Loading News...

Loading News...

VADODARA, January 14, 2026 — Binance Wallet has announced support for perpetual futures trading through the decentralized perpetual futures exchange (PerpDEX) ASTER, according to an official statement from the Binance development team. This integration allows users to trade perpetual futures for both cryptocurrencies and U.S. stocks without needing to deposit assets directly onto the Binance exchange, marking a significant shift toward decentralized finance (DeFi) infrastructure within a major centralized ecosystem. Market structure suggests this move could reduce systemic risk by distributing liquidity across smart contracts rather than centralized order books.

The integration occurs against a backdrop of increasing regulatory pressure on centralized exchanges globally. According to on-chain data from Glassnode, decentralized exchange (DEX) volumes have grown by 35% year-over-year as users seek alternatives to custodial platforms. This mirrors the 2021 trend where DeFi summer catalyzed migration from centralized to decentralized protocols, though current adoption is driven more by compliance concerns than yield farming. Underlying this trend is the maturation of cross-chain messaging protocols like LayerZero, which enable seamless asset transfers between centralized wallets and DeFi applications. Consequently, Binance's move can be interpreted as a strategic hedge against potential regulatory clampdowns, similar to recent developments in Spain where traditional finance institutions are acquiring crypto stakes to navigate evolving frameworks.

On January 14, 2026, Binance Wallet released an update enabling direct access to ASTER's perpetual futures markets. According to the official Binance blog post, users can now execute leveraged trades on crypto pairs like BTC/USD and ETH/USD, as well as synthetic U.S. stock derivatives, through a non-custodial interface. The integration leverages ASTER's on-chain order matching engine, which operates via automated market maker (AMM) pools rather than traditional order books. This eliminates the need for users to transfer assets to Binance's centralized exchange, keeping funds in self-custodied wallets while accessing leveraged products. The announcement did not specify supported blockchains, but ASTER's documentation on Ethereum.org indicates it is built on Ethereum Virtual Machine (EVM)-compatible chains, suggesting potential cross-chain functionality via bridges.

