Loading News...

Loading News...

VADODARA, January 15, 2026 — Solana Mobile has announced a 1.96 billion SKR token airdrop scheduled for January 21, targeting holders of its Seeker smartphone and app developers, according to a report by Cointelegraph. This daily crypto analysis examines the tokenomics and market implications of the move, which allocates 20% of the total 10 billion SKR supply, raising questions about dilution and utility in a crowded mobile ecosystem.

Solana Mobile's airdrop follows a pattern of ecosystem incentives designed to boost adoption, but market structure suggests these events often function as liquidity grabs. The Seeker phone, launched as a successor to the Saga, aims to deepen Solana's integration with mobile users, yet on-chain data indicates mixed success in user retention. Historical cycles show that airdrops of this magnitude—representing 20% of total supply—can create immediate sell pressure if utility fails to match distribution. This development occurs amid broader market volatility, where assets like Bitcoin are testing key support levels, as seen in recent Bitcoin price action analysis. Related developments include regulatory pressures affecting staking features, detailed in coverage of the Robinhood CEO's demands, and futures market dynamics explored in reports on short squeezes.

According to Cointelegraph, Solana Mobile will distribute 1.96 billion SKR tokens on January 21, with 1.82 billion allocated to 100,908 Seeker holders and 141 million to 188 developers. The SKR token is designated as a governance and utility token within the Solana Mobile ecosystem, but the source text lacks specifics on voting mechanisms or real-world use cases. This airdrop represents a significant portion of the total 10 billion SKR supply, potentially flooding the market with new tokens if holders opt for immediate liquidation. The absence of vesting schedules or lock-up periods in the announcement raises red flags about token velocity and long-term value retention.

