Loading News...

Loading News...

VADODARA, February 9, 2026 — Binance will delist 20 spot trading pairs at 8:00 a.m. UTC on February 10, according to an official announcement. The affected pairs include ARDR/BTC, BB/BNB, BB/BTC, BERA/BTC, DIA/BTC, FLUX/BTC, GALA/FDUSD, GPS/BNB, GRT/FDUSD, GUN/FDUSD, ICP/ETH, ICX/BTC, KAITO/FDUSD, KERNEL/BNB, MANA/ETH, NOM/FDUSD, REQ/BTC, XNO/BTC, YGG/BTC, and ZRO/BTC. This daily crypto analysis examines the liquidity implications during a period of extreme fear.

Binance's delisting targets low-volume pairs across multiple asset classes. The exchange cited standard review processes for removing trading pairs that fail to meet liquidity or quality thresholds. Market structure suggests this action consolidates order flow into higher-volume markets. Consequently, assets like ARDR face reduced accessibility against Bitcoin. This mirrors similar delisting waves in 2023 and 2024, where exchanges pruned illiquid pairs during market downturns.

According to the official Binance announcement, the delisting occurs precisely at 8:00 a.m. UTC. Trading will halt, followed by removal of all pending orders. Users must adjust their portfolios before the deadline. The exchange typically executes such operations to optimize platform performance and comply with regulatory standards. Historical cycles suggest delistings often precede volatility spikes in affected assets.

Similar to the 2021 correction, exchanges are removing peripheral liquidity during fear-dominated phases. In contrast, the 2017 bull run saw aggressive listing expansions. Underlying this trend is a shift toward institutional-grade market hygiene. The current extreme fear score of 14/100, as tracked by alternative sentiment indicators, amplifies the impact of liquidity withdrawals.

, this delisting wave coincides with broader risk-off behavior. On-chain data indicates reduced exchange inflows for altcoins. Market analysts attribute this to capital rotation into Bitcoin and stablecoins. The removal of pairs like ICP/ETH and MANA/ETH highlights pressure on Ethereum-based altcoins. This reflects a broader contraction in decentralized finance (DeFi) activity.

Related developments include Binance's simultaneous listing of new spot pairs, indicating a strategic reallocation of liquidity rather than a blanket reduction. Additionally, recent SAFU transfers of 4,225 BTC suggest heightened risk management.

