Loading News...

Loading News...

VADODARA, February 4, 2026 — Eleven U.S. state pension funds have incurred a 60% loss on their MicroStrategy (MSTR) holdings, according to a DL News report. This daily crypto analysis reveals a critical liquidity event in institutional portfolios, mirroring the deleveraging cycles of 2021. The funds' collective stake, now valued at approximately $240 million, has plummeted from an initial investment near $570 million.

DL News identified the New York State Common Retirement Fund and the Florida State Board of Administration among the eleven affected entities. These funds collectively hold nearly 1.8 million shares of MicroStrategy. Market structure suggests a concentrated sell-off pressure, with ten of the eleven funds reporting the full 60% loss. MicroStrategy's stock has declined 67% over the past six months, directly correlating with Bitcoin's volatility. This drawdown represents a significant capital impairment for public retirement systems.

Historically, similar institutional losses preceded broader market capitulation phases. The 2021 correction saw leveraged Bitcoin ETFs and correlated equities like MicroStrategy experience sharp deleveraging. In contrast, the current event involves direct pension fund exposure, amplifying systemic risk. Underlying this trend is a persistent Extreme Fear sentiment, with the Crypto Fear & Greed Index at 14/100. This environment often triggers forced liquidations and order block breakdowns.

Related developments include Stifel's warning of a potential Bitcoin drop to $38K and political signals affecting Fed policy expectations. These factors compound the liquidity pressure on institutional holdings.

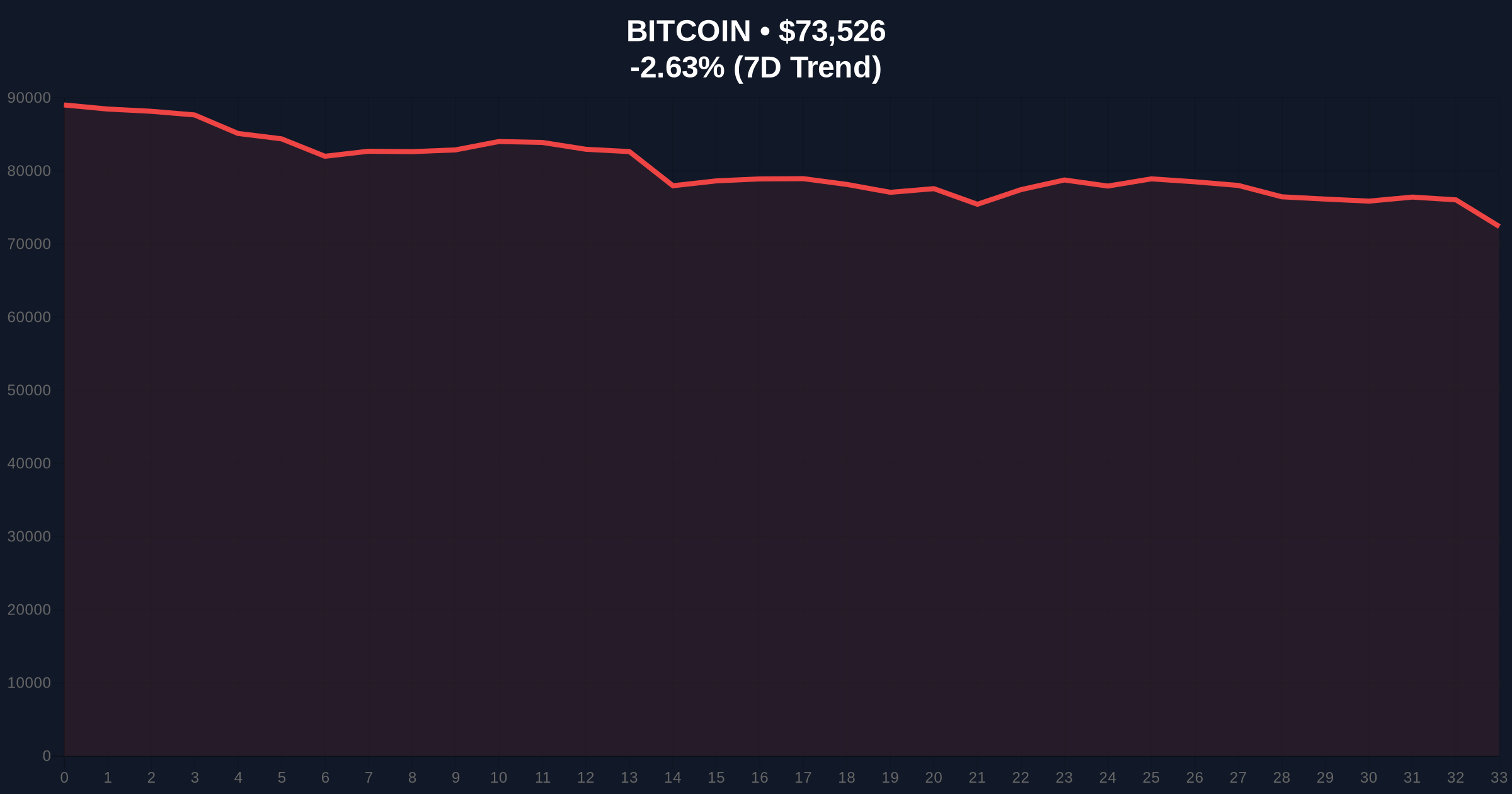

On-chain data indicates MicroStrategy's decline has created a Fair Value Gap (FVG) near the $240 million valuation mark. Bitcoin, currently at $73,564, faces critical support at the Fibonacci 0.618 retracement level of $70,000. The Relative Strength Index (RSI) for both assets sits in oversold territory, suggesting a potential mean reversion. However, volume profile analysis shows weak bid liquidity, increasing downside risk. Market analysts monitor the 200-day moving average as a key trend indicator.

| Metric | Value |

|---|---|

| Affected Pension Funds | 11 |

| MicroStrategy Share Holdings | ~1.8 million |

| Current Portfolio Value | $240 million |

| Initial Investment Value | $570 million |

| Loss Percentage (10 funds) | 60% |

| MicroStrategy 6-Month Decline | 67% |

| Bitcoin Current Price | $73,564 |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This event matters because it highlights contagion risk in institutional crypto adoption. Pension funds, managing long-term liabilities, face amplified volatility from Bitcoin-correlated assets. The 60% loss could trigger regulatory scrutiny and mandate-driven selling. , it the fragility of market structure during Extreme Fear phases. Retail sentiment often follows institutional flows, potentially exacerbating the downtrend.

"The concentration of public pension capital in a single Bitcoin proxy like MicroStrategy creates a systemic vulnerability. Historical cycles suggest such losses precede broader deleveraging, as seen in the 2021 miner capitulation. Portfolio managers must now assess correlation risks beyond direct crypto holdings." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bearish scenario involves continued selling pressure if Bitcoin breaks below $70,000. The bullish scenario requires a reclaim of the $80,000 level to invalidate the downtrend. Over the 12-month horizon, institutional adoption may slow as risk committees reassess exposure. However, long-term Bitcoin network fundamentals, such as the upcoming Pectra upgrade's impact on Ethereum, could provide a counterbalance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.