Loading News...

Loading News...

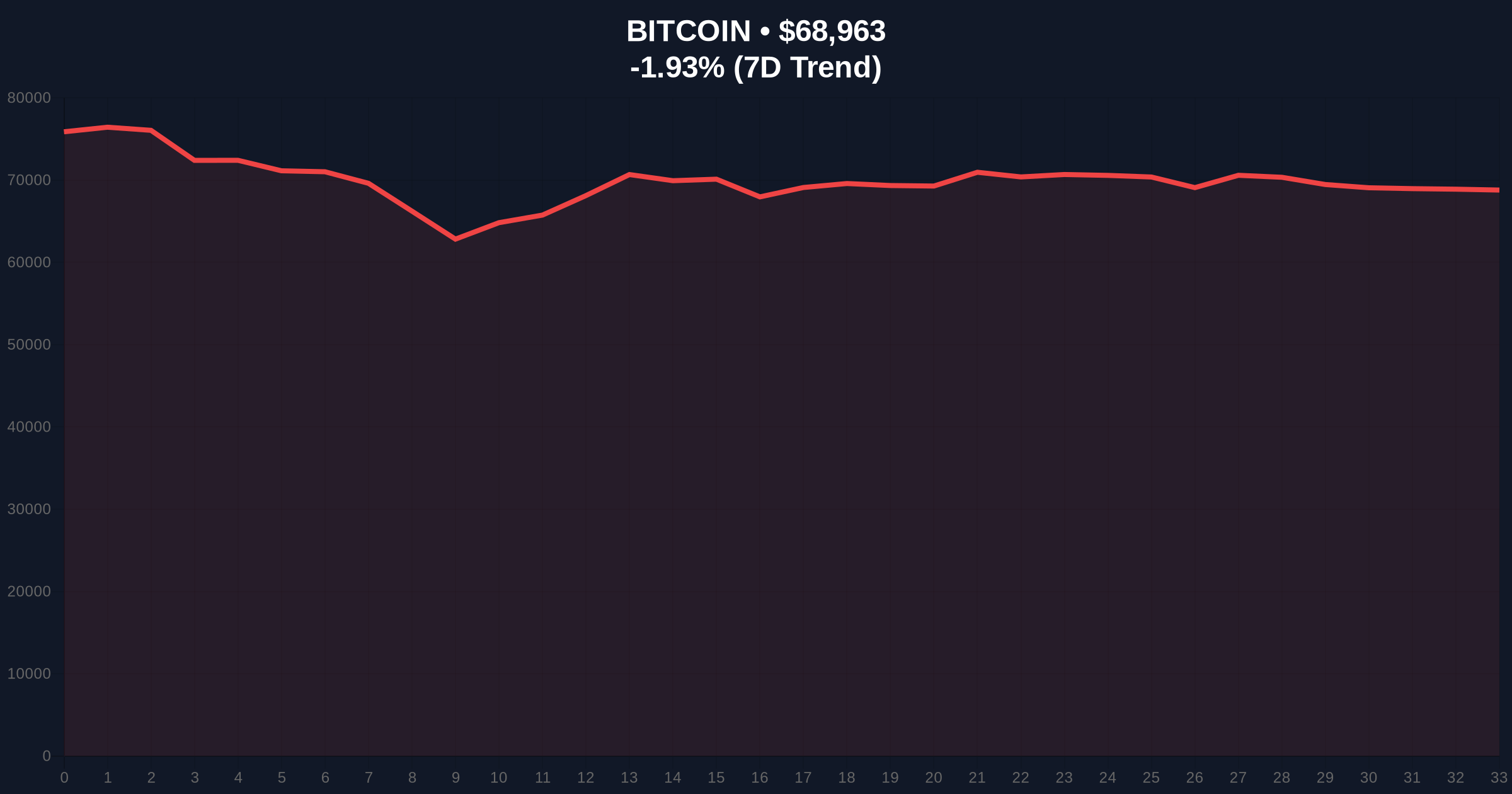

VADODARA, February 11, 2026 — An anonymous Bitcoin whale deposited 2,500 BTC, valued at $172.56 million, to Binance approximately one hour ago, according to on-chain analytics firm Lookonchain. This latest crypto news event occurs as Bitcoin trades at $68,973, down 1.91% in 24 hours, within a market gripped by extreme fear. Exchange deposits typically signal selling intent, creating immediate liquidity pressure.