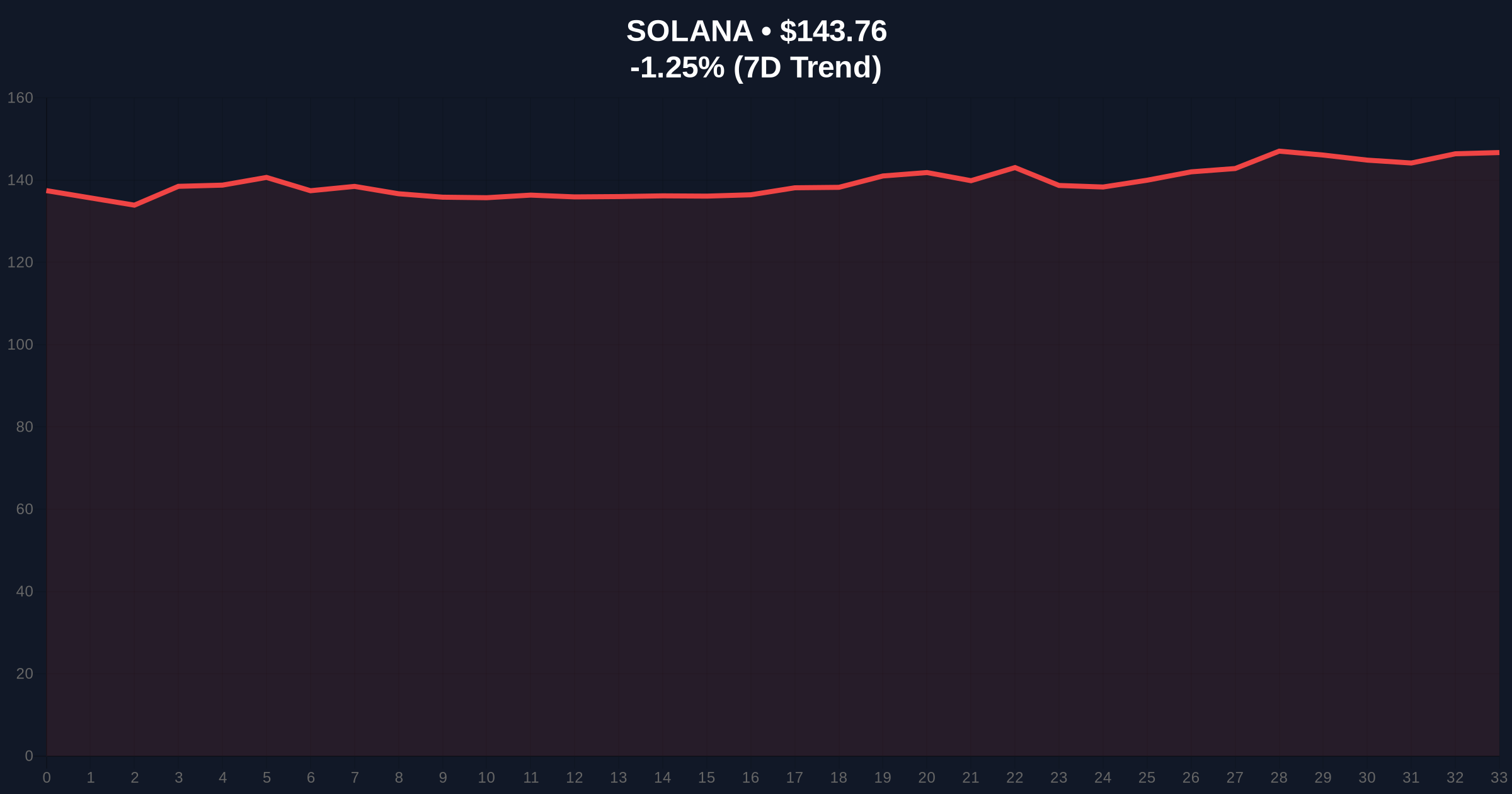

Solana (SOL) is currently trading at $143.8, down 1.22% in the last 24 hours, according to live market data. Volume profile analysis shows weak accumulation near this level, suggesting a lack of conviction among large holders. The RSI sits at 52, indicating neutral momentum, but a break below the 50-day moving average at $140 could trigger further declines. A key Fibonacci support level at $135, derived from the 0.618 retracement of the recent rally, serves as the Bearish Invalidation Level; a sustained drop below this point would invalidate any short-term bullish thesis for SOL. Conversely, the Bullish Invalidation Level is set at $150, where resistance from previous order blocks has capped upward moves. Market structure suggests that the SKR airdrop may create a Fair Value Gap (FVG) if token distribution leads to asymmetric selling pressure on SOL pairs.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 61 (Greed) |

| Solana (SOL) Current Price | $143.8 |

| SOL 24h Trend | -1.22% |

| SOL Market Rank | #6 |

| SKR Airdrop Amount | 1.96 billion tokens |

| SKR Total Supply | 10 billion tokens |

For institutional investors, this airdrop represents a test of Solana's ability to monetize its mobile hardware without diluting ecosystem value. The allocation of 20% of total supply in a single event risks creating a gamma squeeze scenario if derivatives markets misprice volatility. Retail holders, particularly Seeker phone owners, face a liquidity decision: hold SKR for potential governance rights or sell into initial hype. According to Ethereum's official documentation on token standards, governance tokens require clear utility to avoid becoming mere speculative instruments—a lesson Solana Mobile seems to overlook. The broader impact hinges on whether SKR integrates with Solana's DeFi protocols, such as those leveraging EIP-4844-style scaling for lower fees.

Market analysts on X/Twitter express skepticism, with one noting, "Airdrops of this size often lead to immediate sell-offs if tokenomics aren't airtight." Bulls argue that the Seeker phone's user base could drive adoption, but on-chain data indicates low engagement rates for previous mobile-centric tokens. The lack of developer incentives beyond the 141 million SKR allocation raises questions about long-term ecosystem growth, as seen in similar projects that failed to sustain momentum post-distribution.

Bullish Case: If SKR token utility is rapidly adopted, it could enhance Solana's mobile ecosystem, driving demand for SOL and pushing prices toward $160. Historical patterns indicate that successful airdrops can create network effects, but this requires robust on-chain activity post-distribution.

Bearish Case: If the airdrop leads to massive token dumping, SOL could break below the $135 support, triggering a cascade of liquidations. Market structure suggests a drop to $120 is plausible if broader crypto sentiment shifts, as highlighted in analysis of Bitcoin's recent price surge skepticism.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.