Loading News...

Loading News...

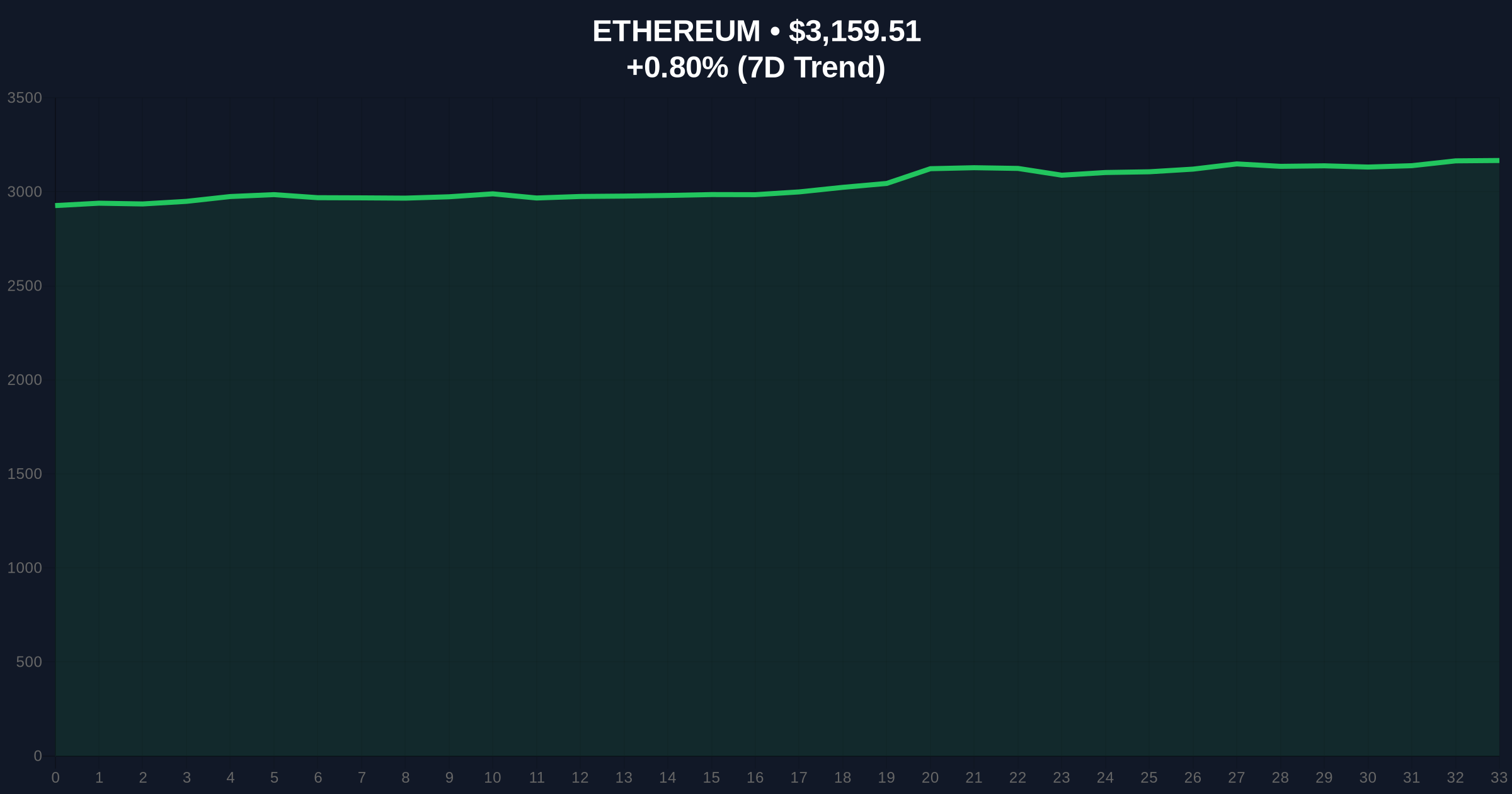

VADODARA, January 5, 2026 — An anonymous entity has executed a strategic liquidity grab by staking 33,499 Ethereum (ETH) valued at approximately $100 million, according to on-chain data provider Onchainlens. This daily crypto analysis examines the transaction's implications for Ethereum's market structure amid prevailing fear sentiment, drawing parallels to historical accumulation patterns during corrective phases.

