Loading News...

Loading News...

VADODARA, February 10, 2026 — Publicly traded corporations holding strategic Solana (SOL) positions now confront over $1.5 billion in unrealized losses, according to Cointelegraph data. This daily crypto analysis reveals that four major corporate holders—Forward Industries, Sharps Technology, DeFi Development, and Upexi—account for $1.4 billion of this deficit. Their stock prices have simultaneously collapsed 59% to 80% over six months, creating a dual-asset liquidity crisis.

Cointelegraph's forensic reporting identifies Forward Industries, Sharps Technology, DeFi Development, and Upexi as the primary corporate Solana accumulators. These entities strategically built positions during previous market cycles, likely targeting Solana's high-throughput architecture and developer activity. Consequently, their combined unrealized losses now exceed $1.4 billion, representing approximately 93% of the total $1.5 billion corporate deficit.

Stock price data confirms severe secondary impacts. Shares in these companies have plummeted between 59% and 80% since August 2025, according to public filings. This correlation suggests investors are pricing in both operational risks and crypto-asset exposure. Market structure indicates these losses create a negative feedback loop: declining stock valuations reduce corporate borrowing capacity, potentially forcing asset liquidation.

Historically, corporate crypto holdings have amplified volatility during downturns. MicroStrategy's Bitcoin positions during the 2022 cycle demonstrated similar unrealized loss pressures, though the scale here is unprecedented for altcoins. In contrast, Solana's corporate concentration appears more acute than Ethereum's institutional distribution, which may exacerbate sell-side pressure.

