Loading News...

Loading News...

VADODARA, January 5, 2026 — The Ethereum Layer 2 network Starknet (STRK) resumed operations after a more than four-hour outage, halting block production and exposing vulnerabilities in scaling infrastructure. This daily crypto analysis examines the technical and market implications of the incident, which occurred against a backdrop of global crypto sentiment in "Fear" territory, with Ethereum trading at $3,235.24. According to Decrypt, the outage began at approximately 10:00 a.m. UTC and ended around 2:00 p.m. UTC, prompting Starknet to announce a post-mortem report on its official X account.

Starknet's outage mirrors historical Layer 2 failures, such as Arbitrum's sequencer issues in 2023, highlighting persistent centralization risks in optimistic and zk-rollup architectures. Underlying this trend is Ethereum's reliance on Layer 2s for scalability post-merge, with networks like Starknet processing transactions off-chain to reduce mainnet congestion. Consequently, any disruption creates a Fair Value Gap (FVG) in associated assets, as seen in previous incidents where outages led to liquidations and liquidity grabs. This event coincides with broader market fear, evidenced by the Crypto Fear & Greed Index at 26/100, suggesting heightened sensitivity to technical failures.

Related Developments:

Block production on the Starknet mainnet halted at 10:00 a.m. UTC on January 5, 2026, according to Decrypt's reporting. The network remained offline for roughly four hours, resuming operations around 2:00 p.m. UTC. In a statement on its official X account, Starknet confirmed plans to release a post-mortem detailing the incident's timeline, root cause, and long-term preventative measures. Market structure suggests the outage likely stemmed from sequencer or prover failures, common pain points in zk-rollups that rely on complex cryptographic proofs. On-chain data indicates minimal transaction activity during the downtime, with Ethereum's mainnet absorbing some diverted volume, as per Etherscan metrics.

