Loading News...

Loading News...

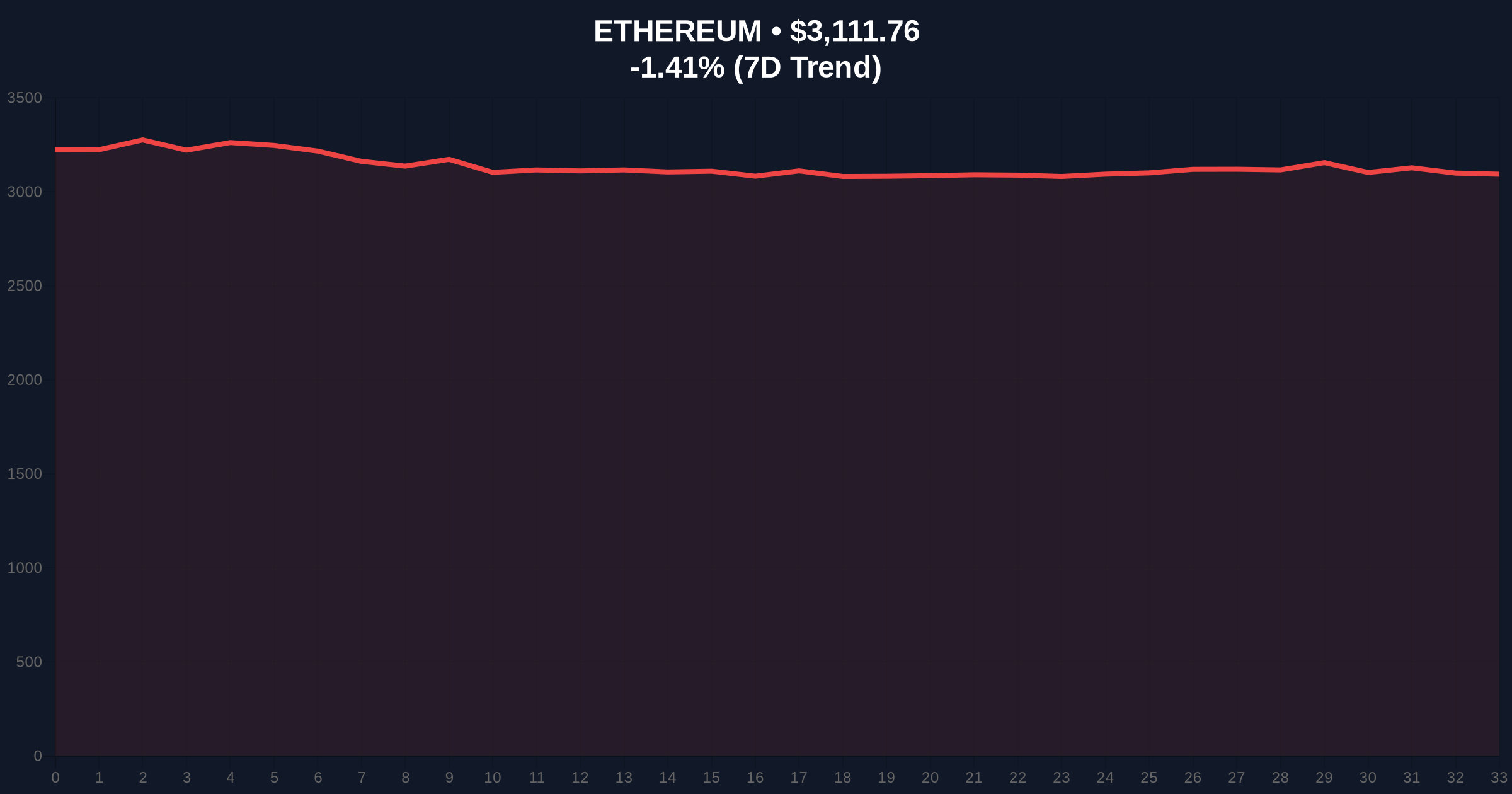

VADODARA, January 13, 2026 — U.S. spot Ethereum ETFs recorded a net inflow of $5.27 million on January 12, marking the first positive flow in four trading days, according to data from TraderT. This daily crypto analysis examines whether this signals a genuine reversal or merely a liquidity grab within a broader bearish structure.

