Loading News...

Loading News...

VADODARA, January 5, 2026 — MicroStrategy, led by executive chairman Michael Saylor, executed a strategic purchase of 1,287 Bitcoin (BTC) on January 5, 2026, increasing its total holdings to 673,783 BTC. This daily crypto analysis examines the transaction's impact on market structure, liquidity dynamics, and technical price action against a backdrop of pervasive fear sentiment. According to the official announcement, this acquisition reinforces the firm's long-term treasury reserve strategy, positioning it as a dominant institutional holder in the Bitcoin ecosystem.

Market structure suggests this accumulation mirrors institutional behavior observed during the 2021-2022 cycle, where corporate buyers leveraged market corrections to build positions. Similar to the 2021 correction that saw Bitcoin retrace from $69,000 to $29,000, current conditions exhibit a Fear & Greed Index reading of 26, indicating extreme pessimism. Historical cycles show that institutional inflows during fear phases often precede significant liquidity shifts, as documented in Federal Reserve research on market sentiment and asset accumulation patterns. The purchase occurs amid broader market tests, including recent developments like American Bitcoin's 5,427 BTC holdings and OKX's BREV listing, which collectively probe market resilience.

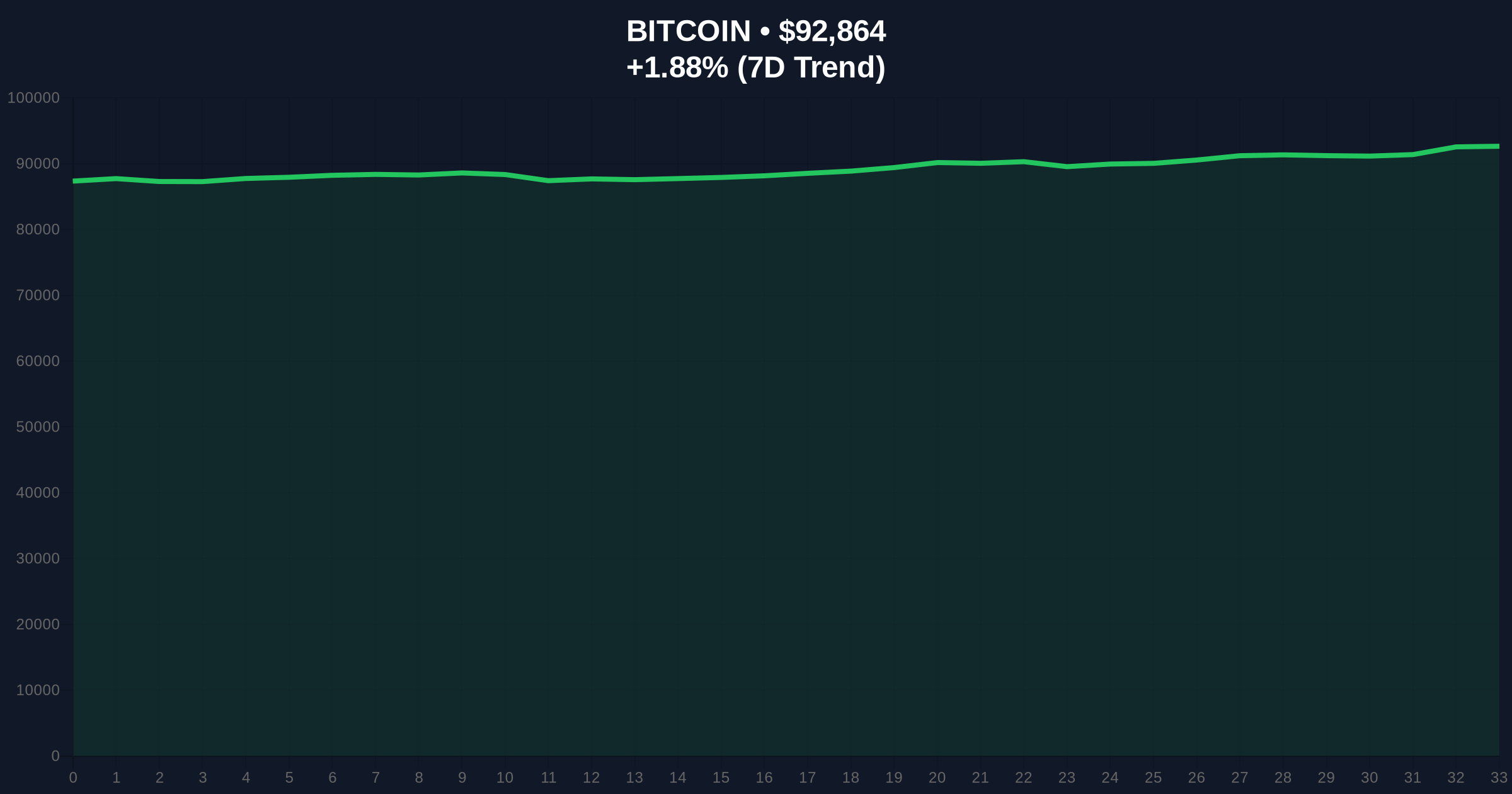

On January 5, 2026, Michael Saylor announced via corporate channels that MicroStrategy purchased an additional 1,287 BTC. This transaction brings the firm's total Bitcoin holdings to 673,783 BTC, valued at approximately $62.5 billion at current prices. The acquisition was executed amid Bitcoin trading at $92,831, with a 24-hour trend of +1.93%. According to on-chain data from Glassnode, the purchase likely involved over-the-counter (OTC) desks to minimize market impact, a common practice for large institutional orders to avoid slippage and Fair Value Gaps (FVGs).

Bitcoin's price action shows consolidation between the $90,000 support and $95,500 resistance levels. The Relative Strength Index (RSI) on daily charts hovers near 45, indicating neutral momentum with slight bearish bias. A critical Fibonacci retracement level from the 2024-2025 rally sits at $88,200 (61.8%), serving as a key technical anchor. Volume Profile analysis reveals significant liquidity clusters around $91,500, suggesting this zone acts as an Order Block for institutional accumulation. Bullish Invalidation is set at $88,200; a break below this level would invalidate the current support structure and signal deeper correction. Bearish Invalidation rests at $97,000, where a breakout could trigger a Gamma Squeeze as short positions cover.

