Loading News...

Loading News...

VADODARA, January 17, 2026 — Bitcoin perpetual futures recorded $41.59 million in liquidations over the past 24 hours, with long positions accounting for 89.52% of the volume. This daily crypto analysis reveals a market structure under pressure as leveraged longs unwind at the $95,271 level. According to liquidation data from Coinness, Ethereum followed with $18.95 million in liquidations (73.11% longs), while RIVER saw $9.15 million (56.91% shorts). Market structure suggests a liquidity grab targeting over-leveraged positions.

Perpetual futures liquidations often precede volatility spikes. This mirrors the Q4 2025 correction where $300 million in Bitcoin longs were liquidated in a single session. The current data indicates a controlled unwind rather than a cascade. Historical cycles suggest such events test underlying spot market support. Related developments include corporate Bitcoin accumulation and regulatory uncertainty impacting sentiment.

On January 17, 2026, liquidation metrics showed asymmetric pressure. Bitcoin's $41.59 million liquidation volume had an 89.52% long bias. Ethereum's $18.95 million followed with 73.11% longs. RIVER's $9.15 million displayed 56.91% short bias. According to the source data from Coinness, these figures represent a 24-hour snapshot of perpetual futures market stress. No single catalyst triggered the event. Market analysts attribute it to profit-taking and stop-loss hunting.

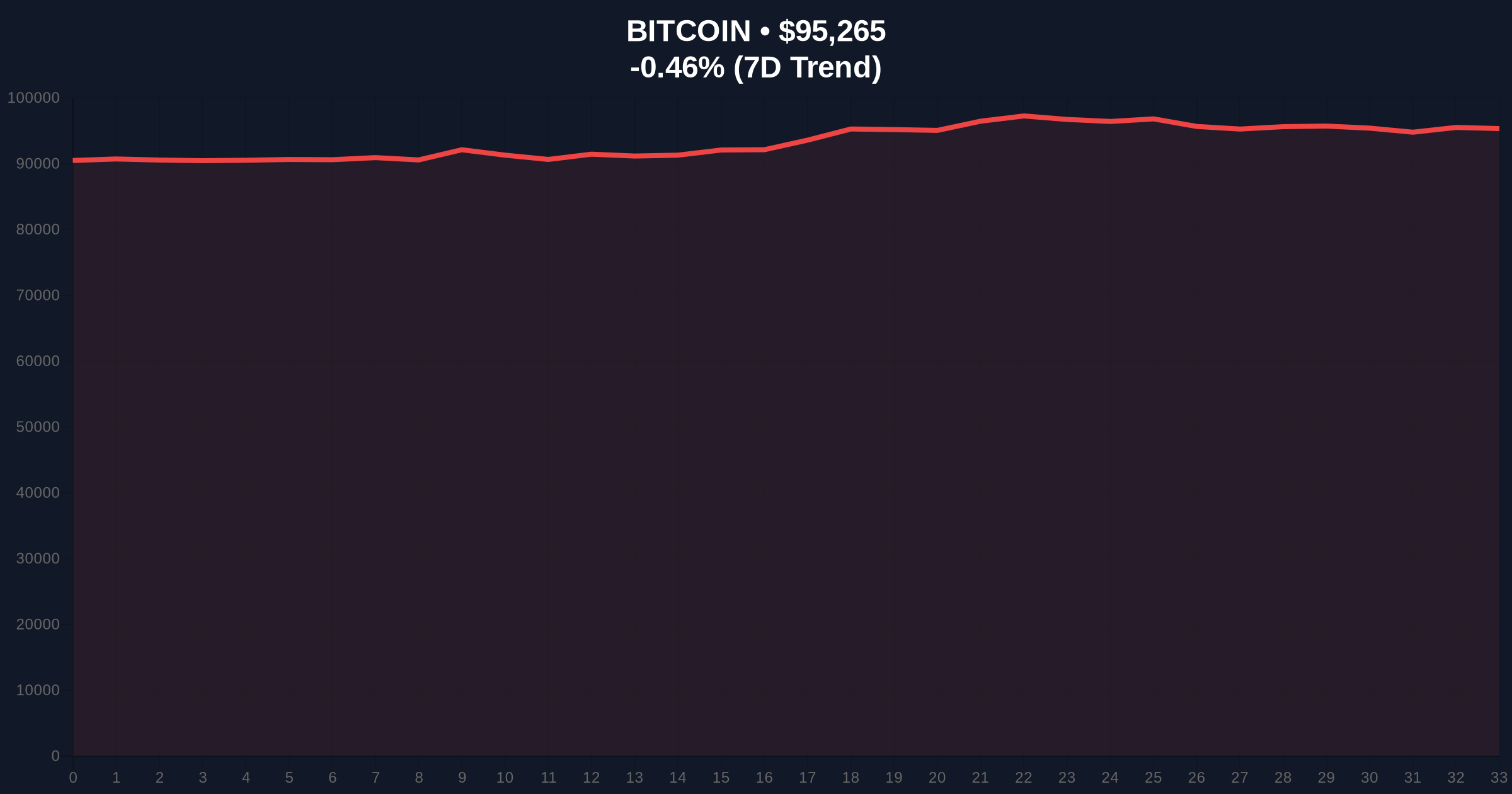

Bitcoin currently trades at $95,271, down 0.37% in 24 hours. The liquidation cluster creates a Fair Value Gap (FVG) between $95,500 and $96,200. Volume Profile indicates high liquidity at $94,200, aligning with the 50-day exponential moving average. RSI sits at 48, showing neutral momentum with bearish divergence. Bullish invalidation level: $94,200. A break below this Order Block suggests further downside to $92,500. Bearish invalidation level: $96,500. A reclaim above this resistance invalidates the short-term bearish structure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 50 (Neutral) |

| Bitcoin Current Price | $95,271 |

| Bitcoin 24h Change | -0.37% |

| BTC Liquidations (24h) | $41.59M (89.52% longs) |

| ETH Liquidations (24h) | $18.95M (73.11% longs) |

For institutions, liquidation events signal market efficiency in removing excessive leverage. According to Ethereum.org documentation on consensus mechanisms, post-merge issuance dynamics can influence derivative markets. Retail traders face margin calls and position resets. The asymmetry in long vs. short liquidations indicates sentiment skew. Market structure suggests this is a healthy correction within a broader uptrend, provided support holds.

Market analysts on X/Twitter note the liquidation volume remains below crisis thresholds. One quant stated, "This is standard deleveraging, not capitulation." Bulls point to sustained institutional inflows, referencing Ethereum ETF trends. Bears highlight regulatory headwinds and potential Gamma Squeeze scenarios if volatility expands. Overall sentiment is cautiously neutral with a watchful eye on support.

Bullish Case: Bitcoin holds $94,200 support and fills the FVG to $96,200. Leverage resets allow for a clean breakout above $97,000. On-chain data indicates accumulation by long-term holders. Target: $100,000 in Q1 2026.

Bearish Case: Support at $94,200 fails. Liquidations cascade, triggering a flush to $92,500. Market structure breaks, leading to a test of $90,000. The 200-day MA at $88,500 becomes critical. This scenario requires a spike in funding rates and negative funding arbitrage.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.