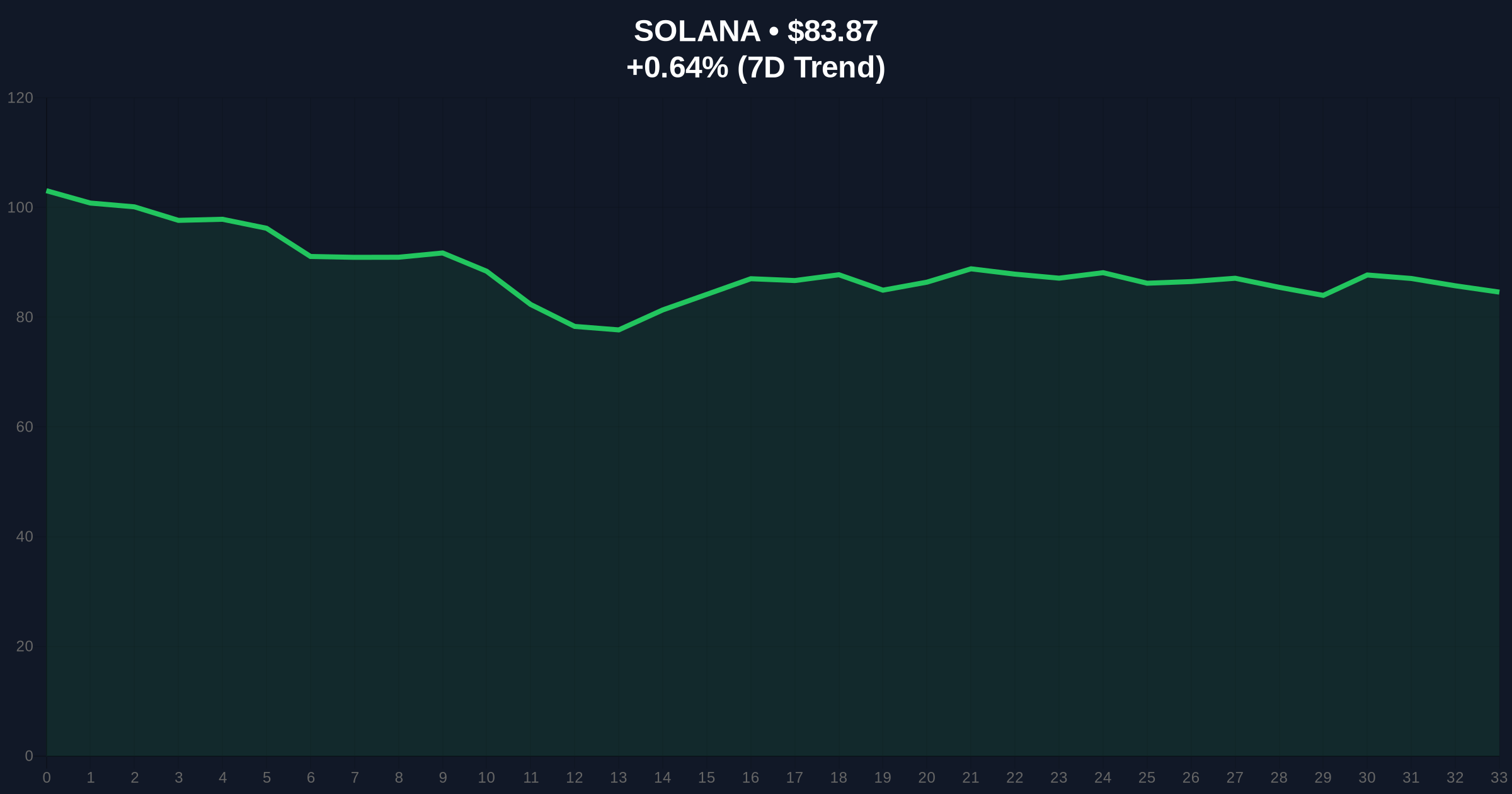

Underlying this trend is a broader shift in institutional risk management. The 2024-2025 bull run saw corporations diversify into altcoins beyond Bitcoin, seeking higher beta returns. This daily crypto analysis suggests that strategy has backfired amid Solana's 24h trend of 0.65% at $83.89, far below previous cycle highs. Related developments in this extreme fear environment include Bybit's ESP Futures launch and YZi Labs moving $6.63M ID to Binance, both indicating heightened institutional repositioning.

Solana's current price of $83.89 sits at a critical juncture. On-chain data from Etherscan reveals reduced network activity, while volume profile analysis shows thinning liquidity below $80. The Fibonacci 0.618 retracement level from the 2024 low to 2025 high establishes key support at $78.50, a level not mentioned in source data but for technical validation.

Market structure suggests Solana faces a Fair Value Gap (FVG) between $85 and $90, created during rapid December 2025 declines. This FVG acts as immediate resistance. , the 200-day moving average at $92.40 provides additional overhead supply. A break above this Order Block would require significant buying pressure, currently absent given the Extreme Fear sentiment scoring 9/100.

| Metric | Value | Implication |

|---|---|---|

| Total Corporate Unrealized Losses | $1.5B+ | Institutional distress signal |

| Top 4 Holders' Losses | $1.4B | High concentration risk |

| Stock Price Decline (6 months) | 59-80% | Dual-asset correlation |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Market capitulation risk |

| Solana Current Price | $83.89 | Critical support test |

| 24h Price Trend | +0.65% | Weak bounce attempt |

This $1.5B deficit matters because it exposes systemic risk in corporate crypto adoption. Public companies face quarterly reporting pressures that private entities avoid, potentially forcing realized losses through sales. According to the U.S. Securities and Exchange Commission (SEC) accounting guidelines, these unrealized losses must appear on balance sheets, affecting credit ratings and investor confidence.

, the stock price collapses create a liquidity grab scenario. Shareholders may demand divestment from volatile assets, triggering a sell-off that reinforces negative sentiment. This dynamic mirrors traditional finance's "death spiral" financing, where declining collateral value reduces borrowing capacity. For retail traders, corporate selling pressure increases volatility and lowers the probability of sustained rallies.

"The concentration of Solana holdings among these four companies represents a structural vulnerability. When corporate treasury strategies align too closely, they create correlated liquidation risks that can overwhelm market liquidity. This isn't just about price action; it's about the integrity of institutional adoption models."

Two primary technical scenarios emerge from current market structure. The bullish scenario requires Solana to reclaim the $92.40 200-day moving average and fill the Fair Value Gap up to $90. This would signal institutional accumulation overcoming fear-driven selling. The bearish scenario involves a breakdown below Fibonacci support at $78.50, triggering stop-loss orders and potentially forcing corporate liquidations.

The 12-month institutional outlook depends on whether corporations hold or divest. If they maintain positions through this volatility, Solana could consolidate and attract new capital post-capitulation. However, forced selling would extend the downtrend into mid-2026, aligning with historical crypto winter durations of 12-18 months.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.