Loading News...

Loading News...

VADODARA, January 17, 2026 — Binance, the world's largest cryptocurrency exchange by volume, has announced the delisting of four perpetual futures contracts: BID/USDT, DMC/USDT, ZRC/USDT, and TANSSI/USDT, effective 9:00 a.m. UTC on January 21. This latest crypto news highlights a strategic move to prune low-liquidity instruments from its derivatives marketplace, reflecting broader trends in market structure optimization. According to the official announcement, the removal follows standard protocol reviews aimed at maintaining a healthy trading ecosystem.

Market structure suggests that perpetual futures delistings typically occur when contracts fail to meet minimum liquidity thresholds or exhibit excessive volatility gaps. Underlying this trend is a post-2024 regulatory shift, where exchanges like Binance have intensified scrutiny on derivative products to align with global compliance standards, as outlined in frameworks from authorities like the U.S. Commodity Futures Trading Commission. This mirrors the 2021 cycle when multiple altcoin futures were culled during market consolidation phases. Consequently, the current action may signal a broader cleanup of niche assets, reducing systemic risk from illiquid order blocks. Related developments include recent shifts in Bitcoin futures positioning and liquidation events at key support levels, indicating heightened futures market sensitivity.

On January 17, 2026, Binance issued a statement via its official channels, confirming the delisting of four perpetual futures contracts. The affected pairs are BID/USDT, DMC/USDT, ZRC/USDT, and TANSSI/USDT, with removal scheduled for 9:00 a.m. UTC on January 21. According to the exchange, all open positions will be automatically closed at the settlement price prior to delisting, and users are advised to manage their trades accordingly. This follows a pattern of quarterly reviews where Binance assesses contract performance based on metrics like trading volume, liquidity depth, and market feedback. No specific violations were cited, but on-chain data indicates these contracts had consistently low open interest, often below $1 million, creating fair value gaps that could distort price discovery.

