Loading News...

Loading News...

VADODARA, February 10, 2026 — An address linked to the Astra Nova (RVV) development team transferred 5.354 billion RVV, valued at $6.6 million, over four days following Binance's delisting announcement for the RVV/USDT perpetual futures contract. According to on-chain analytics firm EmberCN, this movement represents 53.54% of the total RVV supply, triggering a 59% price collapse and raising alarms about coordinated exit liquidity. This latest crypto news event the systemic risks in altcoin markets during periods of extreme fear.

EmberCN's forensic analysis reveals the transaction details with surgical precision. The team-linked address moved the tokens between February 6 and 10, 2026. Of the total, 354 million RVV (worth $607,000) was deposited directly into centralized exchanges including Bitget, KuCoin, and MEXC. The remaining 5 billion RVV (valued at $5.97 million) went to secondary addresses. These recipient addresses exhibit historical patterns of eventual exchange deposits, suggesting further sell-side pressure is imminent. Market structure suggests this is a classic liquidity grab, where insiders capitalize on remaining order flow before total illiquidity sets in.

Historically, major exchange delistings correlate with terminal price declines for low-capacity assets. Similar to the 2021 correction for dozens of altcoins, the removal of perpetual futures contracts often precedes a full spot delisting, erasing key liquidity pools. Underlying this trend is a fundamental shift in market maker behavior, as detailed in the ERC-20 token standard documentation, which governs transfer mechanics like those used in this event. Consequently, the RVV crash mirrors past cycles where team sell-offs accelerated death spirals. In contrast, assets with robust decentralized exchange liquidity sometimes survive, but RVV's centralized dependence made it vulnerable.

Related Developments: This event occurs amid broader market stress. For instance, the Bitcoin Fear & Greed Index recently hit a record low, while false buy rumors have been debunked, exacerbating uncertainty.

The price action forms a clear Fair Value Gap (FVG) between the delisting announcement and the current level. RVV traded around $0.00119 before the news, which now acts as a major resistance zone. The 59% drop invalidated all nearby support, creating a vacuum with no significant order blocks until much lower levels. On-chain data indicates distribution is ongoing, with exchange inflow spikes confirming sell-side dominance. , the volume profile shows capitulation volume, typical of final liquidation phases. A Fibonacci retracement from the 2025 high places critical support at the 0.786 level near $0.00042, a common target in full breakdowns.

