Loading News...

Loading News...

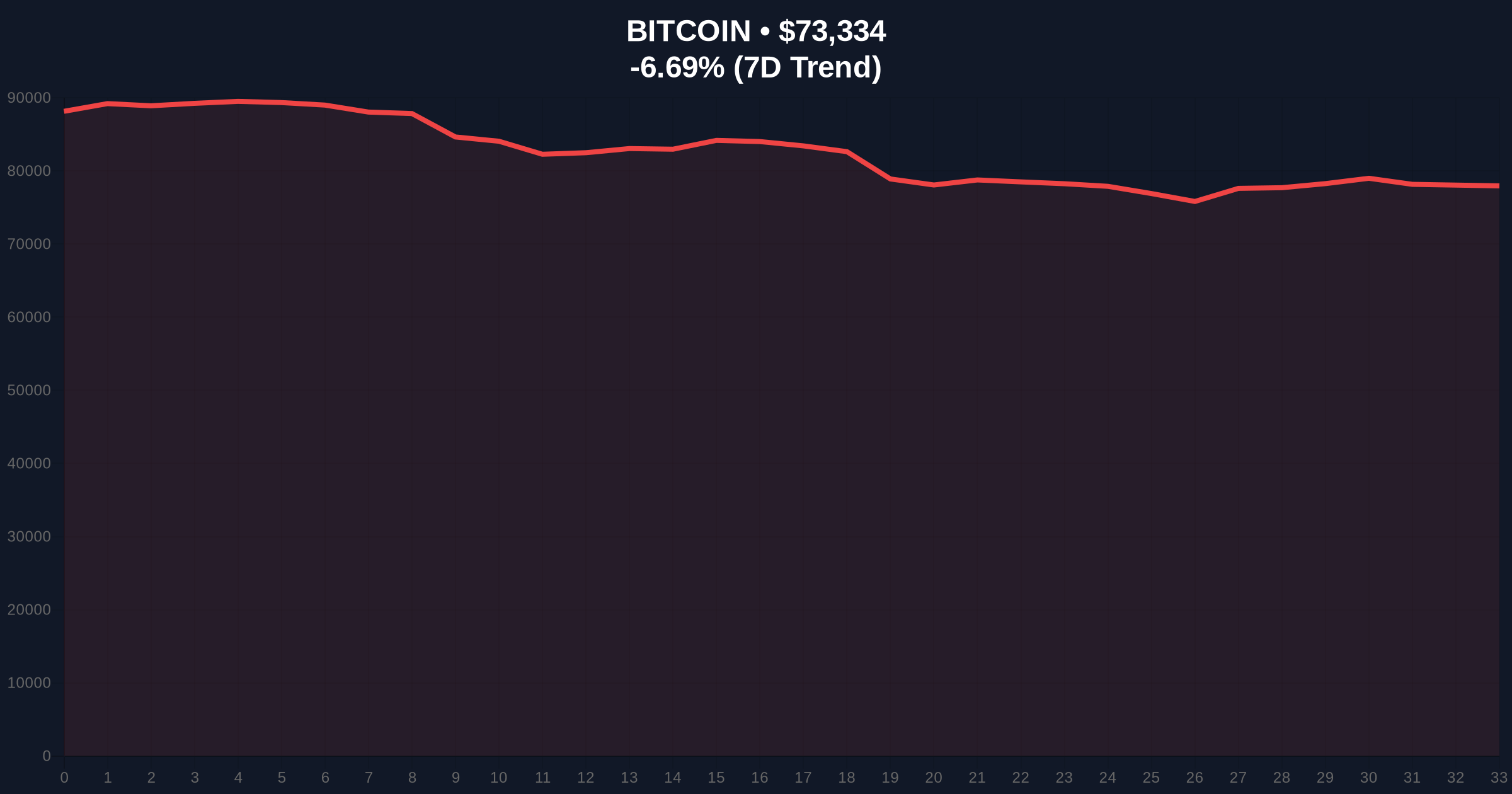

VADODARA, February 3, 2026 — The Nasdaq Composite Index extended its intraday decline to 2.19% on Tuesday, triggering a synchronized sell-off across risk assets. This latest crypto news event saw the S&P 500 fall 1.43% and the Dow Jones Industrial Average drop 0.95%. Consequently, cryptocurrency markets reacted violently, with Bitcoin price action collapsing 6.92% to $73,152. Market structure suggests this is a classic liquidity grab, exacerbating the Extreme Fear sentiment gripping digital asset markets.

