Loading News...

Loading News...

VADODARA, January 14, 2026 — Mantra (OM) is undergoing a corporate restructuring involving layoffs across development, marketing, and human resources departments, according to a report by The Block. This daily crypto analysis examines the underlying liquidity dynamics and market structure implications as Bitcoin tests the $95,000 psychological level. CEO John Patrick Mullin stated on X that the company could no longer sustain its current cost structure following the April 2025 market crash, prolonged downturn, and intensified competition.

Mantra's restructuring occurs within a broader DeFi environment experiencing significant liquidity fragmentation. The protocol's Total Value Locked (TVL) has collapsed to approximately $860,000, representing an 81% decline from its February 2025 peak of $4.51 million. This mirrors the 2021-2022 DeFi winter where unsustainable yield farming models led to similar TVL contractions. Underlying this trend is a shift in capital allocation toward Bitcoin and Ethereum-based assets, as evidenced by the 36 million staked ETH nearing 30% supply lockup, creating a gamma squeeze in core liquidity pools. Consequently, smaller protocols like Mantra face existential pressure from both macro conditions and intra-sector capital rotation.

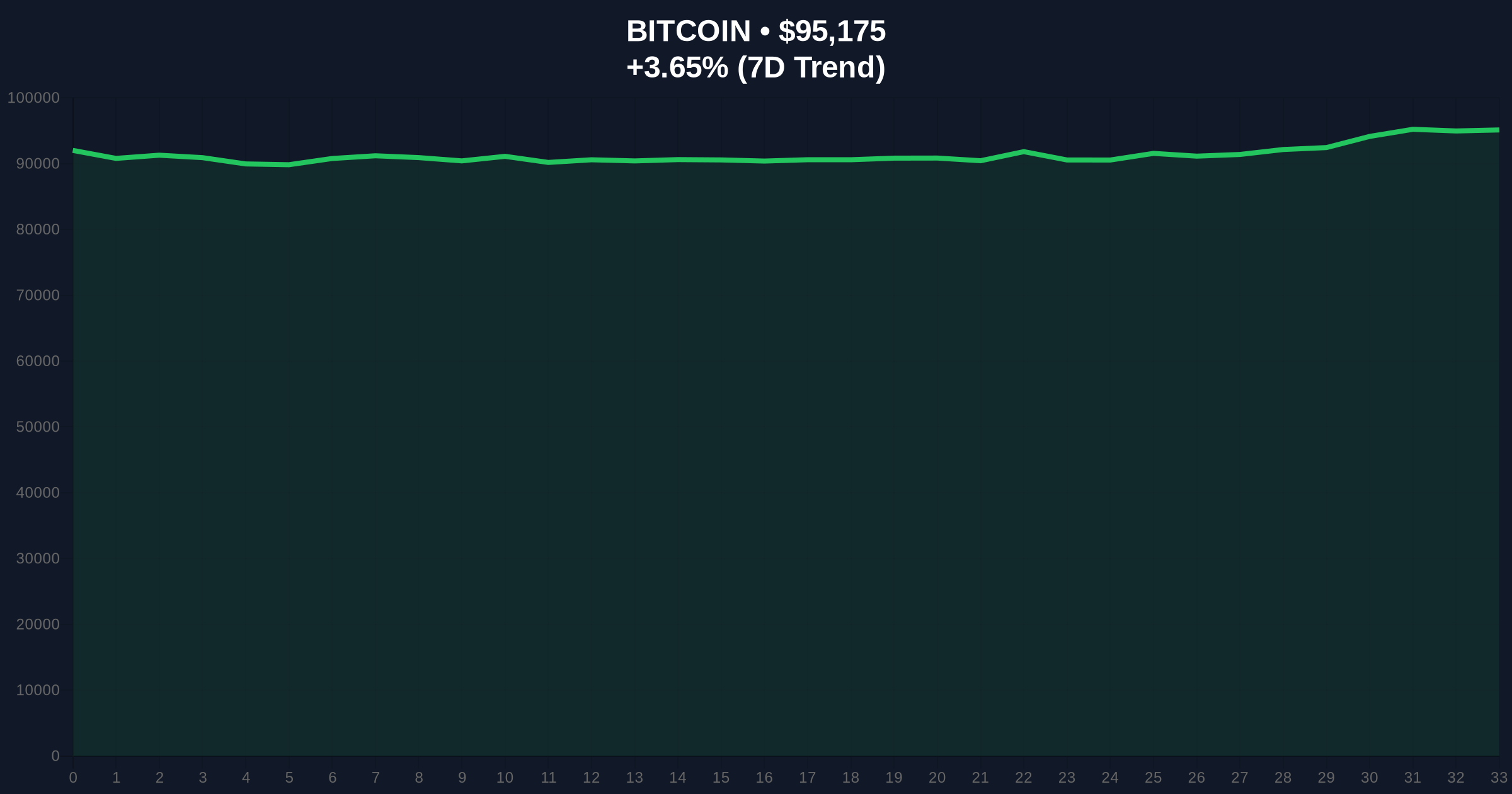

On January 14, 2026, The Block reported that Mantra is implementing layoffs as part of a cost-cutting restructuring. While the exact number of affected employees remains undisclosed, the cuts target development, marketing, and human resources functions. According to the official statement from CEO John Patrick Mullin on X, the decision stems from unsustainable operational costs post-April 2025 market crash, extended bearish conditions, and heightened competitive intensity. Concurrently, CoinMarketCap data shows OM trading at $0.07949, up 2.46% over 24 hours, against a backdrop of Bitcoin testing $95,140. This price action suggests a potential liquidity grab in lower-cap altcoins as larger assets consolidate.