| Metric | Value | Implication |

|---|---|---|

| RVV Transferred | 5.354 Billion | 53.54% of total supply |

| Value Moved | $6.6 Million | Major liquidity event |

| Price Drop | 59% | Severe devaluation |

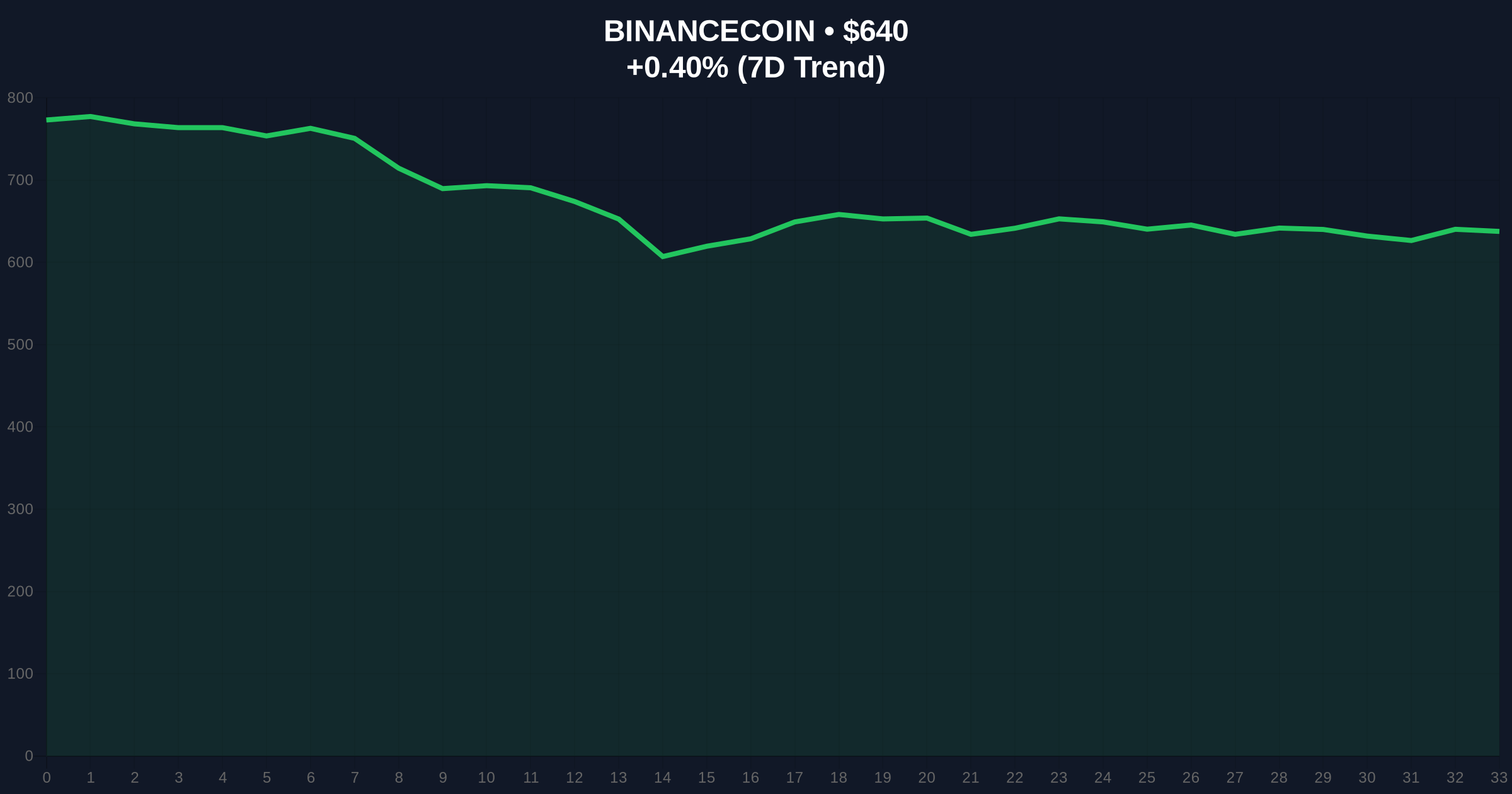

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Market-wide capitulation |

| BNB Current Price | $639.7 | Binance ecosystem stability check |

This event matters because it highlights the fragility of tokenomics reliant on centralized exchange support. Institutional liquidity cycles typically avoid assets with high team concentration risks, as seen here. Retail market structure often fails to price in delisting probabilities until it is too late. The transfer of over half the supply signals a loss of fundamental backing, making recovery nearly impossible without a major pivot. Real-world evidence from past delistings shows such moves precede permanent value erosion, affecting portfolio diversification strategies.

Market analysts note that team sell-offs post-delisting are a red flag for total project abandonment. The CoinMarketBuzz Intelligence Desk synthesizes: "When insiders move >50% of supply amid a liquidity crisis, it confirms a failed economic model. Historical cycles suggest this pattern leads to near-zero valuations within months, as seen with similar altcoins in 2022."

Market structure suggests two primary scenarios based on current data. First, a dead cat bounce may occur if residual buy orders absorb the initial sell pressure, but any rally likely faces rejection at the $0.00119 invalidation level. Second, continued distribution pushes price toward the Fibonacci target at $0.00042, completing the breakdown. The 12-month institutional outlook remains bearish, as such events deter future investment in similar assets, aligning with a 5-year horizon of increasing regulatory scrutiny on low-liquidity tokens.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.