Loading News...

Loading News...

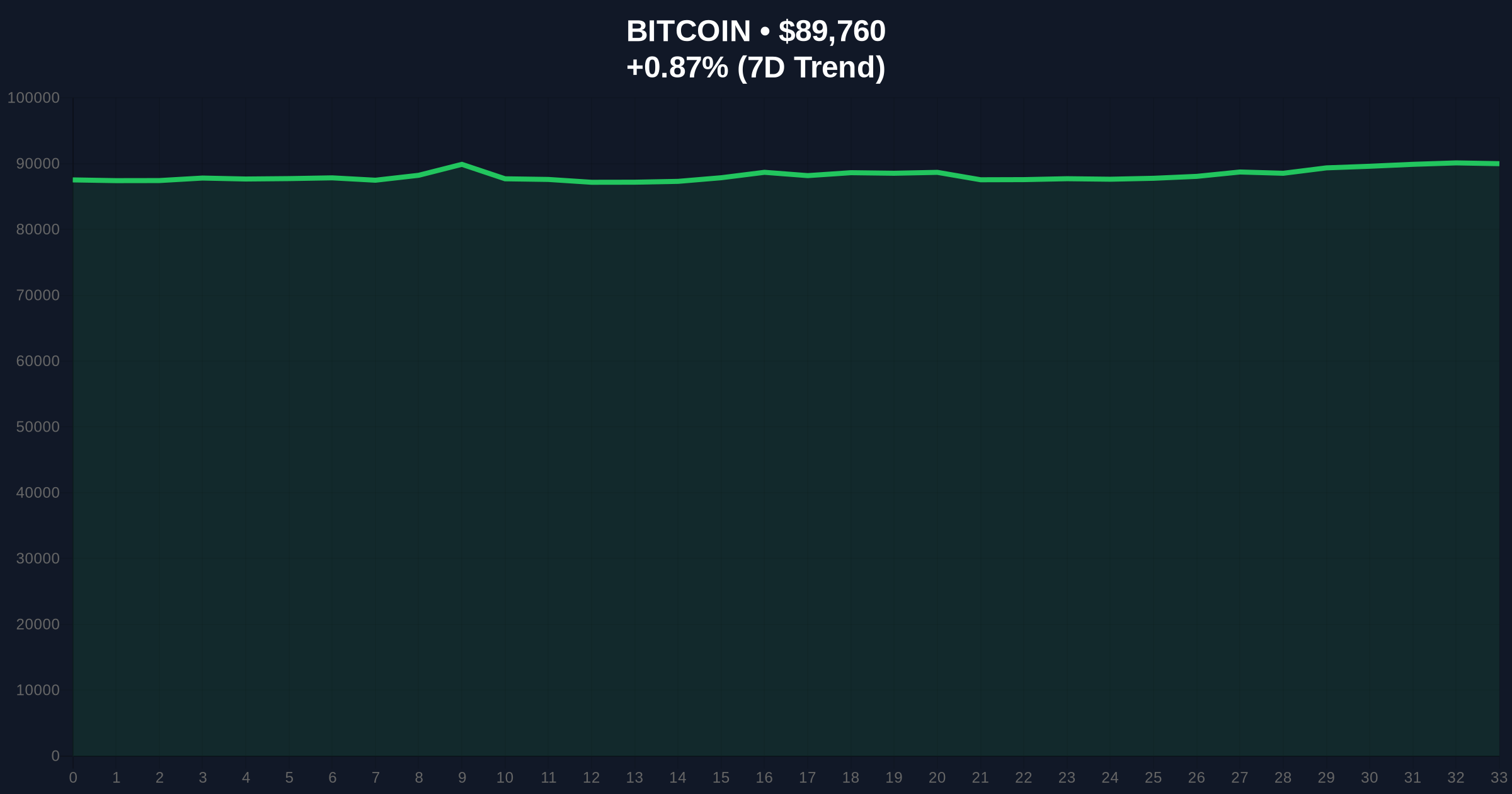

VADODARA, January 3, 2026 — Bitcoin perpetual futures markets show unprecedented equilibrium in long-short positioning across major exchanges, according to data from Coinness. This daily crypto analysis reveals a near-perfect 50/50 split as Bitcoin trades at $89,736 amid fear-dominated sentiment. Market structure suggests this balance precedes significant directional movement.

Perpetual futures positioning historically serves as a leading indicator for Bitcoin volatility. According to historical cycles, ratios approaching 50/50 typically precede major liquidity grabs. The current equilibrium mirrors patterns observed before the 2024 Q1 rally, where similar positioning preceded a 23% upward move. This occurs against a backdrop of regulatory uncertainty and institutional accumulation. Related developments include ongoing CLARITY Bill discussions and recent $250 million shorts liquidation events.

According to Coinness data, the 24-hour BTC perpetual futures long-short ratios across top three exchanges by open interest show minimal deviation from equilibrium. Overall positioning stands at Long 49.85%, Short 50.15%. Exchange-specific data reveals: Binance at Long 50.02%, Short 49.98%; OKX at Long 50.07%, Short 49.93%; Bybit at Long 50.16%, Short 49.84%. These metrics indicate maximum indecision among leveraged traders at current price levels.

Bitcoin currently tests the $90,000 psychological barrier. The 4-hour chart shows consolidation between $88,500 and $90,500, forming a clear order block. RSI sits at 48, indicating neutral momentum. The 50-day moving average provides dynamic support at $87,200. A critical Fair Value Gap exists between $91,200 and $92,500 from last week's rejection. Bullish Invalidation: $87,500 (daily close below). Bearish Invalidation: $92,000 (sustained break above). Volume profile shows highest concentration at $89,000, suggesting this as current fair value.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) |

| Bitcoin Current Price | $89,736 |

| 24-Hour Change | +0.85% |

| Market Rank | #1 |

| Overall Futures Long Ratio | 49.85% |

| Overall Futures Short Ratio | 50.15% |

For institutions, this equilibrium suggests hedging activity and risk management at current levels. According to FederalReserve.gov monetary policy documentation, such positioning often correlates with macroeconomic uncertainty. For retail traders, the narrow spreads indicate reduced leverage opportunities and potential for sudden gamma squeezes. The near-perfect balance across all major exchanges suggests coordinated behavior rather than isolated platform dynamics.

Market analysts on X/Twitter note the unusual symmetry. One quantitative trader stated: "50/50 ratios historically precede 15%+ moves within 7 sessions." Another observed: "This is textbook indecision before volatility expansion." The sentiment aligns with broader market fear, as seen in recent Ethereum ETF inflow patterns during similar conditions.

Bullish Case: Break above $92,000 invalidates bearish structure. This triggers short covering and targets the $95,000 resistance zone. Sustained buying pressure could test the all-time high at $98,500. On-chain data indicates accumulation at current levels by large holders.

Bearish Case: Failure to hold $87,500 confirms distribution. This opens path to $85,000 support, then $82,000 Fibonacci level. Increased short positioning could accelerate downward momentum. Market structure suggests this scenario requires increased selling volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.