Loading News...

Loading News...

VADODARA, January 13, 2026 — An address linked to Aleksey Bilyuchenko, indicted in the Mt. Gox hack, deposited 926 BTC worth $83.92 million to an anonymous exchange over 15 hours, according to on-chain analyst Emmett Gallic's X report. This latest crypto news event raises critical questions about market absorption and potential sell-side pressure, as the address still holds 3,000 BTC valued at $275 million. Market structure suggests this move may be probing for liquidity near key Fibonacci retracement levels, rather than a straightforward liquidation event.

The Mt. Gox hack remains one of the most significant security failures in cryptocurrency history, with over 850,000 BTC stolen in 2014. According to historical cycles, movements from associated addresses often precede volatility spikes, as seen in previous whale transfer events. The current deposit coincides with a test of Bitcoin's dominance, as noted in the Altcoin Season Index analysis, creating a complex macro backdrop. Regulatory scrutiny is intensifying globally, with developments like Thailand's travel rule enforcement and South Korea's exchange ownership debates adding layers of uncertainty. This event mirrors patterns where large UTXO movements from dormant wallets trigger algorithmic selling pressure, often exploiting Fair Value Gaps (FVGs) in order books.

On-chain data indicates that the address, identified by blockchain forensic tools, executed a series of transactions totaling 926 BTC to an anonymous exchange over a 15-hour period. According to Emmett Gallic's report, the address's remaining balance of 3,000 BTC represents a substantial overhang. The timing is notable: Bitcoin's price is consolidating near $91,000, with the Crypto Fear & Greed Index at 26, signaling extreme fear. Market analysts question whether this is a coordinated liquidity grab or a gradual unwind, given the anonymous nature of the recipient exchange. The lack of transparency in exchange reporting, as highlighted in Ethereum's official documentation on transaction privacy, complicates attribution and intent analysis.