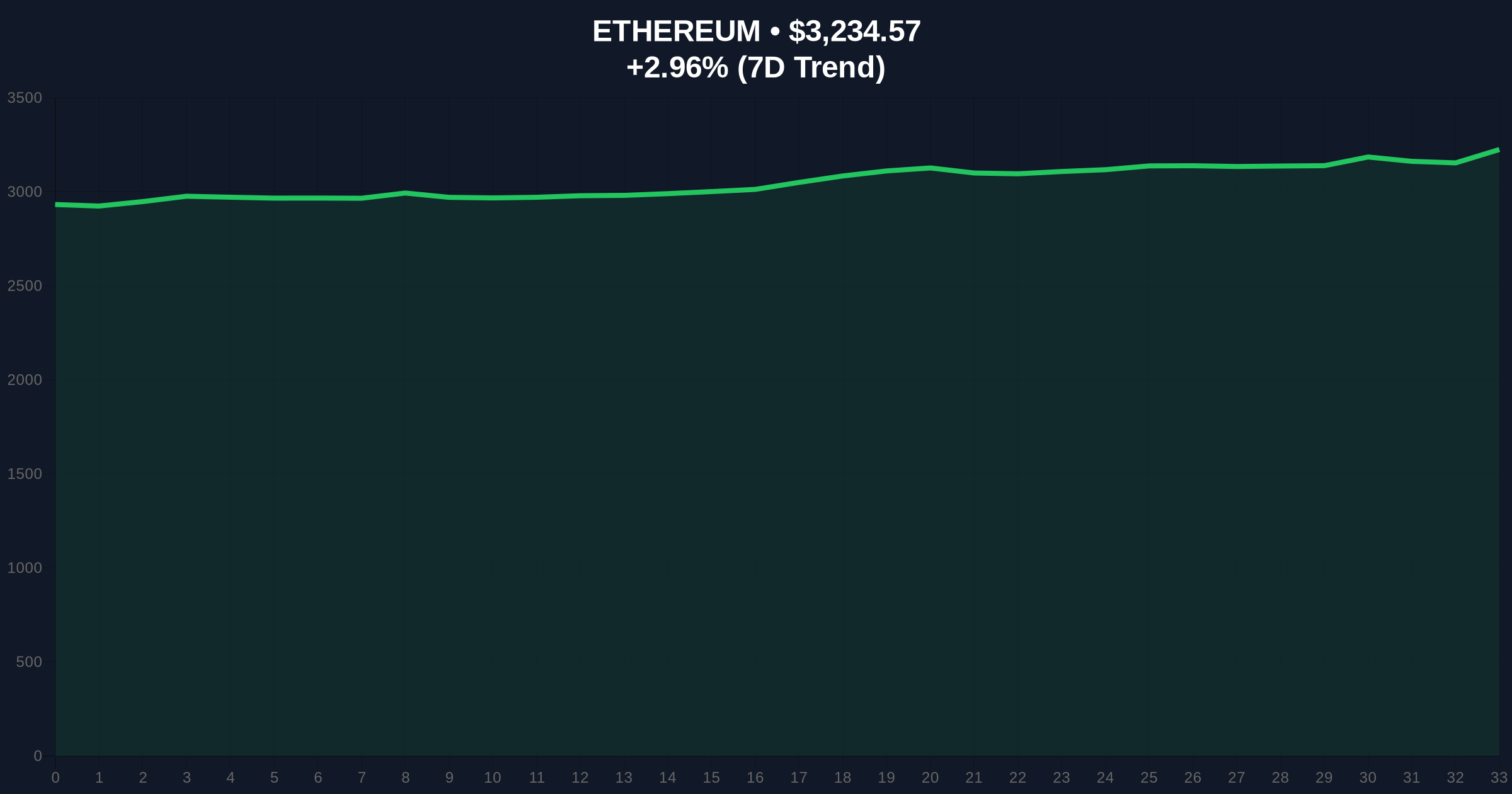

Ethereum's price action shows resilience at $3,235.24, up 2.90% in 24 hours, but technical indicators reveal underlying weakness. The RSI hovers at 45, indicating neutral momentum with bearish divergence from recent highs. A critical Fibonacci support level at $3,150, derived from the 0.618 retracement of the Q4 2025 rally, serves as a Bullish Invalidation level; a break below suggests further downside toward $3,000. Conversely, resistance clusters at $3,350, forming an Order Block that must be reclaimed for bullish continuation. Volume Profile analysis shows low participation during the outage, typical of fear-driven markets where liquidity dries up during uncertainty.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Alternative.me |

| Ethereum (ETH) Price | $3,235.24 | CoinMarketCap |

| 24-Hour Change | +2.90% | CoinMarketCap |

| Market Rank | #2 | CoinMarketCap |

| Outage Duration | ~4 hours | Decrypt |

For institutions, Starknet's outage raises concerns about Layer 2 reliability for high-frequency trading and DeFi applications, potentially slowing adoption of zk-rollups like those detailed in Ethereum's official Layer 2 documentation. Retail users face immediate risks in dApps and liquidity pools, with halted transactions possibly triggering cascading liquidations. This incident the need for robust fail-safes in scaling solutions, as network downtime can erode trust and capital efficiency. Market analysts note that such events often precede volatility spikes, as seen in past Layer 2 failures that correlated with broader market corrections.

On X/Twitter, industry observers expressed caution, with one developer noting, "Sequencer outages remind us that decentralization is still a work in progress." Bulls argue that post-mortem reports and iterative improvements, such as EIP-4844's blob transactions for reduced costs, will strengthen Layer 2 resilience over time. However, bears highlight the systemic risk posed by centralized components, warning that repeated failures could delay Ethereum's scalability roadmap. Sentiment analysis from social platforms indicates a neutral-to-negative shift, aligning with the broader fear index.

Bullish Case: If Starknet's post-mortem implements effective fixes and Ethereum holds $3,150, Layer 2 confidence could rebound, driving STRK and ETH toward resistance at $3,350. Historical cycles suggest that outages often lead to technical upgrades, boosting long-term network value. Market structure indicates potential for a Gamma Squeeze if institutional inflows resume, as seen in prior recovery phases.

Bearish Case: A failure to address root causes may trigger further outages, invalidating bullish setups. Bearish Invalidation occurs if Ethereum breaks below $3,150, targeting $3,000 and exacerbating fear sentiment. On-chain data indicates that prolonged instability could spur capital rotation into alternative Layer 1s, pressuring ETH's market dominance.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.