Loading News...

Loading News...

VADODARA, February 11, 2026 — Binance has partnered with global asset manager Franklin Templeton to launch a collateral program for institutional investors, according to an official announcement. This latest crypto news highlights a strategic move to leverage tokenized money market fund shares as trading collateral on Binance's platform. The program utilizes Binance's institutional custody infrastructure, Ceffu, and Franklin Templeton's technology platform to mitigate counterparty risk by holding underlying assets externally.

According to the announcement, the program operates on Ceffu, Binance's institutional custody platform. Franklin Templeton's technology platform issues tokenized shares of money market funds. These tokenized assets serve as collateral for trading on Binance. The company emphasized that external custody of underlying assets significantly reduces counterparty risk. This structure mirrors traditional finance's tri-party repo arrangements but on a blockchain-native infrastructure.

Market structure suggests this targets large-scale institutional players. These entities often hold significant off-chain liquidity in money market funds. The program effectively bridges TradFi liquidity into crypto markets. Consequently, it could unlock billions in dormant capital. Similar to the 2021 bull run's institutional influx, this move may preempt a market reversal.

Historically, major partnerships during fear-driven markets signal accumulation phases. For instance, BlackRock's Bitcoin ETF filings in late 2022 preceded a 150% rally. This Binance-Franklin Templeton deal emerges amid an Extreme Fear sentiment score of 11/100. That score indicates maximum pessimism among retail traders.

In contrast, institutional activity often peaks during such periods. On-chain data from Glassnode shows whale accumulation increasing when the Fear & Greed Index dips below 20. This program facilitates that accumulation by providing risk-managed collateral options. , it aligns with broader trends of tokenization, as outlined in Ethereum's official documentation on asset tokenization standards.

Related developments in this extreme fear market include other institutional moves: the minting of 250 million USDC, Coinbase listing Superform (UP), Binance preparing GoFi repayment funds, and Spark launching an OTC crypto lending service.