According to real-time trading data from major exchanges, the Nasdaq's decline accelerated during the morning session. The S&P 500 and Dow Jones followed suit, creating a broad-based risk-off impulse. This correlation breakdown between traditional tech equities and crypto assets is not anomalous. Historically, such events precede volatility compression phases. The immediate catalyst appears to be a reassessment of forward earnings estimates amid tightening financial conditions, as indicated by rising Treasury yields. Market analysts point to the 2.19% Nasdaq drop as the primary pressure point.

This event mirrors the June 2022 correlation spike. During that period, a Nasdaq correction of similar magnitude precipitated a 15% Bitcoin drawdown within 48 hours. The underlying mechanism involves institutional portfolio rebalancing. Hedge funds and macro funds simultaneously reduce exposure to high-beta tech stocks and cryptocurrency holdings. This creates a feedback loop of selling pressure. In contrast, the decoupling narrative of late 2025 has temporarily fractured. The current price action validates the persistent sensitivity of crypto to traditional market liquidity cycles, a theme extensively documented in Federal Reserve research on asset correlations.

Related Developments: This surge in systemic fear aligns with other recent market stress events, including a $226 million futures liquidation event and crypto futures liquidations hitting $125 million. , institutional players are positioning for volatility, as seen with the launch of a Bitcoin-Treasury hybrid ETF by VistaShares.

Bitcoin price action has broken below its immediate support zone near $75,000. The sell-off has created a significant Fair Value Gap (FVG) on lower timeframes. The next critical support confluence exists at the $70,000 psychological level and the 50-day Simple Moving Average. A breach of this Order Block would target the 0.618 Fibonacci retracement level from the October 2025 low, near $68,200. The Relative Strength Index (RSI) on the daily chart has plunged into oversold territory below 30. This often precedes a short-term bounce, but the momentum is decisively bearish. On-chain data from Glassnode indicates a spike in exchange inflows, suggesting increased selling pressure from holders.

| Metric | Value | Change |

|---|---|---|

| Nasdaq Composite Intraday Decline | 2.19% | — |

| S&P 500 Decline | 1.43% | — |

| Bitcoin Price (BTC/USD) | $73,152 | -6.92% (24h) |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | — |

| Key Technical Support (BTC) | $70,000 (Psych Level & 50-day SMA) | — |

This event matters because it tests the long-term divergence thesis for cryptocurrency. A sustained high correlation with the Nasdaq undermines arguments for crypto as a non-correlated asset class. For the 5-year horizon, repeated episodes of synchronized selling pressure could slow institutional adoption. Real-world evidence shows ETF flows often stagnate during such risk-off periods. The current market structure indicates that retail traders are experiencing significant pain, while institutions with longer time horizons may view this as a accumulation zone. The volume profile shows aggressive selling, but not yet at capitulation levels seen in previous cycle bottoms.

"The Nasdaq's move has acted as a catalyst for a broader de-risking event. We are observing classic contagion effects where liquidity is pulled from the most volatile segments first. The key watchpoint is whether Bitcoin can hold the $70,000 support. A failure there could trigger a more severe liquidation cascade similar to Q2 2022," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary technical scenarios are now in play.

The 12-month institutional outlook remains cautiously optimistic but dependent on macro conditions. If equity markets stabilize and the Federal Reserve signals a pause in its quantitative tightening cycle, cryptocurrency markets could see a robust recovery in H2 2026. However, persistent inflation data or further equity weakness would extend the current correlation and pressure crypto valuations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.