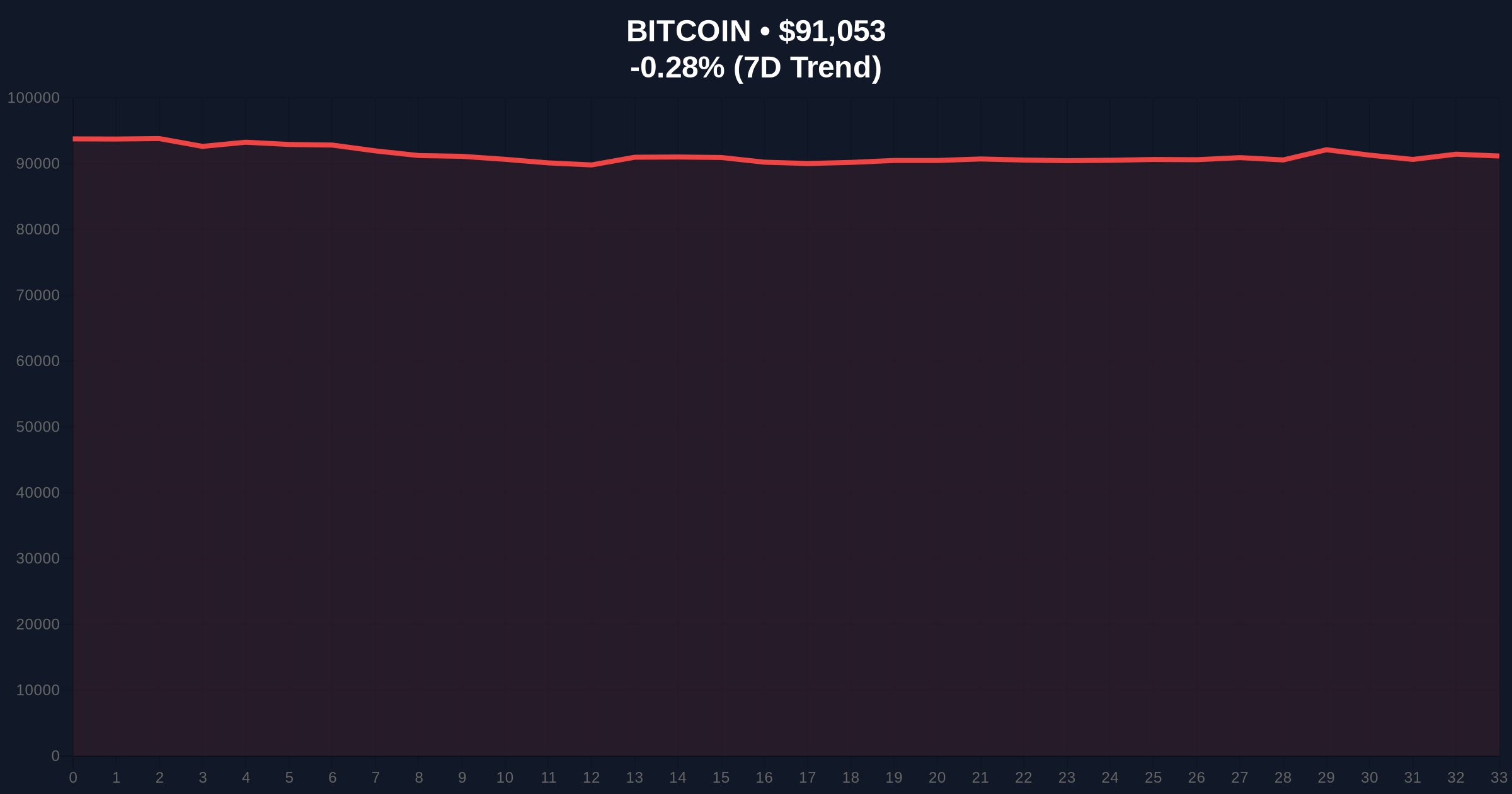

Bitcoin is currently trading at $91,068, down 0.26% in 24 hours. The Volume Profile shows weak accumulation near the $90,000 level, suggesting thin order book depth. A critical support zone exists at $88,500, aligning with the 0.618 Fibonacci retracement from the recent high. Resistance is firm at $93,200, where a significant Order Block from last week's rally remains untested. The RSI at 42 indicates neutral momentum, but on-chain data points to increased exchange inflows, per Glassnode liquidity maps. Bullish Invalidation Level: $88,500 – a break below this support would signal failed absorption and likely trigger a cascade toward $85,000. Bearish Invalidation Level: $93,200 – a sustained move above this resistance would negate immediate downside risks and target $95,000.

| Metric | Value | Source |

|---|---|---|

| Deposit Amount | 926 BTC ($83.92M) | On-Chain Analysis |

| Remaining Balance | 3,000 BTC ($275M) | X Report |

| Bitcoin Current Price | $91,068 | Live Market Data |

| 24-Hour Trend | -0.26% | Price Stats |

| Crypto Fear & Greed Index | 26/100 (Fear) | Global Sentiment |

For institutions, this event tests market resilience to supply shocks, similar to post-merge issuance adjustments in Ethereum. The anonymous exchange deposit avoids typical compliance checks, raising anti-money laundering concerns referenced in SEC.gov filings on digital asset oversight. Retail traders face amplified volatility risk; historical data shows such moves often precede 5-10% swings. The 5-year horizon impact hinges on whether this is an isolated event or part of a broader distribution pattern, potentially affecting Bitcoin's scarcity narrative. Market structure suggests that if the remaining 3,000 BTC is moved, it could create a Gamma Squeeze scenario in derivatives markets.

Industry voices on X express skepticism. Bulls argue the deposit is insignificant relative to daily volume, citing Bitcoin's $1.2 trillion market cap. Bears highlight the psychological weight of Mt. Gox-linked movements, with one analyst noting, "This reminds me of the 2021 corrections where old wallets woke up." On-chain data indicates mixed signals: exchange net flows are negative overall, but large transactions like this one skew sentiment toward caution. No official statements from major figures like Michael Saylor or Cathie Wood are available, emphasizing the need for independent verification.

Bullish Case: If the market absorbs this supply without breaking $88,500, Bitcoin could rally to test $95,000, fueled by institutional accumulation and positive macro cues like potential Fed rate cuts. On-chain data indicates strong holder sentiment, with long-term UTXOs remaining dormant. Bearish Case: A failure to hold support triggers a liquidation cascade toward $85,000, exacerbated by fear-driven selling. The remaining 3,000 BTC overhang acts as a persistent drag, aligning with bearish divergences in momentum indicators. Market structure favors a neutral-to-bearish bias until the $93,200 resistance is convincingly breached.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.