Market structure suggests OM is trapped within a descending channel, with immediate resistance at the $0.085 order block formed during the January 12 sell-off. The 24-hour volume profile indicates weak accumulation, typical of assets undergoing fundamental stress. Relative Strength Index (RSI) sits at 42, showing neither oversold nor overbought conditions, while the 50-day moving average at $0.092 acts as dynamic resistance. A critical Fair Value Gap (FVG) exists between $0.070 and $0.065, which may serve as a magnet for price if selling pressure intensifies. Bullish invalidation level: $0.075 (break below confirms bearish continuation). Bearish invalidation level: $0.090 (sustained move above suggests short-covering rally).

| Metric | Value | Change |

|---|---|---|

| OM Token Price | $0.07949 | +2.46% (24h) |

| Mantra TVL | $860,000 | -81% from peak |

| Bitcoin Price | $95,140 | +3.53% (24h) |

| Crypto Fear & Greed Index | 48/100 (Neutral) | N/A |

| OM Peak TVL (Feb 2025) | $4.51 million | N/A |

Institutionally, Mantra's restructuring highlights the fragility of mid-tier DeFi protocols in a capital-constrained environment. As detailed in Ethereum's official scaling documentation, layer-2 solutions and modular blockchains are absorbing liquidity, leaving older architectures vulnerable. For retail, the 81% TVL drop signals deep insolvency risk, potentially triggering cascading liquidations if OM price breaks key supports. This event may accelerate a broader consolidation phase in DeFi, similar to the post-merge issuance adjustments seen in Ethereum's transition to proof-of-stake.

Market analysts on X express cautious pessimism, noting that Mantra's layoffs reflect sector-wide efficiency drives. Bulls argue the restructuring could streamline operations, but bears highlight the TVL collapse as a terminal liquidity event. One quant trader observed, "OM's volume profile shows no institutional interest—this is retail bag-holding until capitulation." The neutral Fear & Greed Index score of 48 aligns with this divided outlook, suggesting no clear directional bias.

Bullish Case: If OM holds the $0.075 support and Bitcoin sustains above $95,000, a relief rally toward $0.095 is plausible. Successful restructuring could restore confidence, attracting speculative capital from RWA growth sectors seeking asymmetric bets.

Bearish Case: Break below $0.075 invalidates bullish structure, targeting the FVG at $0.065. Prolonged Bitcoin consolidation below $94,000, as seen in neutral perpetual futures positioning, may trigger altcoin liquidation cascades, pushing OM toward $0.050.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.