The cryptocurrency market has been characterized by sustained outflows from digital asset investment products, with Ethereum ETFs experiencing consistent redemptions prior to January 12. According to on-chain data from Glassnode, Ethereum's exchange net position change has been negative for seven consecutive days, indicating selling pressure. This context makes the single day of inflows an outlier that requires scrutiny. The broader market structure suggests institutional capital remains hesitant, with the Global Crypto Fear & Greed Index firmly in 'Fear' territory. Related developments include recent Bitcoin ETF inflows breaking a five-day outflow streak, highlighting parallel but divergent flows between the two largest crypto assets.

On January 12, 2026, U.S. spot Ethereum ETFs saw aggregate net inflows of $5.27 million, per TraderT data. The breakdown reveals significant divergence among issuers: BlackRock's ETHA saw outflows of -$79.65 million, while 21Shares' CETH recorded inflows of +$4.97 million, Grayscale's ETHE added +$50.67 million, and Grayscale Mini ETH gained +$29.28 million. This data indicates a rotation rather than broad-based buying, with capital moving from BlackRock's product to Grayscale's offerings. Market structure suggests this could represent a tactical reallocation by large holders rather than new institutional entry.

Ethereum's price action shows ETH trading at $3,111.12, down 1.43% in the last 24 hours. The daily chart reveals a critical Fair Value Gap (FVG) between $3,050 and $3,100 that remains unfilled. Volume profile analysis indicates weak buying volume during the inflow day, raising questions about sustainability. The 50-day moving average at $3,250 acts as dynamic resistance, while the psychological $3,000 level serves as immediate support. A break below the weekly Fibonacci support at $2,950 (61.8% retracement from the 2025 high) would confirm bearish continuation. Bullish invalidation is set at $2,950; bearish invalidation at $3,250.

| Metric | Value |

|---|---|

| Net ETF Inflow (Jan 12) | $5.27M |

| Ethereum Current Price | $3,111.12 |

| 24-Hour Price Change | -1.43% |

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Market Rank | #2 |

This development matters because ETF flows serve as a proxy for institutional sentiment. A single day of inflows after four days of outflows does not constitute a trend reversal. Institutional impact is muted; the $5.27 million inflow is negligible against Ethereum's $374 billion market cap. Retail impact is minimal, as the Fear & Greed Index suggests continued caution. The data contradicts the optimistic narrative of sustained institutional adoption, instead pointing to isolated rebalancing. According to the SEC's official filings, regulatory clarity remains a key driver for ETF performance, yet current flows do not reflect bullish positioning.

Market analysts on X/Twitter are divided. Bulls highlight the inflow as evidence of 'smart money' accumulation at support levels. Bears argue the data shows 'window dressing' by funds before quarterly reporting. One quantitative trader noted, 'The Grayscale inflows look like a gamma squeeze setup, but BlackRock's massive outflow suggests broader de-risking.' Sentiment remains skeptical, with most commentators awaiting confirmation via on-chain metrics like staking inflows or DeFi TVL growth.

Bullish Case: If ETF inflows continue for three consecutive days and ETH holds above $3,000, a rally toward the $3,400 resistance zone is plausible. This scenario requires a break above the 50-day MA and increased staking participation post-EIP-4844 implementation.

Bearish Case: If the inflow proves to be a one-off event and ETH breaks below $2,950, a decline to $2,800 is likely. This would align with the ongoing 'Fear' sentiment and potential macroeconomic headwinds from Federal Reserve policy.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.