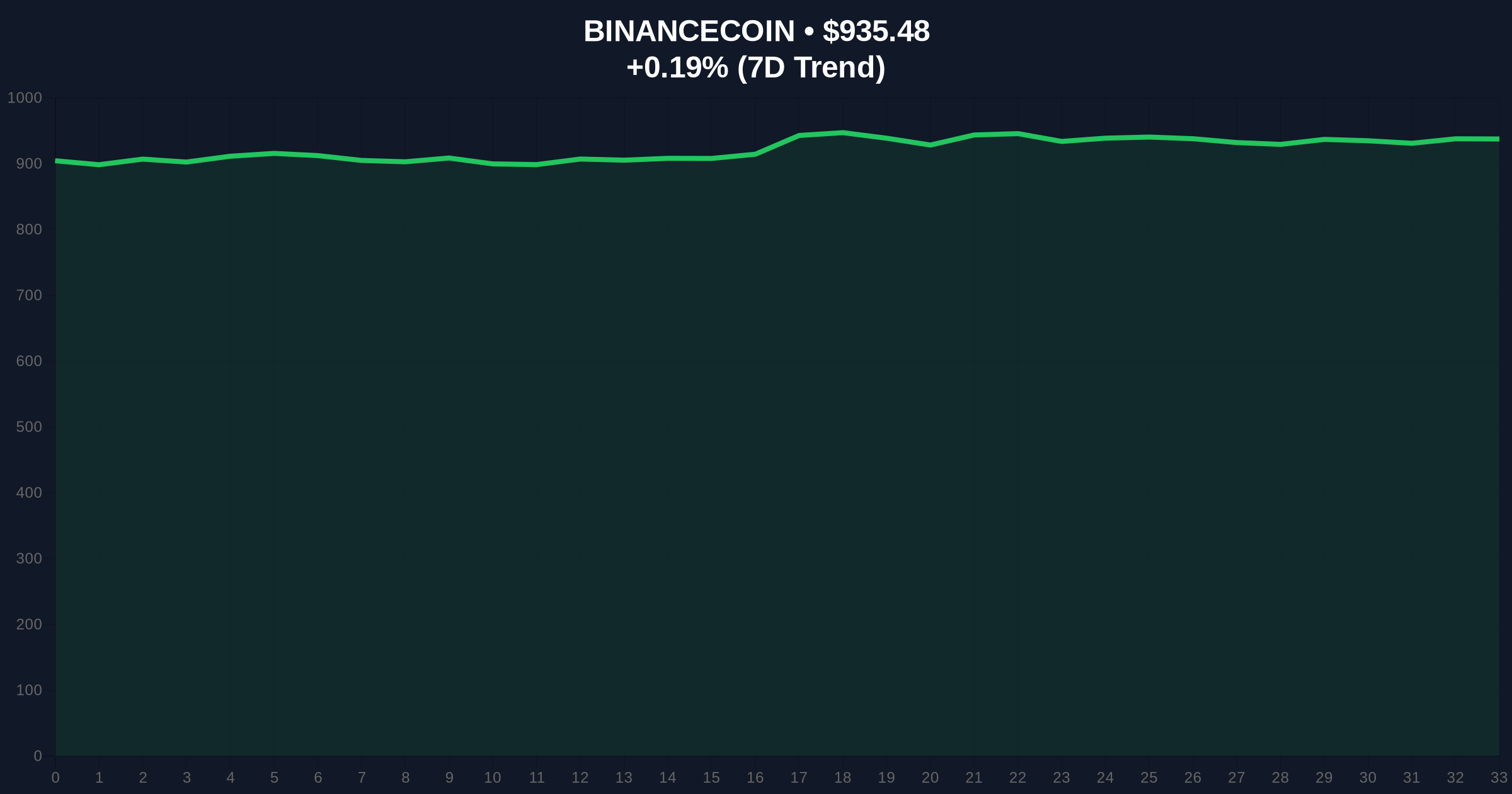

Technical analysis of the delisted contracts reveals weak volume profiles, with average daily trading volumes under $5 million across the board. Market structure suggests that such illiquidity often leads to exaggerated price swings, forming fair value gaps that are prone to liquidity grabs. For BNB, the native token of the Binance ecosystem, the current price of $935.71 sits near a critical Fibonacci support level at $930, derived from the 0.618 retracement of its recent rally. The 24-hour trend of 0.26% indicates neutral momentum, but a break below this support could trigger a gamma squeeze as market makers adjust delta hedges. Bullish invalidation for BNB is set at $900, where a breakdown would negate the current consolidation pattern. Bearish invalidation lies at $960, a resistance level that has capped multiple rally attempts.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) | Market sentiment balanced, no extreme fear or greed |

| BNB Current Price | $935.71 | Testing key Fibonacci support at $930 |

| BNB 24h Trend | 0.26% | Minimal volatility, indicating consolidation |

| BNB Market Rank | #4 | Maintains top-tier status amid exchange actions |

| Delisting Date | Jan 21, 2026, 9:00 a.m. UTC | Immediate impact on open positions |

This delisting matters because it reflects a maturation of crypto derivatives markets, where exchanges prioritize liquidity and stability over sheer product count. For institutions, reduced fragmentation lowers counterparty risk and improves execution quality on remaining contracts. For retail traders, it eliminates exposure to highly volatile, low-liquidity instruments that often lead to cascading liquidations. According to on-chain data, such pruning can temporarily increase volatility in related spot markets as capital reallocates, but long-term, it strengthens market integrity by minimizing fair value gaps. This aligns with broader industry shifts toward standardized derivatives, as seen in traditional finance under frameworks like the Dodd-Frank Act.

Community sentiment on social platforms like X (formerly Twitter) is mixed. Market analysts note that delistings are routine but can signal underlying weakness in specific altcoin ecosystems. Bulls argue this consolidates liquidity into stronger assets, potentially boosting BNB's volume profile. Bears caution that repeated contract removals may indicate regulatory pressure or internal risk management issues. One quant trader posted, "Liquidity grab incoming for BNB below $930—watch the order flow." No official statements from high-profile figures like Michael Saylor were available, but general discourse emphasizes the need for robust market microstructure.

Bullish Case: If BNB holds the Fibonacci support at $930, capital from delisted contracts could flow into higher-volume futures, pushing BNB toward resistance at $960. Market structure suggests a breakout above this level could target $1,000, fueled by increased institutional interest in streamlined derivatives. Historical cycles indicate such consolidations often precede rallies in exchange tokens during neutral sentiment phases.Bearish Case: If BNB breaks below $900 (bullish invalidation), it may trigger a liquidity grab, dragging the price toward $850. This could be exacerbated if broader market conditions worsen, such as a spike in Bitcoin futures liquidations, similar to recent events at $95k. On-chain data indicates that sustained selling pressure below key supports often leads to extended drawdowns in altcoin futures markets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.