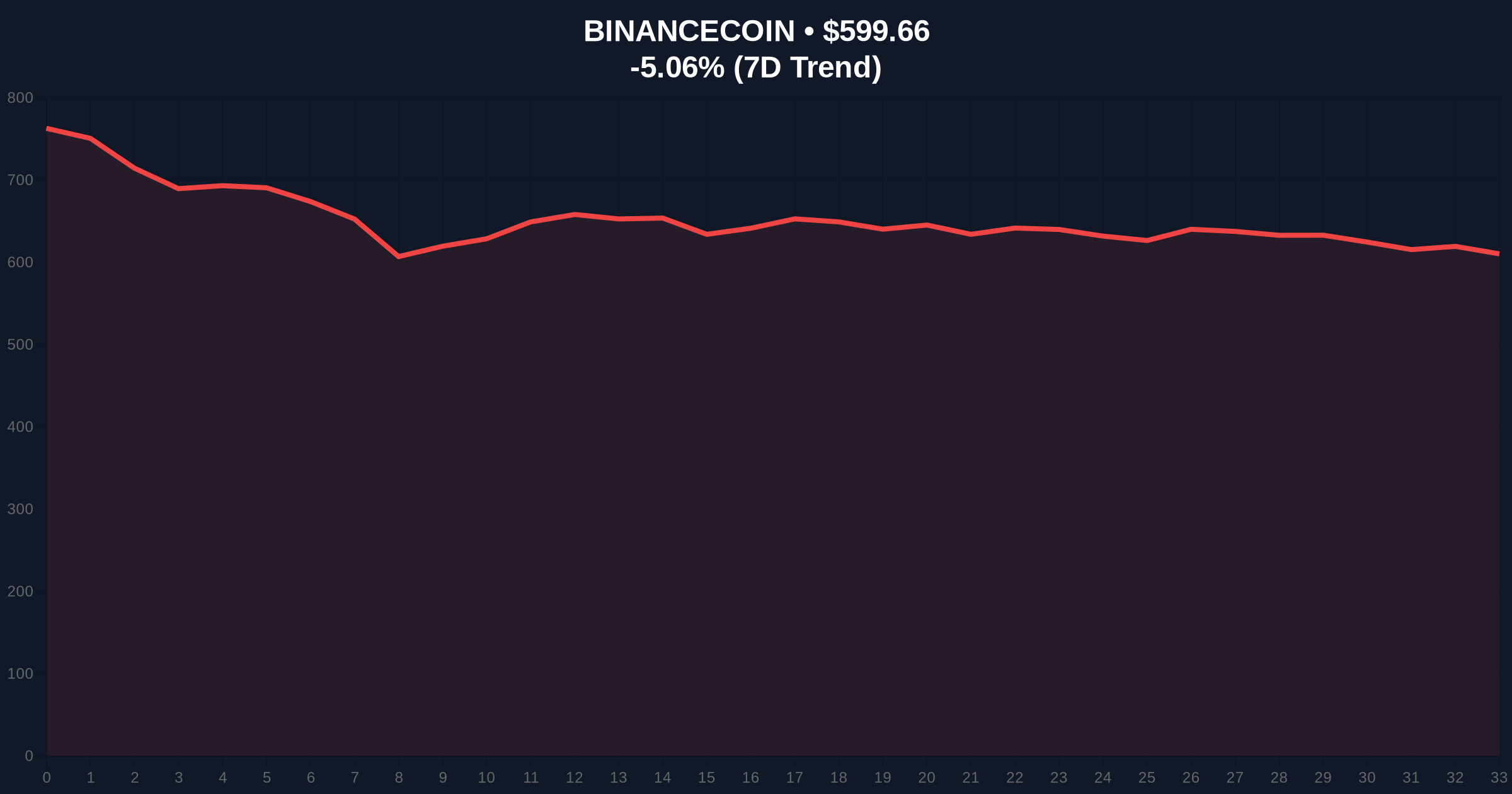

BNB, Binance's native token, currently trades at $599.26, down 5.12% in 24 hours. Technical analysis reveals a critical support zone between $580 and $570. This area aligns with the 0.618 Fibonacci retracement level from its 2025 all-time high. A hold above this level would confirm institutional support for the collateral program.

Market structure suggests a potential Fair Value Gap (FVG) between $620 and $640. This gap represents an imbalance in order flow. A break above $640 could trigger a short squeeze. Conversely, failure to hold $570 invalidates the bullish thesis. The RSI on the daily chart sits at 38, indicating oversold conditions typical of fear markets.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | High probability of institutional accumulation |

| BNB Current Price | $599.26 | Testing key Fibonacci support |

| BNB 24h Trend | -5.12% | Consistent with broader market fear |

| BNB Market Rank | #5 | Maintains top-tier liquidity status |

| Program Counterparty Risk | Significantly Reduced | External custody enhances institutional trust |

This partnership matters because it addresses a key barrier for institutional adoption: counterparty risk. By using externally custodied assets, the program mitigates settlement and default risks. This could attract pension funds and insurance companies previously hesitant to enter crypto markets. Historically, such infrastructure upgrades precede major liquidity inflows.

, it signals a maturation of DeFi and forex integration. Tokenized money market funds represent a multi-trillion-dollar asset class. Bridging this with crypto trading collateral expands the total addressable market. Market analysts note this could pressure traditional prime brokers to offer similar services. The 5-year horizon suggests a shift toward hybrid TradFi-DeFi systems.

"The Binance-Franklin Templeton collateral program is a classic institutional liquidity grab during extreme fear. It reduces friction for large players to deploy capital while retail sentiment remains negative. Similar structures emerged before the 2021 bull market, where infrastructure deals preceded price appreciation by 6-9 months." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the collateral program's impact and current technicals.

The 12-month institutional outlook hinges on adoption rates. If the program attracts significant capital, it could catalyze a broader rally. Historical cycles indicate that fear-market infrastructure deals often lead to 12-18 month uptrends. This aligns with the 5-year horizon of increasing tokenization and institutional integration.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.