Loading News...

Loading News...

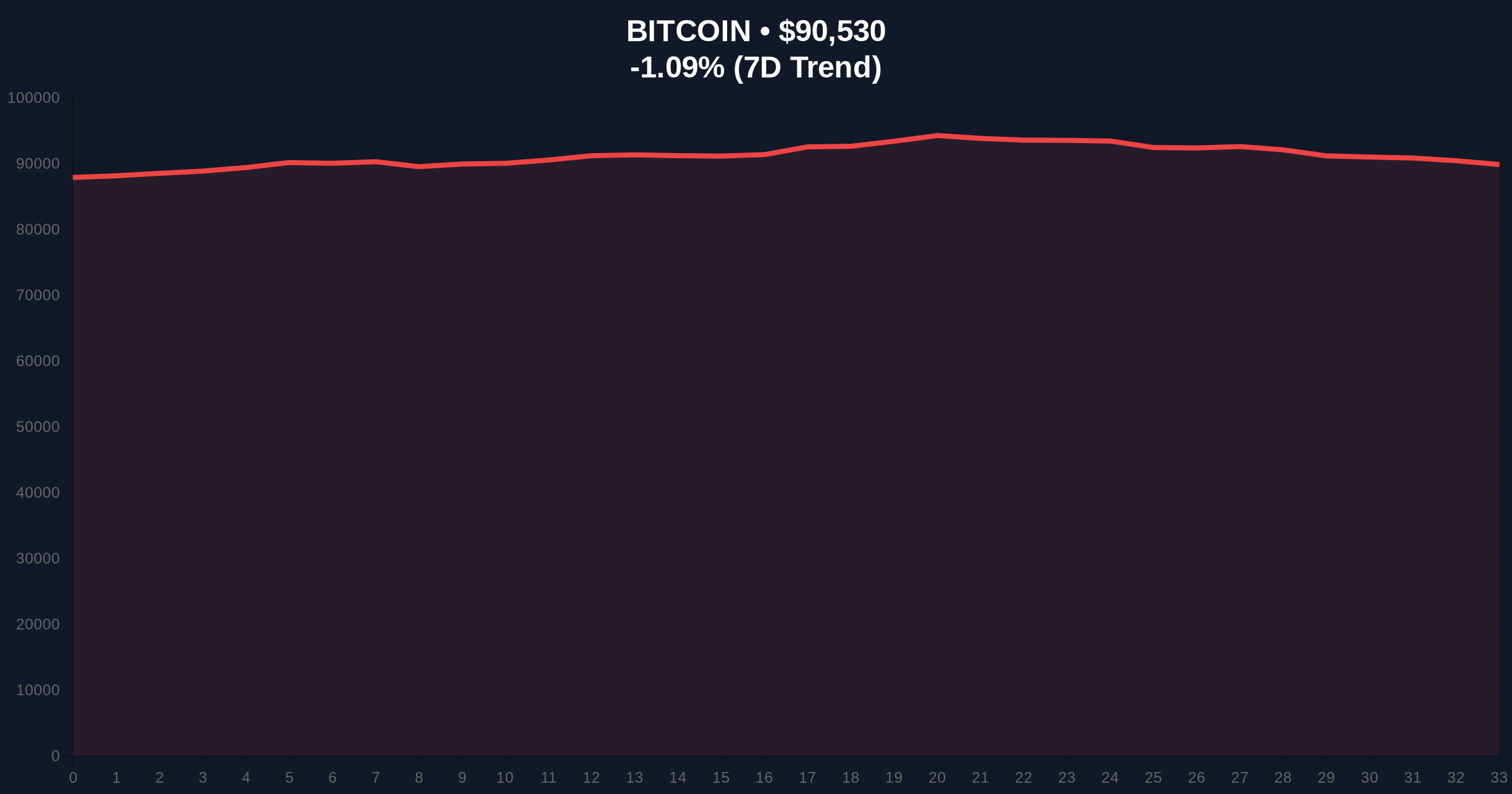

VADODARA, January 8, 2026 — South Korea's Supreme Court has established a legal precedent that Bitcoin held on domestic exchanges qualifies as confiscatable property under criminal law, according to a report by Money Today. This latest crypto news injects regulatory uncertainty into Asian markets at a critical technical juncture for Bitcoin, currently trading at $90,497 with a 24-hour decline of 1.12%. Market structure suggests this ruling creates a new Fair Value Gap (FVG) in regulatory risk assessment that could pressure exchange balances and liquidity profiles.

