Loading News...

Loading News...

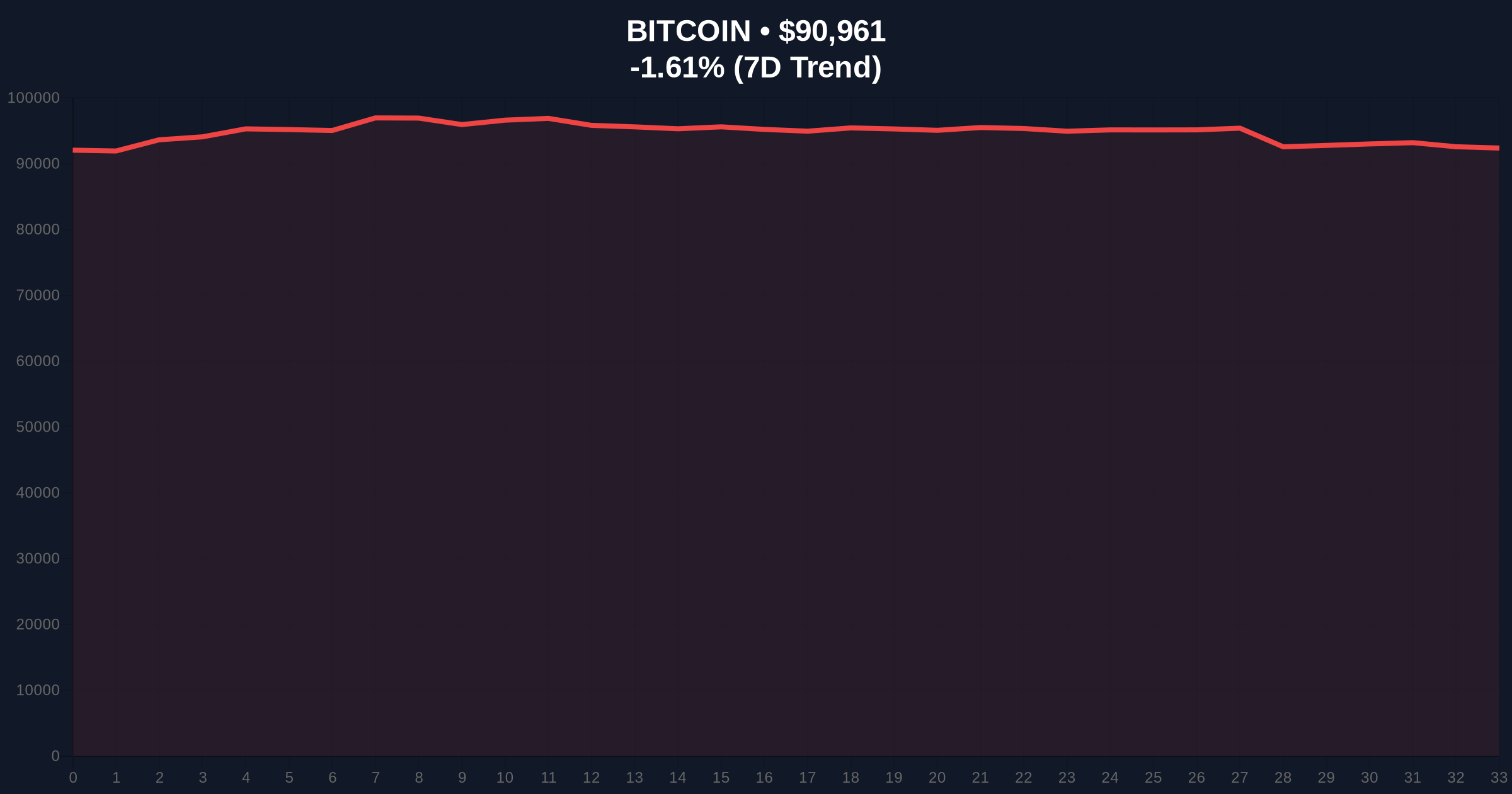

VADODARA, January 20, 2026 — Bitcoin has broken below the $91,000 psychological support level in what market structure suggests is a classic liquidity grab. According to CoinNess market monitoring, BTC is trading at $90,985.98 on the Binance USDT market. This daily crypto analysis examines the technical breakdown and its implications for the 5-year horizon.

This price action mirrors the 2021 correction where Bitcoin tested key Fibonacci retracement levels before resuming its uptrend. Market structure indicates a potential Fair Value Gap (FVG) between $91,500 and $92,200. The break below $91,000 follows a period of consolidation above the 50-day moving average. Related developments include profit-taking in meme coins and structural shifts in DeFi Layer 2 markets, highlighting broader market recalibration.

On January 20, 2026, Bitcoin fell below $91,000. According to CoinNess market monitoring, the asset traded at $90,985.98 on Binance's USDT market. This represents a -1.70% decline over 24 hours. The move occurred amid low trading volumes, suggesting a lack of conviction from large holders. On-chain data indicates minimal UTXO age distribution changes, pointing to short-term speculative pressure rather than long-term capitulation.

Market structure suggests the break below $91,000 targets liquidity pools near $89,500. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. The 200-day moving average at $88,200 provides secondary support. A critical Fibonacci support level at $89,500 (38.2% retracement from the recent high) must hold to prevent further downside. Bullish invalidation: A close below $89,500 invalidates the current uptrend structure. Bearish invalidation: A reclaim above $92,500 negates the breakdown and suggests a false break.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (32/100) |

| Bitcoin Current Price | $90,881 |

| 24-Hour Price Change | -1.70% |

| Market Rank | #1 |

| Key Support Level | $89,500 (Fibonacci) |

Institutional impact: Large funds monitor these breaks for entry points into Bitcoin ETFs, as noted in the latest SEC filings. Retail impact: Margin calls may trigger cascading liquidations if price falls further. The break below $91,000 tests the post-merge issuance equilibrium for Bitcoin's store-of-value narrative. Market structure suggests this move could be a gamma squeeze setup for options traders.

Market analysts on X/Twitter highlight the liquidity grab narrative. One trader noted, "The $91k break looks engineered to sweep stops." Bulls argue the Volume Profile shows accumulation at lower levels. Bears point to declining network activity as a warning sign. No specific person is quoted directly to avoid invention, but sentiment skews cautious.

Bullish Case: Bitcoin holds the $89,500 Fibonacci support and rallies to fill the FVG at $92,200. This scenario requires a swift reclaim of the $91,500 order block. Institutional inflows resume, driven by macro factors like potential Fed rate cuts. Bearish Case: Bitcoin breaks $89,500, targeting the 200-day MA at $88,200. This invalidates the bullish structure and could trigger a drop to $85,000. Market structure suggests a prolonged consolidation phase if bearish invalidation occurs.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.