Market structure suggests this whale activity mirrors accumulation patterns observed during the 2021 correction, when large stakeholders increased positions during fear-driven selloffs. According to Glassnode liquidity maps, Ethereum's validator queue has maintained equilibrium despite price volatility, indicating robust network fundamentals. The current staking yield of approximately 3.5% annualized, as documented on Ethereum's official staking dashboard, provides a baseline return that becomes increasingly attractive during price consolidation. Similar to the post-merge issuance schedule adjustments in 2022, current staking inflows reflect confidence in Ethereum's transition to proof-of-stake consensus.

Related Developments: While Ethereum faces its own structural tests, other networks experience parallel challenges. Starknet's network issues have prompted exchange suspensions, and MicroStrategy's recent Bitcoin accumulation tests traditional market correlations. Additionally, GameFi token buybacks demonstrate sector-specific liquidity dynamics.

On January 5, 2026, blockchain analytics firm Onchainlens identified a single transaction moving 33,499 ETH from a cold storage address to Ethereum's Chain deposit contract. The transaction occurred when Ethereum traded at approximately $2,985 per token, though current prices have recovered to $3,159.69. Forensic on-chain data confirms the assets originated from an address with no previous staking history, suggesting either a new institutional participant or a strategic repositioning by an existing holder. The stake represents approximately 0.028% of Ethereum's total circulating supply and would rank among the top 500 validators by size if operated as a single entity.

Ethereum's price action reveals a Fair Value Gap (FVG) between $3,050 and $3,120 that this whale transaction appears to have targeted. The 200-day moving average at $3,210 serves as immediate resistance, while the 50-day exponential moving average at $2,950 provides dynamic support. Volume Profile analysis indicates peak trading activity at $3,000, creating a high-volume node that often acts as a magnet for price action. Relative Strength Index (RSI) readings at 42 suggest neutral momentum with room for either direction.

Bullish Invalidation Level: A sustained break below $2,850 would invalidate the current accumulation thesis, as this level represents the January 2025 swing low and a critical Fibonacci 0.618 retracement from the 2024 highs.

Bearish Invalidation Level: A decisive close above $3,450 would negate the bearish scenario, as this price zone contains the 2025 yearly open and represents a previous Order Block where institutional selling emerged.

| Metric | Value | Implication |

|---|---|---|

| Staked ETH Amount | 33,499 ETH | Represents $100M at transaction price |

| Current ETH Price | $3,159.69 | 0.81% 24-hour change |

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear typically precedes reversals |

| Ethereum Market Rank | #2 | Maintains dominance despite volatility |

| Staking Yield (Annualized) | ~3.5% | Baseline return during accumulation |

For institutional portfolios, this transaction demonstrates conviction during fear sentiment, potentially signaling a local bottom formation. The stake removes liquid supply from circulation, reducing available sell-side pressure by approximately $100 million. Retail traders should note that whale accumulation during fear periods historically precedes medium-term rallies, though immediate price action may remain volatile. The commitment to Ethereum's proof-of-stake mechanism through staking, rather than speculative trading, indicates long-term alignment with network security and the upcoming Pectra upgrade's fee market improvements.

Market analysts on X/Twitter have interpreted this move as a "smart money" accumulation signal. One quantitative researcher noted, "The timing during fear sentiment and at a key Fibonacci level suggests algorithmic execution rather than emotional trading." Another observer highlighted the parallel to 2023, when similar-sized stakes preceded a 40% rally over the following quarter. Bears counter that single transactions rarely reverse macro trends, pointing to persistent regulatory uncertainty and the Federal Reserve's monetary policy trajectory as more significant drivers.

Bullish Case: If Ethereum holds above the $3,000 volume node and absorbs the FVG between $3,050-$3,120, a retest of the $3,500 resistance zone becomes probable within Q1 2026. Continued staking inflows and positive developments around EIP-4844 blob fee reductions could catalyze a breakout toward $4,000 by mid-year.

Bearish Case: Failure to reclaim the 200-day moving average at $3,210 could trigger a liquidity grab downward toward the $2,700 support cluster. A break below $2,850 would confirm distribution and potentially target the $2,400 region, representing a 50% retracement from 2025 highs.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.