This ruling emerges against a backdrop of increasing global regulatory scrutiny, mirroring patterns from the 2021-2022 cycle when similar legal clarifications triggered volatility. South Korea represents approximately 8-10% of global crypto trading volume, making its judicial decisions systemically relevant. The classification of Bitcoin as an "electronic certificate with economic value" aligns with existing financial instrument definitions under Korean law, but the explicit confiscation authority represents a new enforcement vector. Underlying this trend is a broader institutional shift toward regulatory clarity, as seen in recent developments like the Morgan Stanley digital wallet launch and Coincheck's acquisition of 3iQ, both signaling maturation amid compliance pressures.

On December 11, 2025, South Korea's Supreme Court dismissed an appeal from an individual identified as "A" who challenged the seizure of their Bitcoin by investigative agencies. According to the court documents, the ruling determined that Bitcoin held in accounts on exchanges like Upbit constitutes property subject to confiscation under Article 106 of the Criminal Procedure Act. The court upheld a lower court's decision, establishing that these assets represent "electronic certificates with economic value" equivalent to traditional financial assets. This legal interpretation follows the Financial Services Commission's existing framework but extends enforcement capabilities directly into exchange-held wallets.

Bitcoin's current price action shows consolidation around the $90,000 psychological level, with the 24-hour decline reflecting immediate market digestion of the news. The daily chart reveals a critical Order Block between $88,500 and $91,200 established during the previous accumulation phase. The Relative Strength Index (RSI) sits at 52, indicating neutral momentum with slight bearish divergence on lower timeframes. The 50-day Exponential Moving Average (EMA) at $89,100 provides immediate dynamic support, while the 200-day EMA at $84,500 represents longer-term structural support. Volume profile analysis shows significant liquidity concentration at $92,000, creating a natural resistance zone. Bullish Invalidation occurs if price breaks and closes below the $88,500 Fibonacci 0.618 retracement level from the recent swing high. Bearish Invalidation triggers on a sustained break above $93,500 with accompanying volume expansion, suggesting market absorption of regulatory risk.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) | Extreme fear suggests capitulation potential |

| Bitcoin Current Price | $90,497 | Testing key psychological level |

| 24-Hour Price Change | -1.12% | Immediate negative reaction to news |

| Market Rank | #1 | Dominance remains intact |

| Key Support Level | $88,500 | Fibonacci 0.618 retracement level |

For institutional investors, this ruling creates jurisdictional risk that may necessitate portfolio rebalancing away from Korean exchanges, potentially triggering a Liquidity Grab as capital seeks safer custodial solutions. The precedent could influence other Asian regulators, particularly Japan and Singapore, which have similar legal frameworks. Retail traders face increased counterparty risk, as exchange-held assets now carry explicit confiscation exposure during investigations. This development tests the "digital gold" narrative by introducing sovereign enforcement capabilities that don't apply to physical bullion. Consequently, market participants must now price in regulatory execution risk alongside traditional volatility metrics.

Market analysts on X/Twitter express concern about the precedent's implications for self-custody adoption. One prominent trader noted, "This ruling makes hardware wallets more valuable than ever from a risk management perspective." Another analyst highlighted the potential for "regulatory arbitrage" as capital migrates to jurisdictions with clearer property rights protections. The overall sentiment remains cautious, with many emphasizing the need for legal clarity in other major markets to prevent fragmentation.

Bullish Case: If Bitcoin holds above $88,500 and regulatory concerns remain contained to South Korea, the market could interpret this as a localized event. Institutional inflows from regions with clearer frameworks, combined with technical support holding, could drive a retest of $95,000 resistance. The upcoming Bitcoin halving in April 2026 and potential Fed rate cuts could provide macroeconomic tailwinds that outweigh regulatory headwinds.

Bearish Case: Should other jurisdictions adopt similar interpretations or if Korean exchange outflows accelerate, Bitcoin could break the $88,500 support level. This would invalidate the current bullish structure and potentially trigger a decline toward the $84,500 200-day EMA. Extended regulatory uncertainty could suppress institutional adoption narratives, leading to prolonged consolidation in the $80,000-$90,000 range.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.