Loading News...

Loading News...

VADODARA, January 15, 2026 — Bitcoin derivatives open interest has plummeted by 31% since October 2025, a move analysts interpret as a deleveraging event that could precede a market rebound. This daily crypto analysis scrutinizes whether this data point signals a healthy correction or masks deeper structural weaknesses in the market.

Historically, sharp declines in open interest have correlated with market bottoms, as excessive leverage is flushed from the system. According to on-chain data from CryptoQuant, similar OI drops in 2022 and 2024 preceded significant rallies, but each cycle exhibits unique liquidity dynamics. The current environment is complicated by macroeconomic factors, including potential Federal Reserve policy shifts, which could influence risk assets like Bitcoin. Market structure suggests that deleveraging alone is insufficient; it must coincide with a shift in volume profile and order flow to confirm a sustainable reversal. Related developments include recent analyses on market sentiment, such as extreme Bitcoin FUD potentially triggering a breakout, and scrutiny of liquidity events like BTC-backed financial products.

According to an analysis by CryptoQuant contributor Darkpost, Bitcoin derivatives open interest has fallen by 31% since October 2025. Darkpost described this as a healthy signal that excessive leverage is being cleared from the market, potentially establishing a major bottom. However, the contributor cautioned that if Bitcoin enters a full-blown bear market, OI could decline further, prolonging the correction. This data is sourced from derivatives exchanges tracked by CryptoQuant, which aggregates OI metrics across platforms like Binance and Bybit. Market analysts note that the decline aligns with reduced speculative activity, but the timing raises questions about whether it reflects capitulation or merely a temporary liquidity grab.

