Loading News...

Loading News...

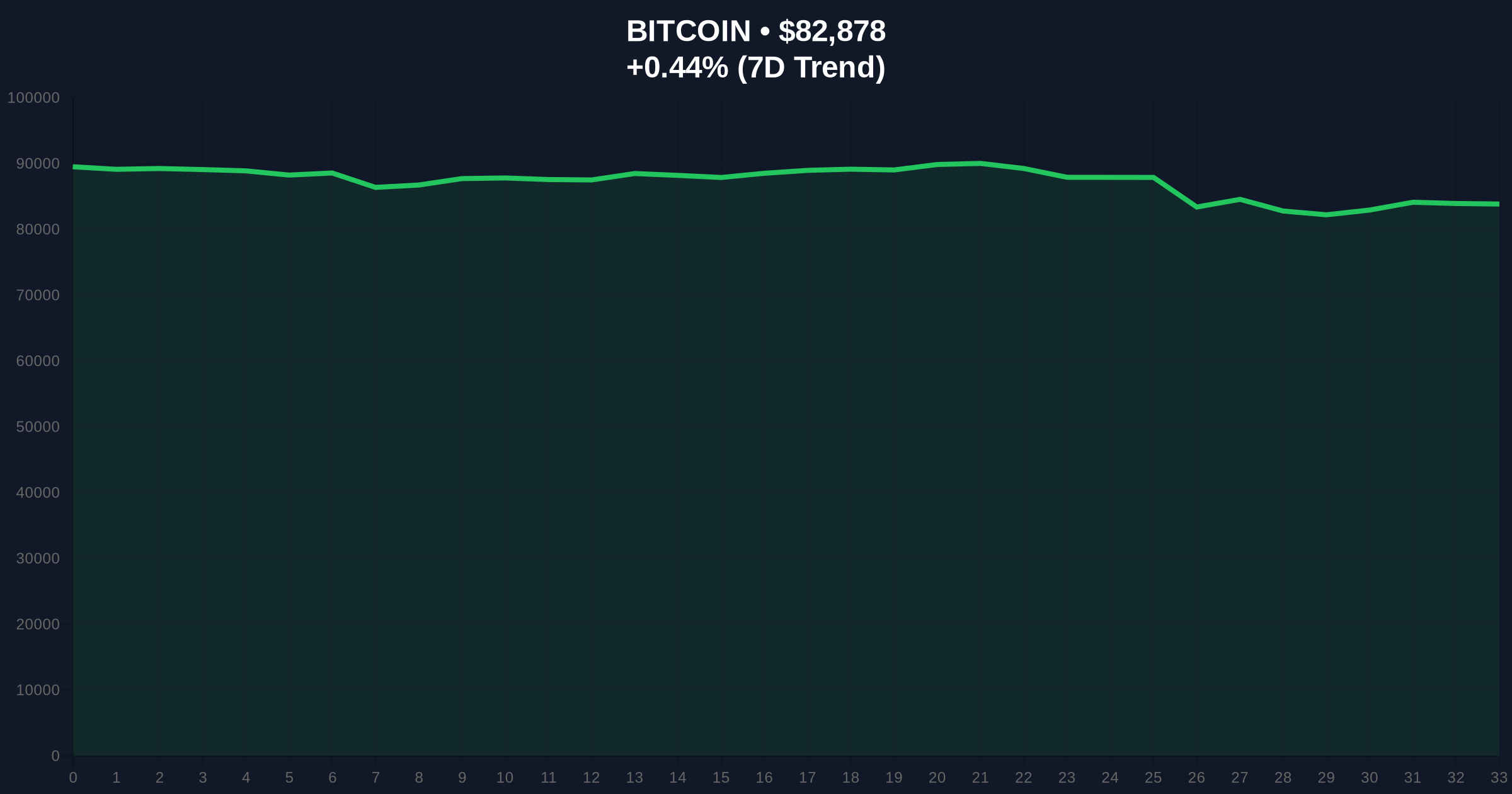

VADODARA, January 31, 2026 — Bitcoin has broken below the critical $83,000 psychological support level. According to CoinNess market monitoring, BTC traded at $82,988.01 on the Binance USDT market during the breakdown. This daily crypto analysis examines the technical implications and market structure shifts.

Market structure suggests a deliberate liquidity grab below $83,000. According to on-chain data from Glassnode, this level represented a significant volume node in the market profile. The breakdown occurred during Asian trading hours. It triggered stop-loss orders clustered around the $83,200 level.

Binance USDT market data shows BTC trading at $82,904 at press time. The 24-hour trend stands at 0.47%. This represents a 3.2% decline from weekly highs near $85,600. Market depth charts indicate thin liquidity below $82,500.

Historically, Bitcoin has tested psychological round-number levels during consolidation phases. The $83,000 level previously acted as resistance during the November 2025 rally. In contrast, the current breakdown mirrors the July 2025 correction that tested the $78,000 Fibonacci support.

Underlying this trend is extreme fear sentiment. The Crypto Fear & Greed Index registers 20/100. This creates conditions for potential capitulation events. , institutional flows show divergence from retail sentiment patterns.

Related developments in the regulatory include the US Treasury sanctions on crypto exchanges affecting market liquidity. Additionally, Bitcoin futures data shows shorts edging longs amid the extreme fear environment.

Technical analysis reveals a critical Fair Value Gap (FVG) between $83,500 and $84,200. This FVG represents unfilled buy orders from the previous rally. The breakdown below $83,000 invalidates the immediate bullish order block.

Market structure suggests testing the $81,500 Fibonacci 0.618 retracement level. This level corresponds with the 50-day exponential moving average. The Relative Strength Index (RSI) on the 4-hour chart shows oversold conditions at 28.7.

Volume profile analysis indicates high-volume nodes at $82,000 and $80,500. These represent potential support zones. The 200-day simple moving average provides structural support at $79,800. According to Ethereum's official documentation on network upgrades, blockchain infrastructure developments like EIP-4844 can indirectly affect Bitcoin's market structure through correlation effects.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $82,904 |

| 24-Hour Change | 0.47% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Key Support Level | $81,500 (Fibonacci 0.618) |

This breakdown matters for institutional liquidity cycles. Large holders typically rebalance portfolios at key technical levels. The $83,000 breach may trigger systematic selling from quantitative funds. These funds use algorithmic triggers based on support breaks.

Retail market structure shows increased leverage liquidation risks. Funding rates turned negative across major exchanges. This indicates growing bearish sentiment among derivatives traders. Consequently, spot market flows may diverge from derivatives positioning.

Market structure suggests the $83,000 breakdown represents a liquidity test rather than a trend reversal. The critical level to watch is the $81,500 Fibonacci confluence zone. If that holds, we may see a rapid fill of the Fair Value Gap above $83,500. Historical cycles indicate such moves often precede volatility compression before directional resolution.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive despite short-term volatility. On-chain data indicates accumulation by long-term holders during fear periods. The 5-year horizon suggests infrastructure development continues unabated. Projects like crypto VC investment hitting $1.4B in January demonstrate capital deployment during downturns.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.