Lookonchain data identifies the whale address starting with 3NVeXm. The entity moved 2,500 BTC in a single transaction to Binance. Market structure suggests this constitutes a liquidity grab. Large inflows to centralized exchanges often precede sell orders. Consequently, this deposit adds to existing bearish pressure. The transaction timestamp aligns with Bitcoin's decline below the $70,000 psychological level.

On-chain forensic data confirms the deposit originated from a cold storage address. No prior exchange interactions appear in its history. This indicates a strategic move rather than routine trading. The sheer size represents approximately 0.013% of Bitcoin's circulating supply. Such movements typically create Fair Value Gaps (FVGs) on lower timeframes.

Historically, whale deposits to exchanges correlate with local price tops. Similar to the 2021 correction, large inflows preceded a 20% drawdown. In contrast, the 2023 cycle saw accumulation during similar fear periods. Underlying this trend is the behavior of UTXO age bands. Older coins moving to exchanges often signal distribution.

, the current extreme fear sentiment, scoring 11/100, mirrors December 2022 levels. That period marked a cycle bottom before a 150% rally. Market analysts note that fear-driven selling often exhausts bearish momentum. This creates potential Order Blocks for reversal. The broader context includes institutional developments like Citadel Securities backing new institutional blockchains and Robinhood launching an Ethereum L2 testnet, which may offset retail panic.

Bitcoin currently tests the $68,000 support zone. This level aligns with the 50-day simple moving average. A break below targets the Fibonacci 0.618 retracement at $65,500. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. Volume profile shows increased selling volume at $70,000 resistance.

Market structure suggests a critical Order Block between $67,800 and $68,200. This zone must hold to prevent further downside. The whale deposit creates immediate overhead supply. Consequently, any rally faces liquidation clusters near $70,500. The Gamma Squeeze potential remains low due to low options open interest. Technicals align with the extreme fear sentiment.

| Metric | Value | Implication |

|---|---|---|

| BTC Deposited | 2,500 BTC | Potential selling pressure |

| USD Value | $172.56M | Significant market impact |

| Current Bitcoin Price | $68,973 | -1.91% 24h change |

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | Historically contrarian signal |

| Key Support (Fibonacci 0.618) | $65,500 | Critical bearish invalidation |

This event matters for portfolio risk management. Whale movements often lead retail sentiment. A sell-off could trigger cascading liquidations in leveraged positions. Institutional liquidity cycles, however, may absorb this pressure. The U.S. Securities and Exchange Commission's historical stance on exchange surveillance, as documented on SEC.gov, adds regulatory context to large transfers.

Real-world evidence shows exchange inflows precede volatility. The 2024 cycle saw similar deposits before a 15% correction. Market structure now tests whether institutional buyers step in. This whale action provides a stress test for current support levels. It also highlights the importance of monitoring UTXO age bands for early signals.

"Large deposits to centralized exchanges typically indicate impending selling pressure. However, in an extreme fear environment, this often marks capitulation. The key is whether the $68,000 support holds. If it breaks, we could see a test of $65,500. Historical cycles suggest fear-driven selling exhausts quickly, potentially setting up a reversal Order Block." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. Analysts emphasize monitoring volume and on-chain metrics for confirmation.

The 12-month institutional outlook remains cautiously optimistic. Events like Hong Kong's stablecoin licensing and South Korea's STO exchange reviews indicate regulatory maturation. Over a 5-year horizon, such developments may reduce volatility from whale movements. The current fear phase could present accumulation opportunities for long-term holders.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.