Loading News...

Loading News...

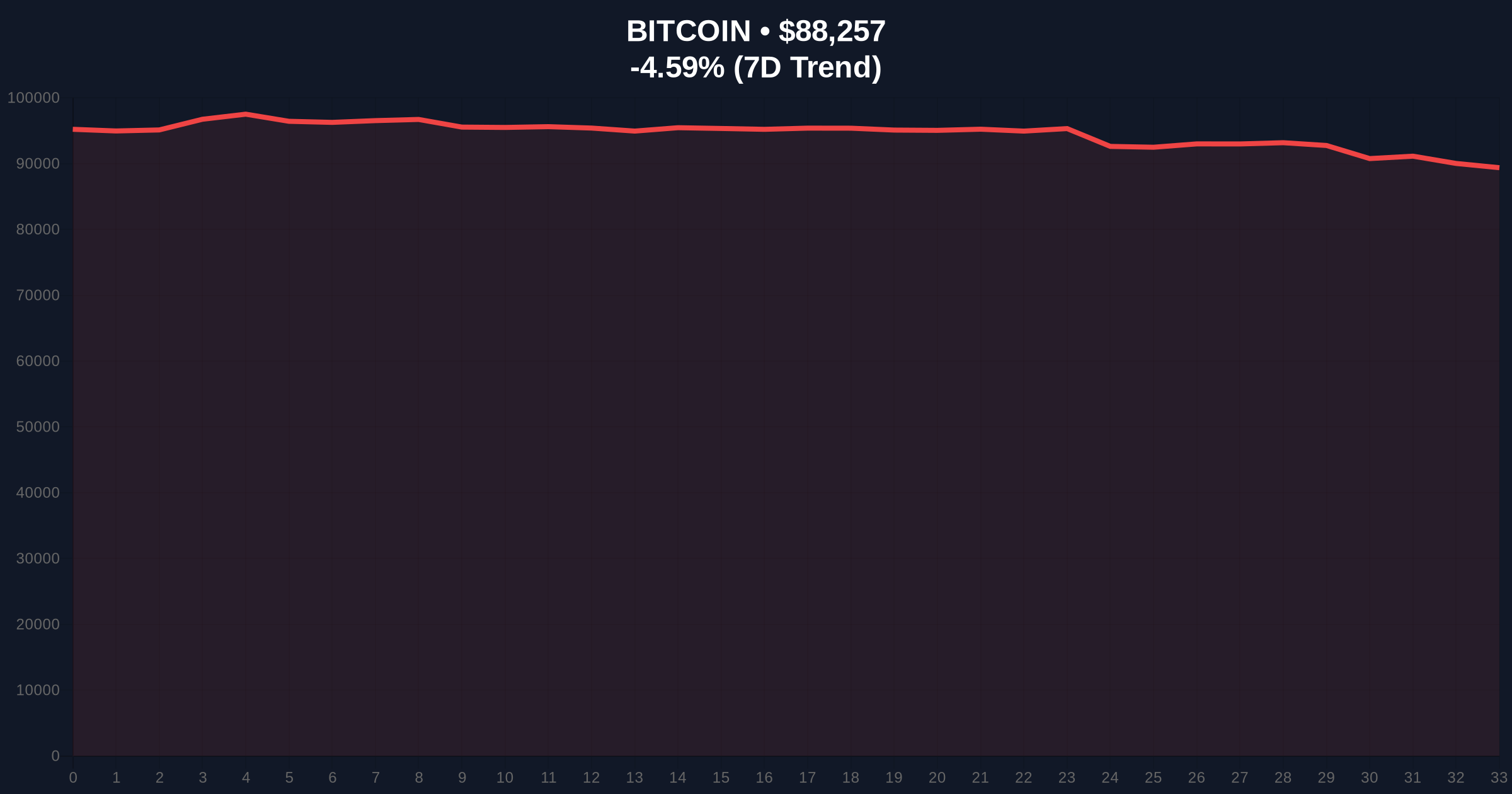

VADODARA, January 21, 2026 — Bitcoin's price action has broken below the critical $88,000 support level, trading at $88,271 with a -4.71% 24-hour decline, as renewed tariff threats from U.S. President Donald Trump trigger broad risk aversion across financial markets. According to analysis from XWIN Research Japan, a contributor to CryptoQuant, investor sentiment toward risk assets including Bitcoin has cooled sharply amid tariff pressure that directly impacts corporate earnings, inflation expectations, and monetary policy outlooks.

Market structure suggests Bitcoin has entered a phase of increased correlation with traditional macroeconomic indicators, contradicting earlier narratives about its decoupling from legacy financial systems. Historical cycles indicate that during periods of heightened trade policy uncertainty, Bitcoin often experiences accelerated selling pressure as institutional investors rebalance portfolios toward less volatile assets. This mirrors patterns observed during the 2018-2019 trade war period when Bitcoin's 200-day moving average failed to provide meaningful support during multiple liquidity events. The current environment represents a critical test of Bitcoin's resilience as both a risk-on asset and potential inflation hedge.

