Loading News...

Loading News...

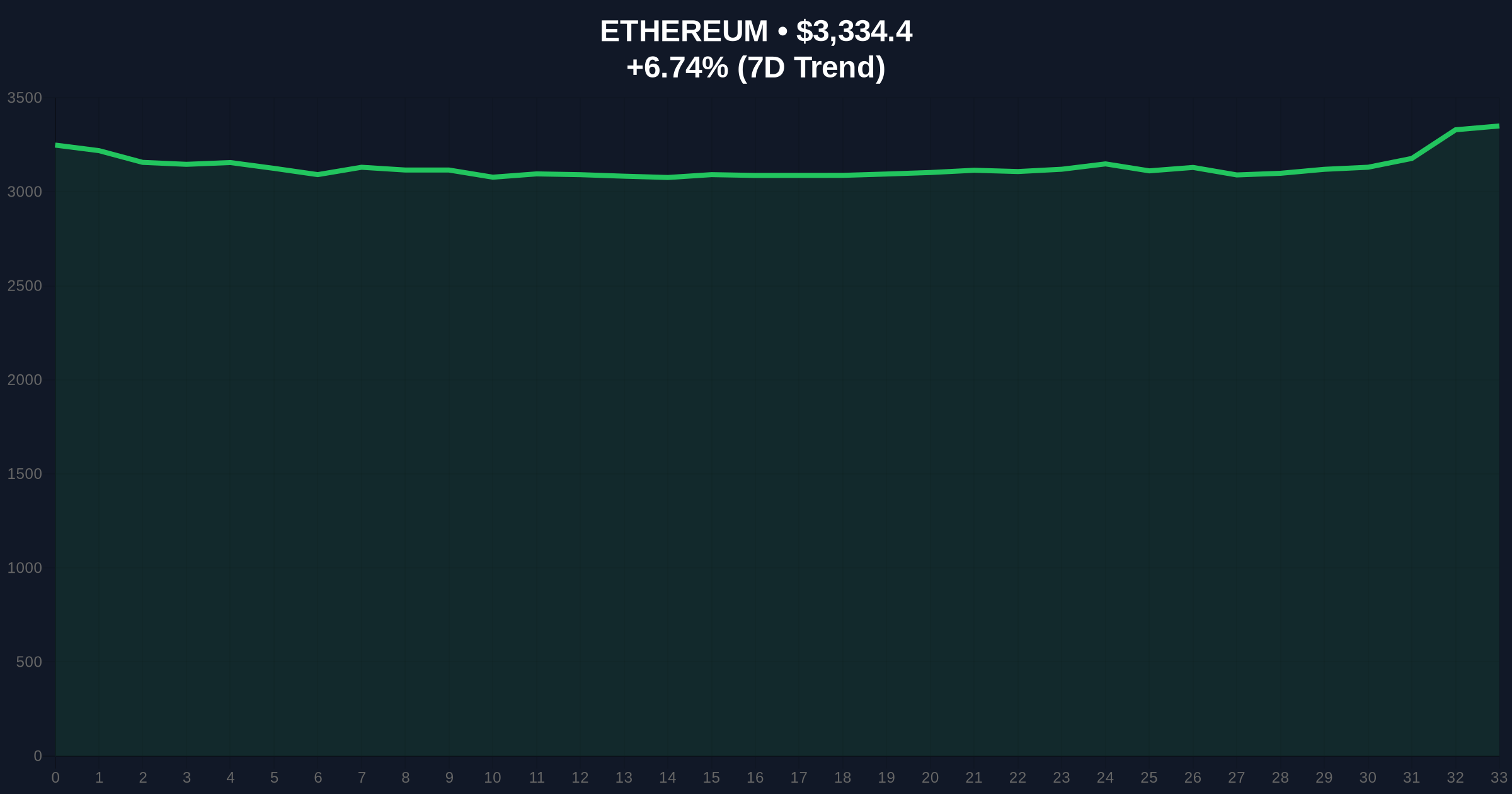

VADODARA, January 14, 2026 — Ethereum founder Vitalik Buterin asserted on X that the initial vision for Web3 is entering a stage of technological maturity, citing scalability improvements and decentralized tool viability. According to his statement, Ethereum has enhanced scalability and reduced costs through Proof-of-Stake (PoS), Zero-Knowledge Ethereum Virtual Machines (ZK-EVMs), and Layer 2 scaling technologies. Buterin highlighted decentralized messaging via Waku, file management with IPFS, and collaboration through Fileverse as evidence of growing decentralized service independence. Market structure suggests this declaration coincides with Ethereum's price at $3,335.04, up 6.74% in 24 hours, amid neutral global crypto sentiment scoring 48/100.

