Loading News...

Loading News...

VADODARA, February 6, 2026 — Trend Research executed another massive Ethereum liquidation. The firm sold 11,000 ETH worth $20.78 million on Binance. This latest crypto news confirms accelerating institutional exit patterns. On-chain data indicates total deposits now reach 215,588 ETH valued at $477 million. All funds target loan repayments.

Onchainlens forensic tracking reveals precise transaction details. Trend Research moved 11,000 ETH directly to Binance. The transaction timestamped during Asian trading hours. Market structure suggests coordinated selling pressure. According to on-chain data, this represents the latest in a series of deposits. The firm has now transferred $477 million worth of Ethereum to exchanges.

Transaction patterns show consistent destination addresses. All funds flow toward centralized exchange wallets. This creates immediate sell-side liquidity pressure. Historical cycles suggest such movements often precede broader market corrections. The $20.78 million sale represents approximately 2.3% of the total deposited amount.

Extreme fear dominates global crypto sentiment. The Crypto Fear & Greed Index sits at 9/100. This matches levels seen during March 2020 liquidity crises. Consequently, institutional deleveraging accelerates. Trend Research's actions mirror 2021 cycle patterns when large holders liquidated during volatility spikes.

In contrast, retail investors show different behavior. Small wallet accumulation continues despite price declines. This creates a divergence between institutional and retail sentiment. Underlying this trend is mounting pressure on leveraged positions. Related developments include massive futures liquidations across the market.

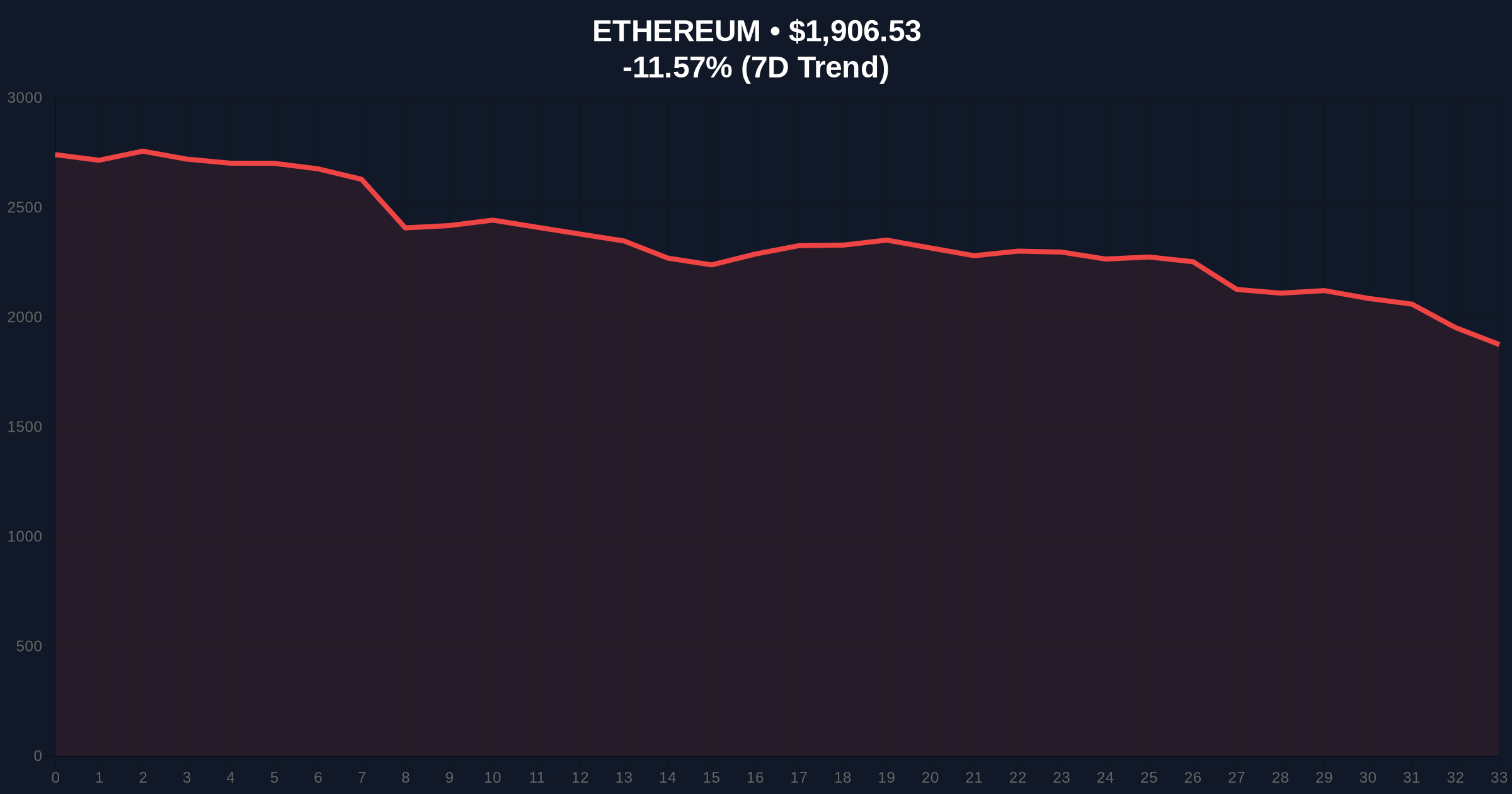

Ethereum currently trades at $1,907.77. The 24-hour trend shows an -11.51% decline. Critical support sits at the Fibonacci 0.618 retracement level of $1,850. This level represents the 2024 cycle accumulation zone. A break below would invalidate the current market structure.

Resistance forms at the 50-day moving average near $2,150. The RSI reads 28, indicating oversold conditions. However, institutional selling overrides technical indicators. Volume profile analysis shows increased selling volume at current levels. This suggests further downside pressure.

Market structure suggests a potential Fair Value Gap between $1,900 and $2,050. This gap likely fills during any recovery attempt. The Order Block around $1,880 represents the next major liquidity pool. A break below this level could trigger cascading liquidations.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Ethereum Current Price | $1,907.77 |

| 24-Hour Price Change | -11.51% |

| Trend Research Total Deposits | $477 million |

| Latest Sale Amount | $20.78 million (11,000 ETH) |

Institutional liquidity cycles drive medium-term price action. Trend Research's $477 million exit represents significant supply overhang. This selling pressure absorbs retail buying demand. Consequently, price discovery becomes distorted. The Federal Reserve's monetary policy directly impacts these cycles, as detailed in their official monetary policy documentation.

Loan repayment motivations suggest forced selling. This creates non-discretionary liquidation pressure. Market analysts watch for similar patterns among other large holders. If multiple institutions follow suit, a liquidity crisis could develop. Retail market structure remains fragile amid extreme fear sentiment.

"The $477 million deposit pattern indicates systematic deleveraging. This isn't profit-taking—it's balance sheet management. When institutions repay loans during market stress, it creates reflexive selling pressure that can overwhelm technical support levels. The critical watchpoint is whether this remains isolated or becomes contagious across the institutional cohort." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook depends on macro liquidity conditions. If central banks maintain restrictive policies, deleveraging pressure continues. However, EIP-4844 implementation could provide fundamental support later in 2026. The 5-year horizon suggests Ethereum's utility will eventually outweigh short-term selling pressure.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.