Loading News...

Loading News...

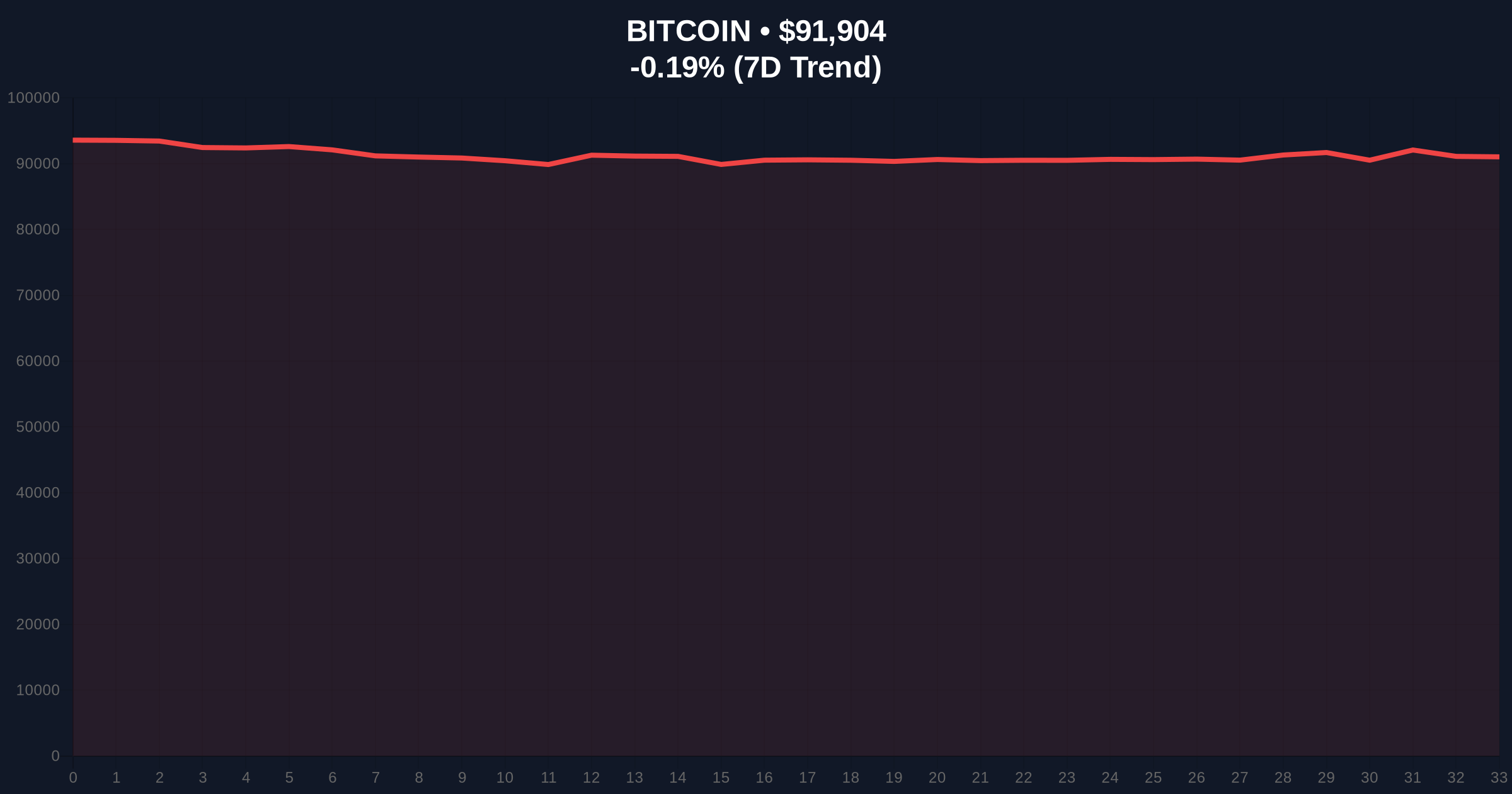

VADODARA, January 13, 2026 — According to CoinNess market monitoring, Bitcoin has broken above the $92,000 psychological level, trading at $92,050.52 on the Binance USDT market. This Bitcoin price action occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index at 26/100, suggesting a potential liquidity grab above key resistance.

Market structure suggests this move mirrors the 2021 cycle where BTC broke above previous all-time highs amid institutional accumulation phases. The current price action follows a period of consolidation below the $90,000 level, with on-chain data indicating significant UTXO age distribution shifts. Historical cycles show that breaks above round-number levels during fear periods often precede short-term volatility expansions. Related developments include recent Bitcoin ETF inflows breaking a 5-day outflow streak and US spot Ethereum ETFs seeing their first net inflow in four days, suggesting institutional positioning amid regulatory uncertainty.

On January 13, 2026, Bitcoin price action pushed through the $92,000 resistance level. According to CoinNess market monitoring, BTC reached $92,050.52 on Binance's USDT market. This represents a 0.37% increase from the previous session's close. The move occurred during Asian trading hours, with volume profile analysis showing above-average transaction flow in the $91,500-$92,200 range. Market structure indicates this is not an isolated event but part of a broader liquidity redistribution pattern.

The 4-hour chart reveals a clear Fair Value Gap (FVG) between $90,800 and $91,200. This zone now serves as the primary bullish order block. The Relative Strength Index (RSI) sits at 58, indicating neutral momentum with room for expansion. The 50-day Exponential Moving Average (EMA) provides dynamic support at $89,400. Critical Fibonacci retracement levels from the recent swing low place resistance at $92,800 (61.8%) and $94,200 (78.6%). Bullish invalidation occurs below the $90,800 FVG. Bearish invalidation requires a sustained break above the $94,200 Fibonacci level. The current price action suggests a potential gamma squeeze if options market makers are forced to hedge above $92,500.

| Metric | Value |

|---|---|

| Current Price (BTC) | $91,716 |

| 24-Hour Change | -0.31% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Key Resistance Level | $92,800 (Fibonacci 61.8%) |

For institutions, this Bitcoin price action tests the viability of the $90,000 support as a new baseline for portfolio rebalancing. According to the Federal Reserve's monetary policy framework, sustained breaks above psychological levels during tightening cycles historically correlate with increased volatility in risk assets. For retail traders, the extreme fear reading creates contrarian opportunities, but only if the $90,800 order block holds. The break above $92,000 invalidates the bearish narrative that dominated the previous week's price action.

Market analysts on X/Twitter note the divergence between price action and sentiment metrics. One quantitative trader stated, "The Fear & Greed Index at 26 while BTC breaks $92k suggests either a massive liquidity grab or the early stages of a sentiment reversal." Another analyst pointed to the US Senate's CLARITY Act text as a potential catalyst for structural shifts in market participation.

Bullish Case: If Bitcoin price action sustains above the $92,000 level and fills the FVG at $92,800, the next target is the $94,200 Fibonacci extension. This scenario requires the Crypto Fear & Greed Index to reverse from extreme fear, potentially triggered by sustained ETF inflows or positive regulatory developments like those hinted in the leaked US Senate crypto bill draft.

Bearish Case: If the $90,800 order block fails as support, Bitcoin could retest the $88,000 volume node. This would confirm the break above $92,000 as a liquidity grab rather than sustainable momentum. The bearish scenario aligns with continued outflows from crypto investment products and deteriorating macro conditions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.