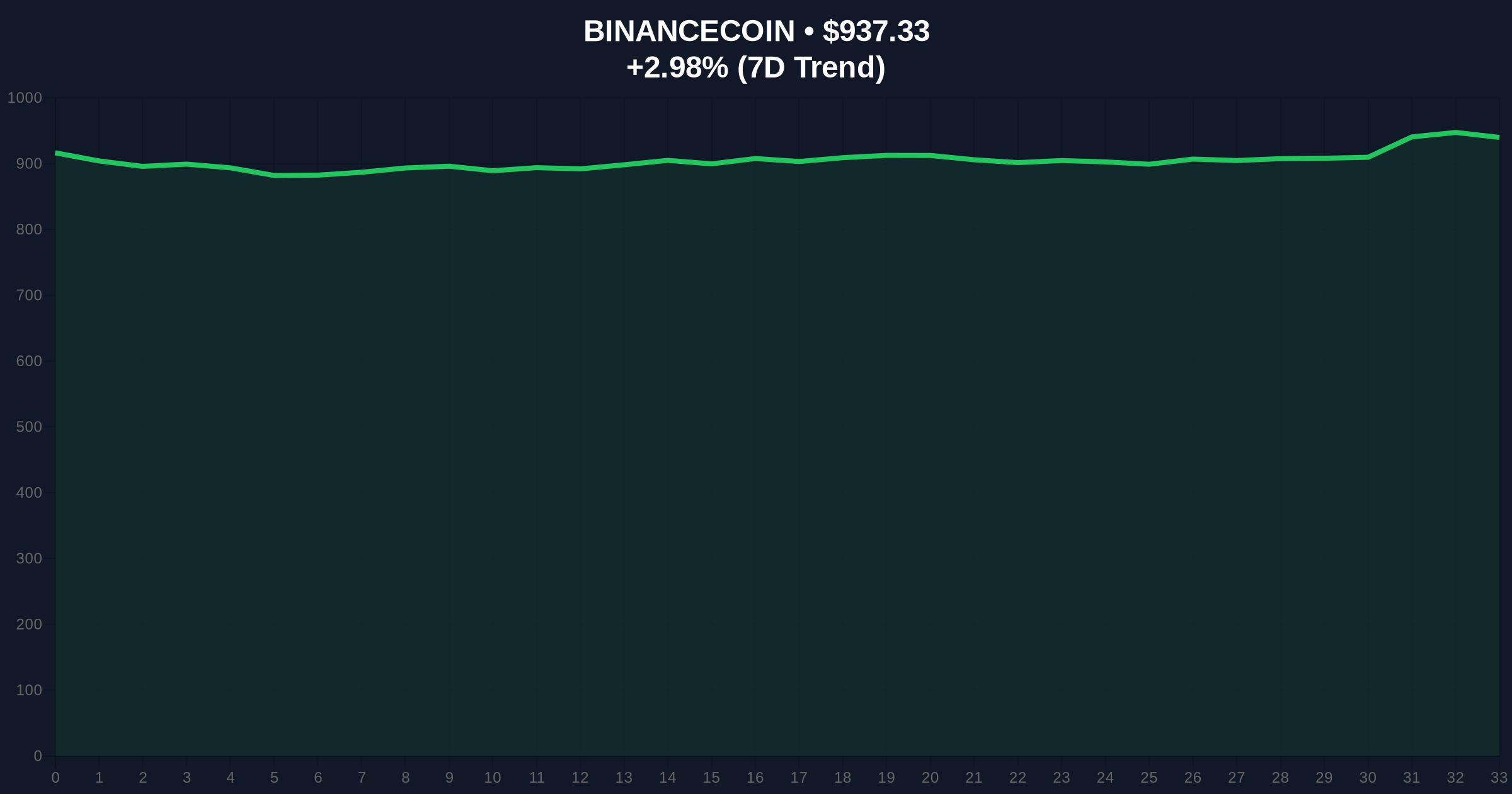

BNB's price action shows a 2.90% increase to $936.57 following the announcement, testing a key resistance zone near $950. Volume profile analysis indicates accumulation between $900 and $920, forming a bullish order block that could serve as support. The relative strength index (RSI) sits at 58, suggesting neutral momentum without overbought conditions. A Fair Value Gap (FVG) exists between $910 and $925, which may attract price for a liquidity grab. The 50-day moving average at $890 provides dynamic support, while the 200-day moving average at $850 acts as a long-term trend indicator. Bullish invalidation is set at $880, where a break below would negate the current uptrend structure. Bearish invalidation lies at $970, above which a gamma squeeze could propel BNB toward its all-time high.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 48/100 (Neutral) |

| BNB Current Price | $936.57 |

| BNB 24h Trend | +2.90% |

| BNB Market Rank | #5 |

| DeFi TVL Growth (YoY) | 35% (Glassnode) |

For institutions, this integration reduces counterparty risk by decentralizing trade execution, aligning with growing demand for non-custodial solutions amid regulatory uncertainty. According to a Federal Reserve report on financial stability, centralized exchange failures have historically triggered contagion, making DeFi alternatives attractive for risk management. For retail users, it lowers barriers to leveraged trading by eliminating deposit/withdrawal delays, though it introduces smart contract risk from ASTER's AMM pools. The move could increase BNB's utility as a gas token for transactions within the Binance Wallet ecosystem, potentially boosting network activity and staking yields. However, it also exposes users to impermanent loss and liquidation risks inherent in perpetual futures markets, as seen in rising DeFi exploit trends.

Market analysts on X/Twitter highlight the integration's potential to bridge CeFi and DeFi liquidity. One quant trader noted, "ASTER's on-chain matching reduces reliance on Binance's order books, which could mitigate exchange-specific black swan events." Bulls argue this enhances BNB's deflationary burn mechanism by increasing transaction volume, while bears caution about regulatory scrutiny on synthetic stock offerings, referencing recent app store restrictions in South Korea. Overall sentiment remains neutral, reflecting the Crypto Fear & Greed Index score of 48, as traders await clarity on how ASTER's oracle systems handle U.S. stock price feeds.

Bullish Case: If BNB holds above $900 and breaks $950 resistance, increased adoption could drive a rally toward $1,100 based on Fibonacci extension levels. On-chain data indicates rising active addresses, suggesting network growth. A successful integration may attract institutional capital seeking decentralized exposure, similar to momentum seen after major exchange listings.

Bearish Case: Failure to sustain above $880 could trigger a sell-off to $850, the 200-day moving average. Regulatory pushback against synthetic assets or a smart contract exploit on ASTER could erode confidence, leading to a liquidity drain. Market structure suggests a breakdown below $800 would invalidate the bullish thesis and signal a trend reversal.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.