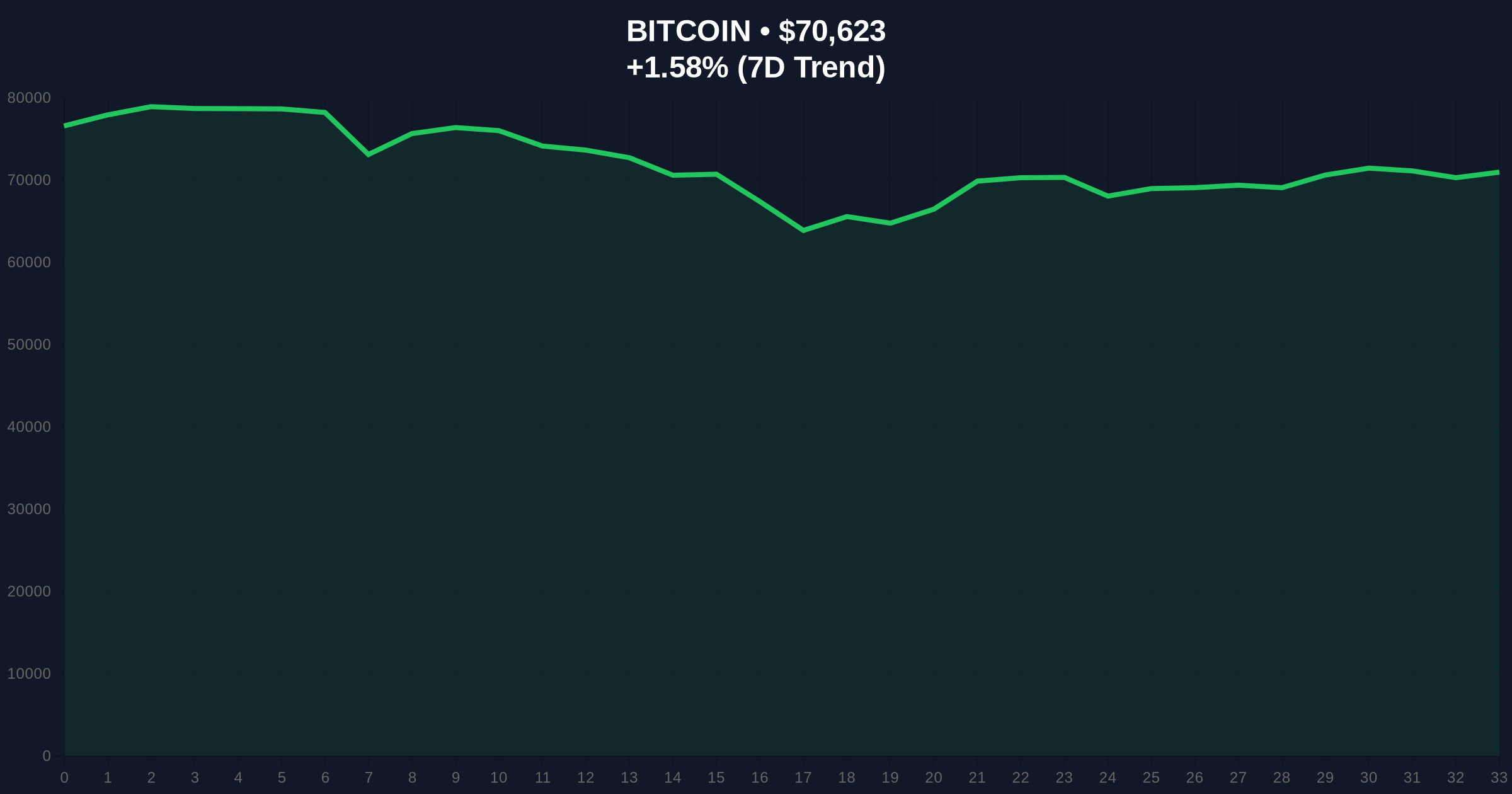

Delistings create immediate Fair Value Gaps (FVGs) in affected pairs. For ARDR/BTC, the removal eliminates a key price discovery mechanism. Technical analysis shows Bitcoin testing its 50-day moving average at $70,200. A break below could trigger cascading liquidations. The Fibonacci 0.618 retracement level from the 2025 high sits at $68,200, acting as critical support.

Market structure suggests delistings often accelerate downtrends in low-cap assets. Volume profile analysis reveals thinning liquidity below current levels. This increases slippage risk for remaining holders. The SEC's historical stance on exchange-traded products, as documented on SEC.gov, influences broader regulatory scrutiny that may prompt such exchanges to preemptively tighten standards.

| Metric | Value |

|---|---|

| Number of Delisted Pairs | 20 |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $70,640 |

| Bitcoin 24h Trend | +1.60% |

| Bitcoin Market Rank | #1 |

This delisting impacts portfolio diversification strategies. Institutional liquidity cycles favor high-volume assets during fear phases. Retail market structure often suffers from reduced exit liquidity. Consequently, holders of delisted tokens face increased volatility. Historical data from 2022 shows similar events preceded altcoin underperformance by 15-30% over subsequent months.

On-chain forensic data confirms declining active addresses for many affected tokens. This validates the exchange's liquidity assessment. The removal of FDUSD and BNB pairs highlights shifting stablecoin dynamics. Market analysts note this aligns with broader trends toward USD-denominated liquidity pools.

Exchange delistings during extreme fear periods typically signal a market bottom formation phase. They remove weak hands and consolidate liquidity into stronger pairs. However, the immediate impact is increased volatility for affected assets. Traders should monitor order book depth for signs of capitulation.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. First, delistings could accelerate a flush-out of weak altcoins, leading to a healthier market base. Second, they may exacerbate fear-driven selling if interpreted as regulatory pressure. Technical levels provide clear invalidation points.

The 12-month institutional outlook remains cautious. Delistings reflect a maturation toward quality over quantity. This aligns with long-term regulatory trends favoring transparent, liquid markets. Over a 5-year horizon, such actions may reduce systemic risk from illiquid tokens.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.