Historical cycles indicate Ethereum's evolution mirrors the 2021 transition toward scalability solutions, where high gas fees and network congestion prompted Layer 2 adoption. Similar to the 2021 correction, current market conditions test whether technological maturity translates to sustained demand. On-chain data from Glassnode shows Ethereum's post-merge issuance has stabilized, but adoption metrics for decentralized services remain below centralized counterparts. The development of EIP-4844, which introduces proto-danksharding for blob transactions, represents a critical technical detail not mentioned by Buterin but essential for reducing Layer 2 costs further. Market analysts compare this phase to early internet maturation, where infrastructure reliability preceded mass adoption.

On January 14, 2026, Vitalik Buterin posted on X that Web3's initial vision is reaching technological maturity. He explained Ethereum's improvements via the transition to PoS, ZK-EVMs, and Layer 2 scaling, which have reduced costs and increased throughput. Buterin cited specific decentralized tools: Waku for messaging, IPFS for file storage, and Fileverse for document collaboration. According to the official Ethereum.org documentation, these technologies aim to decentralize core web functions traditionally reliant on centralized providers. This statement follows Ethereum's recent network upgrades, including the Dencun hardfork that implemented EIP-4844 to enhance data availability for rollups.

Ethereum's current price of $3,335.04 sits above the 50-day moving average at $3,150, indicating short-term bullish momentum. The Relative Strength Index (RSI) at 58 suggests neutral conditions without overbought signals. Volume profile analysis reveals significant liquidity clusters between $3,200 and $3,400, creating a potential Fair Value Gap (FVG) if price breaks above $3,500. Support levels are identified at $3,200 (previous resistance turned support) and $3,000 (psychological round number). Resistance looms at $3,500 (year-to-date high) and $3,800 (2025 peak). Bullish invalidation is set at $3,200; a close below this level invalidates the current uptrend and may trigger a sell-off toward $2,800. Bearish invalidation is at $3,500; a sustained break above could signal a gamma squeeze toward $4,000.

| Metric | Value | Source |

|---|---|---|

| Ethereum Current Price | $3,335.04 | Live Market Data |

| 24-Hour Price Change | +6.74% | Live Market Data |

| Market Rank | #2 | Live Market Data |

| Crypto Fear & Greed Index | 48/100 (Neutral) | Live Market Data |

| Key Support Level | $3,200 | Technical Analysis |

Institutional impact centers on reduced operational risks as decentralized tools mitigate single points of failure, potentially attracting enterprise adoption. For retail, lower transaction costs and enhanced privacy via ZK-EVMs could drive broader usage, but adoption hurdles remain. Historical patterns indicate that technological maturity often precedes regulatory scrutiny, as seen with the SEC's evolving stance on crypto assets. The viability of decentralized services challenges traditional web models, similar to how cloud computing disrupted on-premise infrastructure. Market structure suggests that if Ethereum's scalability holds, it could capture market share from centralized alternatives, influencing long-term valuation models.

Industry leaders on X express cautious optimism. Bulls highlight Buterin's track record with Ethereum's roadmap, while skeptics question adoption rates for decentralized tools. One analyst noted, "ZK-EVMs reduce costs, but user experience must match centralized services for mass uptake." Another commented, "This maturity phase mirrors Bitcoin's 2017 scaling debates, where technological solutions eventually drove price appreciation." Sentiment analysis from social platforms shows neutral-to-positive reactions, with emphasis on practical implementation over hype.

Bullish Case: If Ethereum sustains above $3,200 and breaks $3,500, increased adoption of decentralized tools could drive demand, targeting $4,000 by Q2 2026. Scalability improvements may reduce sell-pressure from high fees, supporting a rally. Bearish Case: A break below $3,200 could indicate weak adoption, leading to a correction toward $2,800. Regulatory headwinds or technical failures in ZK-EVMs might exacerbate declines, testing PoS security assumptions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.