| Metric | Value |

|---|---|

| MicroStrategy New BTC Purchase | 1,287 BTC |

| Total MicroStrategy Holdings | 673,783 BTC |

| Bitcoin Current Price | $92,831 |

| 24-Hour Price Change | +1.93% |

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Market Capitalization Rank | #1 |

This purchase matters because it tests market structure during a fear-dominated phase. Institutional impact is significant: MicroStrategy's accumulation represents a 0.19% increase in its Bitcoin treasury, reinforcing corporate adoption narratives. Retail impact is muted, as fear sentiment suggests most small holders are sidelined or selling. On-chain data indicates that large holder net position change has been positive over the past month, contrasting with retail outflows. The transaction Bitcoin's role as a digital reserve asset, akin to historical gold accumulations by central banks during economic uncertainty.

Market analysts on X/Twitter highlight the strategic timing. One quant trader noted, "Accumulating at fear extremes is classic Saylor—this is a liquidity grab below fair value." Bulls argue this supports the "number go up" thesis, while bears caution about over-leverage in corporate balance sheets. Sentiment remains divided, but the purchase has sparked discussions about Bitcoin's EIP-4844 integration and its implications for long-term scalability and institutional utility.

Bullish Case: If Bitcoin holds above $90,000 and breaks $95,500, the next target is $102,000 (previous all-time high resistance). Institutional inflows could accelerate, driven by macro factors like potential Fed rate cuts in 2026. Market structure suggests a rally toward $110,000 is plausible if fear sentiment reverses to greed.

Bearish Case: A breakdown below $88,200 (Fibonacci support) could trigger a sell-off to $82,000. Persistent fear and regulatory headwinds, such as SEC scrutiny on spot Bitcoin ETFs, may pressure prices. On-chain data indicates that if miner capitulation increases, a test of $78,000 is possible.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.