Until macro conditions shift, altcoins will struggle. Watch Bitcoin's on-chain metrics for clues."

Two data-backed scenarios emerge from current market structure.

The 12-month outlook hinges on macro liquidity. Federal Reserve policy will dictate flows. Institutional adoption of Bitcoin ETFs may further drain altcoin liquidity. Over a 5-year horizon, altcoin seasons will return. But not until Bitcoin consolidates at higher valuations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.