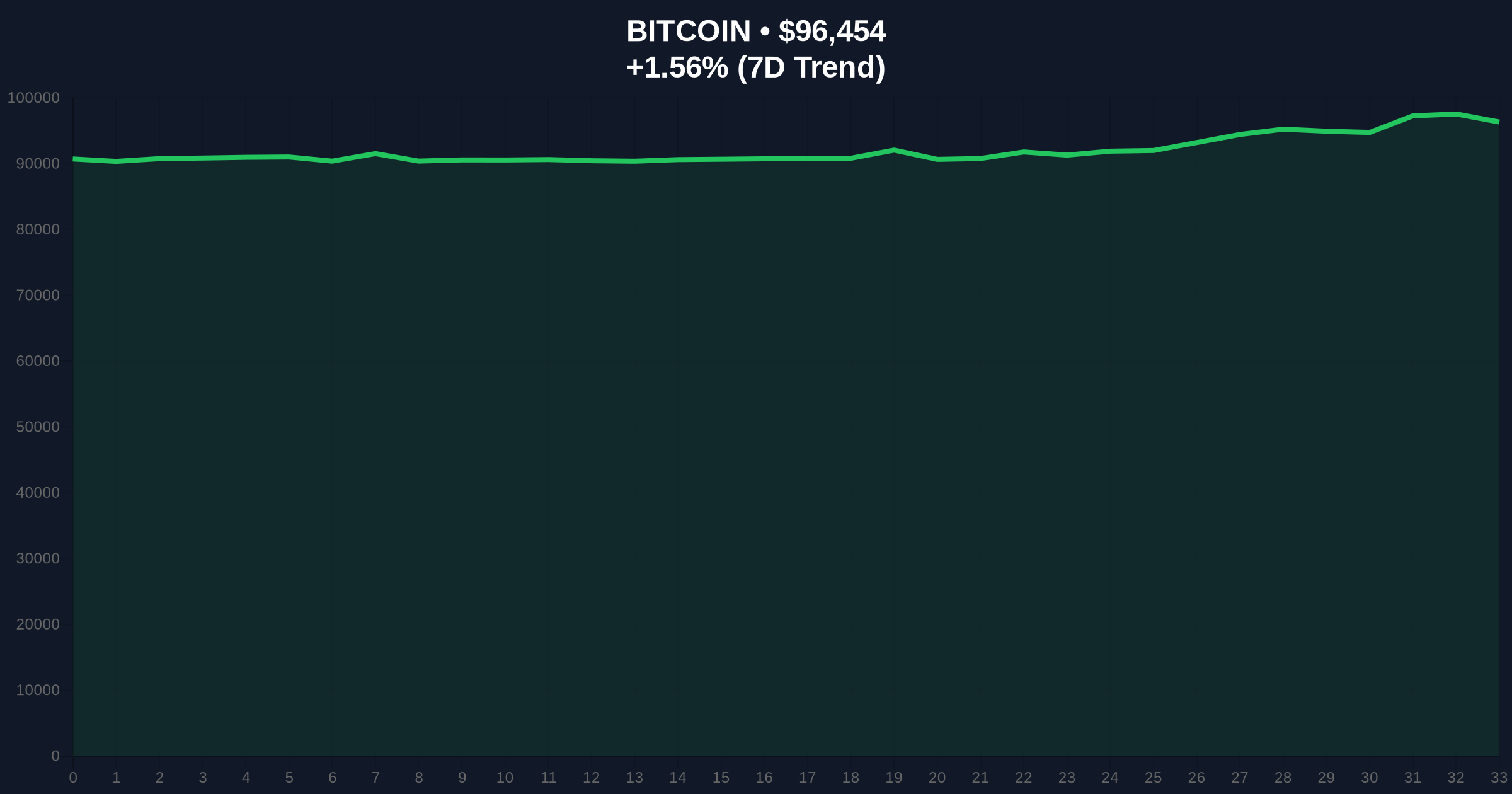

Bitcoin is currently trading at $96,427, up 1.53% in the last 24 hours. The price action shows consolidation near the $95,000 level, with a critical support zone at $92,000—a Fibonacci retracement level from the 2025 highs. The RSI is at 58, indicating neutral momentum, while the 50-day moving average at $94,500 provides dynamic support. A Fair Value Gap (FVG) exists between $98,000 and $100,000, which could act as resistance if price advances. Bullish invalidation is set at $92,000; a break below this level would suggest the OI decline is part of a broader bearish structure. Bearish invalidation is at $102,000, where a breakout could trigger a gamma squeeze. Market structure suggests that without a clear order block formation above $100,000, the rebound thesis remains unconfirmed.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Open Interest Decline | 31% (since Oct 2025) | CryptoQuant |

| Current Bitcoin Price | $96,427 | Live Market Data |

| 24-Hour Price Change | +1.53% | Live Market Data |

| Crypto Fear & Greed Index | Greed (61/100) | Live Market Data |

| Key Support Level | $92,000 (Fibonacci) | Technical Analysis |

For institutional investors, a deleveraged market reduces systemic risk and could attract capital from entities like pension funds, as outlined in regulatory frameworks on SEC.gov. For retail traders, lower OI implies reduced liquidation risks but also diminished liquidity, potentially increasing volatility. The 31% OI drop matters because it aligns with historical bottoming patterns, yet the current Greed score of 61 contradicts typical capitulation signals. Market structure suggests that if this is a genuine deleveraging, it could pave the way for a sustainable rally; however, if it masks underlying weakness, it may represent a bear trap. The impact extends to altcoins, as Bitcoin dominance often dictates broader market trends.

Market analysts on X/Twitter are divided. Bulls argue that the OI decline is a classic sign of market cleansing, citing similar patterns in 2024. One analyst posted, "Open interest washout often precedes major moves—this could be the setup for a run to $110,000." Bears counter that the Greed index and lack of volume surge indicate complacency. A skeptic noted, "Deleveraging without fear is just a liquidity grab; watch for a break below $92,000 to confirm bearish continuation." This dichotomy highlights the uncertainty in interpreting on-chain data in isolation.

Bullish Case: If the OI decline represents true deleveraging, Bitcoin could rebound to fill the FVG at $100,000, with a target of $105,000 based on historical mean reversion. This scenario requires holding support at $92,000 and increasing spot buying volume. Market structure suggests a breakout above $102,000 would invalidate bearish momentum.

Bearish Case: If the OI drop is part of a broader downtrend, Bitcoin could break below $92,000, targeting $88,000 (the 0.618 Fibonacci level). This would prolong the correction, with OI potentially falling another 20-30%. A sustained bear market could see prices test $85,000, driven by macroeconomic headwinds like rising interest rates.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.