Related developments in the cryptocurrency space include conflicting price predictions amid macroeconomic uncertainty and technical breakdowns below key support levels that warrant cross-market analysis.

According to the XWIN Research Japan analysis published on January 21, 2026, Trump's tariff policy has exerted downward pressure on Bitcoin's price from 2025 onward through multiple transmission channels. The research firm explained that tariffs directly impact corporate earnings, inflation expectations, and monetary policy outlooks, thereby weakening overall risk appetite. This environment makes risk assets like Bitcoin more vulnerable to corrections as uncertainty over economic growth and interest rates increases. The analysis noted that periods of Bitcoin price declines from last year to the present have coincided with times of heightened economic uncertainty stemming from tariffs and trade conflicts, suggesting a measurable correlation coefficient that warrants further statistical validation.

XWIN Research Japan further stated that economic risks tend to be priced into Bitcoin quickly through on-chain transaction flows. As uncertainty increases, investors move to reduce their short-term exposure, treating Bitcoin more as a liquid asset for risk aversion than a long-term store of value during these periods. This behavioral pattern leads to temporary sell-offs that create Fair Value Gaps (FVGs) in the price structure. The firm concluded that economic risks amplified by Trump's tariff policy are currently having a negative impact on Bitcoin's price, but cautioned that the market's assessment could change if there is a structural increase in exchange inflows or a general deterioration in supply and demand conditions.

On-chain data indicates the breakdown below $88,000 represents a significant technical failure that invalidates the previous bullish order block established in late December 2025. The daily Relative Strength Index (RSI) currently reads 38.7, approaching oversold territory but not yet at extreme levels that would suggest imminent reversal. The 50-day exponential moving average at $90,450 now acts as dynamic resistance, while the 200-day simple moving average at $84,900 provides the next major support confluence.

Volume profile analysis shows increased selling pressure during Asian and European trading sessions, with particular weakness following tariff-related headlines. The $85,200 level represents a critical Fibonacci 0.618 retracement from the November 2025 swing low to the January 2026 high, making it a likely target for bearish continuation. Market structure suggests the current move represents a liquidity grab below the psychological $90,000 level before potential reversal.

Bullish Invalidation Level: A sustained break below $84,900 (200-day SMA) would invalidate the longer-term uptrend structure and suggest further downside toward $82,000.

Bearish Invalidation Level: A reclaim above $90,450 (50-day EMA) with accompanying volume would suggest the current breakdown was a false breakdown and resume the primary uptrend.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $88,271 | Below critical $88k support |

| 24-Hour Change | -4.71% | Significant bearish momentum |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Maximum risk aversion sentiment |

| Market Capitalization Rank | #1 | Maintains dominance despite weakness |

| Daily RSI Reading | 38.7 | Approaching oversold conditions |

For institutional investors, this development challenges portfolio allocation models that positioned Bitcoin as an uncorrelated asset during geopolitical stress. The Federal Reserve's monetary policy response to potential tariff-induced inflation, as documented in official Federal Reserve communications, will directly impact Bitcoin's valuation through interest rate expectations and dollar strength. For retail traders, the breakdown represents a critical test of risk management protocols, particularly for leveraged positions that may face margin calls during increased volatility.

The correlation between tariff announcements and Bitcoin sell-offs suggests the market is pricing in second-order effects including potential supply chain disruptions, corporate earnings revisions, and central bank policy responses. This represents a maturation of Bitcoin's integration into global financial markets but also exposes it to traditional macroeconomic headwinds that were previously considered less relevant.

Market analysts on social platforms express divided views about the sustainability of the current correlation. Some technical traders point to the breakdown below $88,000 as confirmation of a larger corrective pattern, while long-term holders emphasize Bitcoin's historical resilience during periods of monetary policy uncertainty. The absence of panic selling in older UTXO cohorts suggests conviction among core holders, but the increase in short-term exchange inflows indicates speculative positioning is being unwound.

Bullish Case: If tariff rhetoric moderates and economic data suggests contained inflation impact, Bitcoin could reclaim the $90,450 resistance level and target the previous high near $95,000. A structural increase in exchange inflows from institutional buyers, particularly through approved ETF vehicles, would provide fundamental support for this scenario. The implementation of technical improvements like Schnorr signature adoption could enhance network efficiency and support price appreciation.

Bearish Case: Escalating trade tensions leading to actual tariff implementation could push Bitcoin toward the $85,200 Fibonacci support, with potential extension to $82,000 if macroeconomic conditions deteriorate further. Continued correlation with traditional risk assets during the uncertainty would validate the risk-off narrative and potentially trigger a larger correction toward the $78,000 volume node. A sustained break below the 200-day moving average would signal a regime change in market structure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.